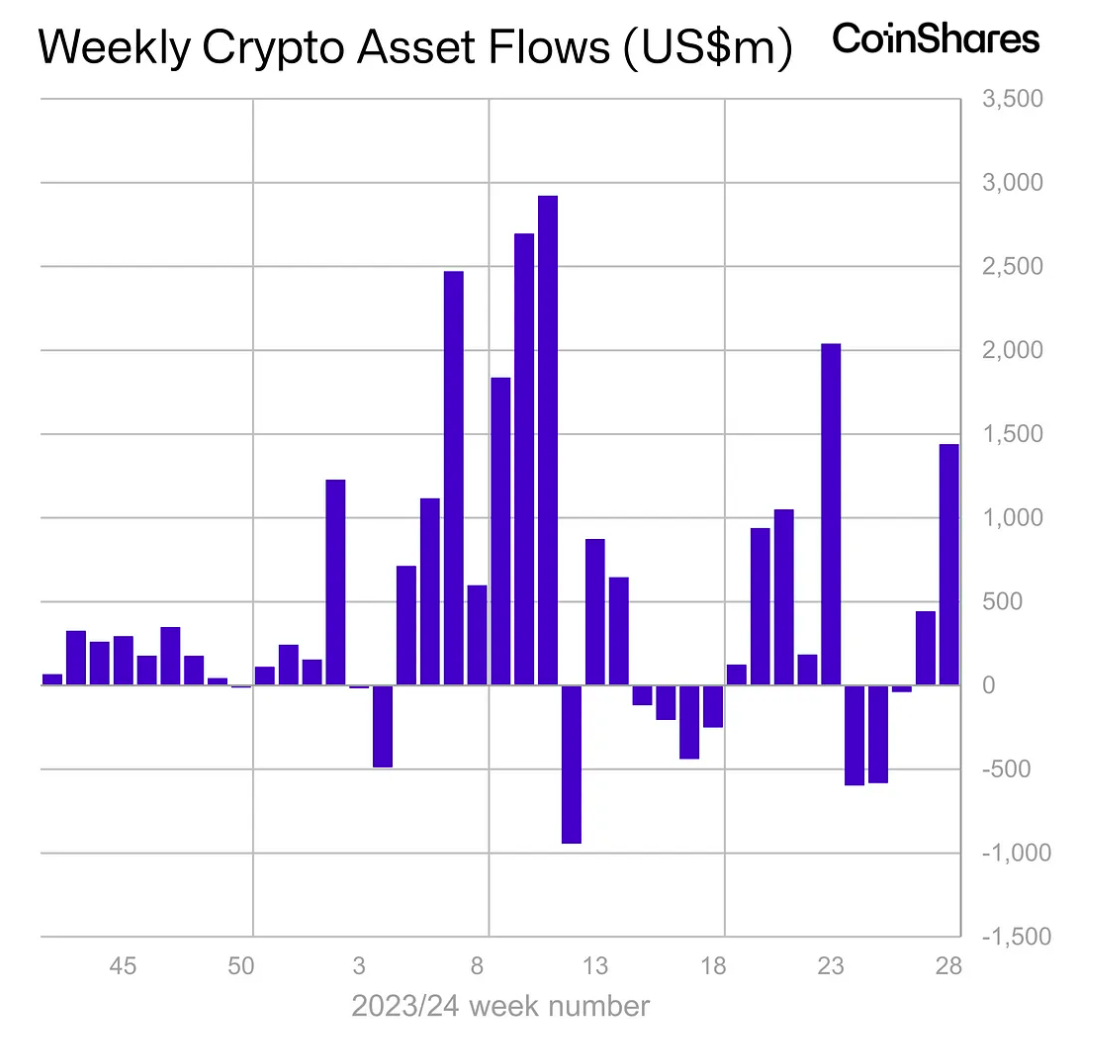

Last week, Bitcoin investment products saw a massive inflow of $1.35 billion, its fifth largest positive flow since inception. The staggering flow capped off a week of large investor inflow, with crypto investment products seeing $1.44 billion in inflow.

The robust inflows from crypto investment products have propelled the year-to-date inflow to $17.8 billion, surpassing the entire 2021 bull run’s inflow of $10.6 billion. Coinshare’s Monday report also revealed that the positive flow from June 8–12 marked the second consecutive week of net inflow, following a $144 million investment into crypto the previous week.

According to Coinshare’s James Butterfil, the massive investor influx is a buy-the-dip approach as Bitcoin and the broader crypto market experienced a significant price downturn the previous week. Selling pressure from the German government, followed by Mt. Gox’s repayment resumption, saw Bitcoin slide to $53,000.

“We believe price weakness due to the German government bitcoin sales and a turnaround in sentiment due to a lower than expected CPI in the US prompted investors to add to positions,” Butterfly said.

Bitcoin, Ethereum Products Shine

Typically, Bitcoin investment products brought the most cash to crypto last week, with $1.35 billion in inflow. US Bitcoin exchange-traded funds (ETFs) alone brought in $1.05 billion as the fund is on a six-day inflow streak starting on July 5. The US-traded Bitcoin product has now recorded over $15.8 billion in total net inflow since its launch on January 11.

Ethereum investment products also saw a strong week, recording a $72 million net inflow last week. The fund had its best weekly inflow since March as the launch of the Ethereum spot ETF in the US reached its final stages.

Other altcoins also saw net inflows. Solana, Avalanche, Litecoin, and Chainlink saw $4.4 million, $2 million, $1.2 million, and $1.3 million, respectively.

Bitcoin Rebound

The largest crypto asset saw a notable rebound from below $60,000 during the weekend to reach $63,000 on Monday. Bitcoin added more than 4.5% in the past 24 hours and traded at $62,664 at press time.

Bitcoin grappled on Sunday, falling first on the report of US presidential candidate Donald Trump’s assassination attempts, then rising above $60,000 at the confirmation that he was unshattered from the attack.

Since then, the asset has gained bullish momentum and has recovered all its losses since the German government started selling its Bitcoin holdings. The German government ran out of Bitcoin to sell over the weekend.