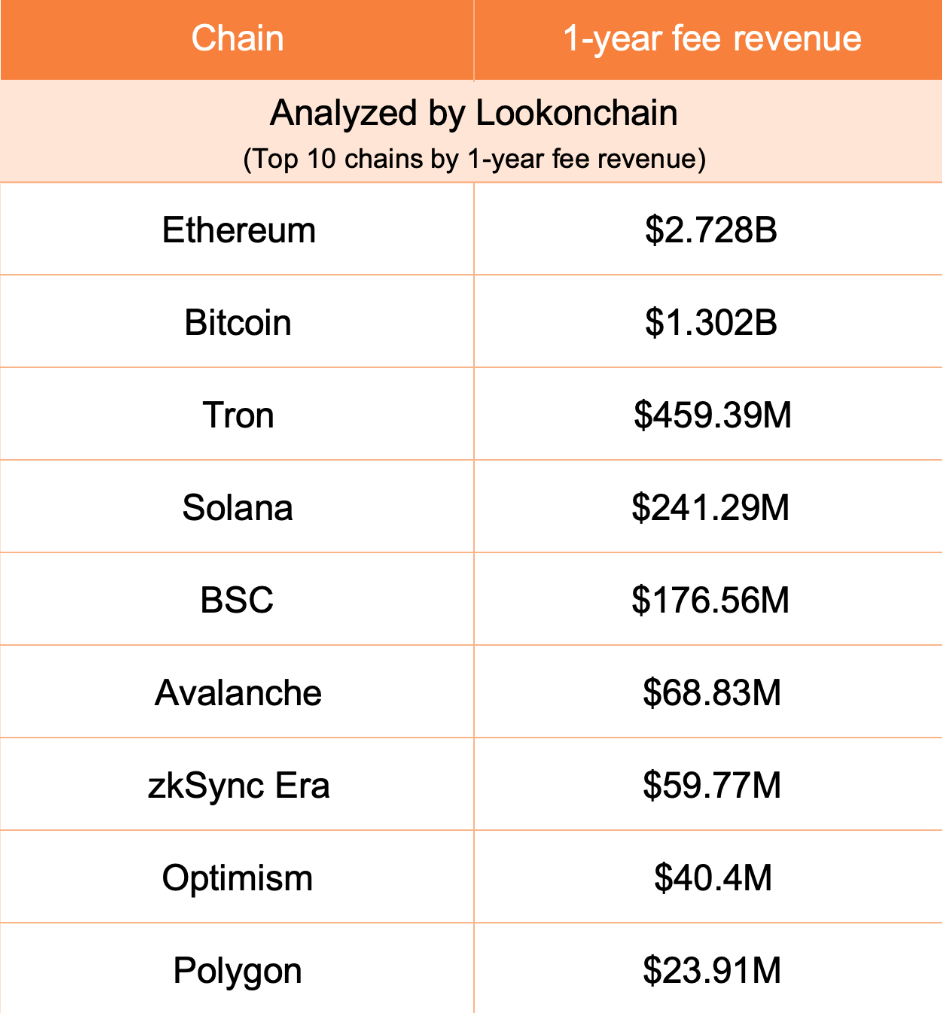

Data published by Lookonchain on Wednesday has shown that the Ethereum network earns two times more fee revenue than any other blockchain. Ethereum hauls in $2.7 billion per year in fee revenues despite its recent Dencun upgrade, which reduced its fee drastically.

The largest crypto asset, Bitcoin, occupied the second spot, generating $1.3 billion in fee revenue annually. Activities in the Bitcoin network saw a significant increment following the launch of Rune, a protocol that enables the creation of fungible tokens on the blockchain.

The creation of Rune brought transactions in the Bitcoin network to a new all-time high, reaching over 927,000 transactions in April. Such on-chain activity contributed to Bitcoin’s strong fee revenue.

Surprisingly, the Tron network toppled Solana to third place despite the buzz around the latter. Tron raked in more than double Solana’s yearly fee revenue, making nearly $460 million in fees.

Solana was one of the most prominent networks in the past year, flipping Ethereum on several occasions in daily transaction volume. The memecoin buzz around the network saw it become the most used network by investors. However, the growing on-chain activity only coughed out $241 million for the blockchain in the past year.

Binance Smart Chain (BSC), Avalanche, zkSync Era, Optimism, and Polygon occupied the other slots in the top ten chains by yearly revenue, respectively. The chains earned $176 million, $68.8 million, $59.77 million, $40.4 million, and $23.9 million, respectively.

Ethereum Dominate Other Chains

The Ethereum network not only doubled Bitcoin’s yearly fee revenue but also beat the revenue generated by the blockchains in the top ten earning charts combined. In the first quarter of the year, the Ethereum network saw a 155% year-over-year increment in fee revenue.

Notably, Ethereum achieved this feat despite a massive reduction in fees following an upgrade earlier in the year that saw fees in the network reduced drastically. Ethereum’s transaction fees fell over 60% to an average of 8 Gwei after reaching 22.28 Gwei on Jan 2.

Ethereum also dominates other chains in terms of the total value locked (TVL) in the blockchain. Data from DeFiLlama shows that about $58 billion is locked in the Ethereum network, 60% of the TVL of the entire blockchain in the crypto sector.