The crypto market saw a heightened liquidation in the past 24 hours as major assets corrected following a 2-week bullish trajectory. Data from Coinglass showed that nearly $300 million has been liquidated in the crypto market.

Bitcoin and Ethereum fell 3% and 8% in the past 24 hours as the Mt. Gox repayment gained momentum. CoinTab reported earlier that more than 40% of creditor funds in Bitcoin and Bitcoin Cash have been sent to exchanges for reimbursement.

Ethereum Leads Liquidation Chart

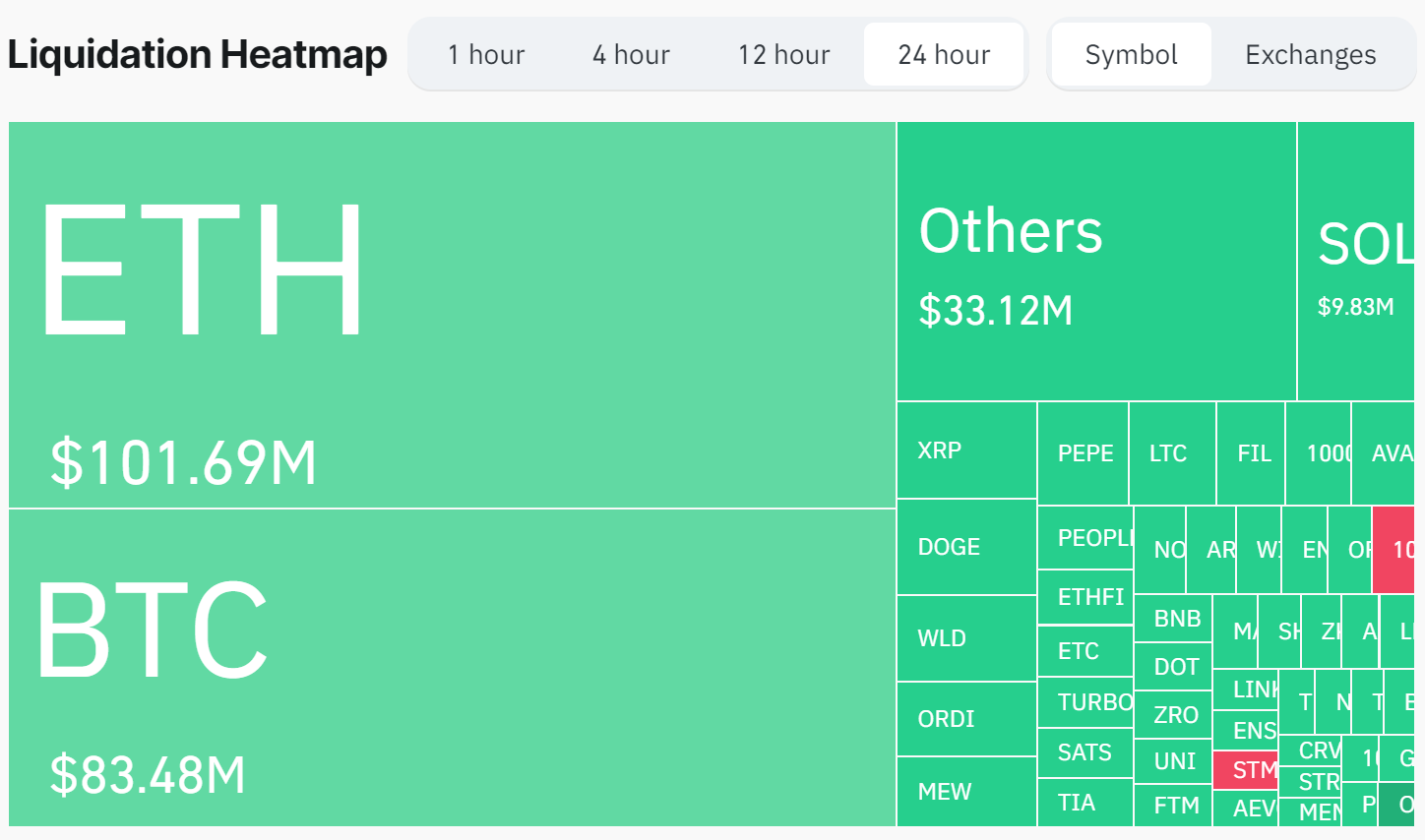

Surprisingly, Ethereum has led the liquidation heatmap in the past 24 hours, with over 95% of them long positions. About $101 million of ETH market positions have been liquidated, with $97.55 million in longs and $4.14 million in shorts affected.

The asset has seen increased selling pressure since the launch of the spot Ethereum exchange-traded fund (ETF) in the US. Grayscale’s Ethereum Fund has led the outflow, with $811 million in outflow already seen from the asset manager’s fund in just two days. Data from Lookonchain also showed that Grayscale transferred a net total of 135,662 ETH ($470.8 million) to Coinbase in the past 24 hours.

Bitcoin also saw significant trader liquidations in the past 24 hours, with over 85% of them bulls. About $83.4 million positions have been liquidated, with $71.76 million longs and $11.72 million shorts. Coins like Solana, XRP, and Worldcoin also saw substantial liquidations, with $9.8 million, $4 million, and $3.58 million in open positions wiped out of the market.

Whales Liquidated

There was a 93% increment in leveraged trading liquidation in the past 24 hours as the market saw notable corrections. The highest singular liquidation on a Bitcoin pair was $11.78 million, which happened on BTC/USDT on Binance. Also, the highest liquidation on an Ethereum pair was $7.35 million, an ETH/USDT pair on Binance.

Bitcoin traded at $64,270 at press time, while Ethereum exchanged hands for $3,169. The global crypto market cap decreased 4.28% to $2.31 trillion, with the Fear and Greed Index staying neutral at 59.