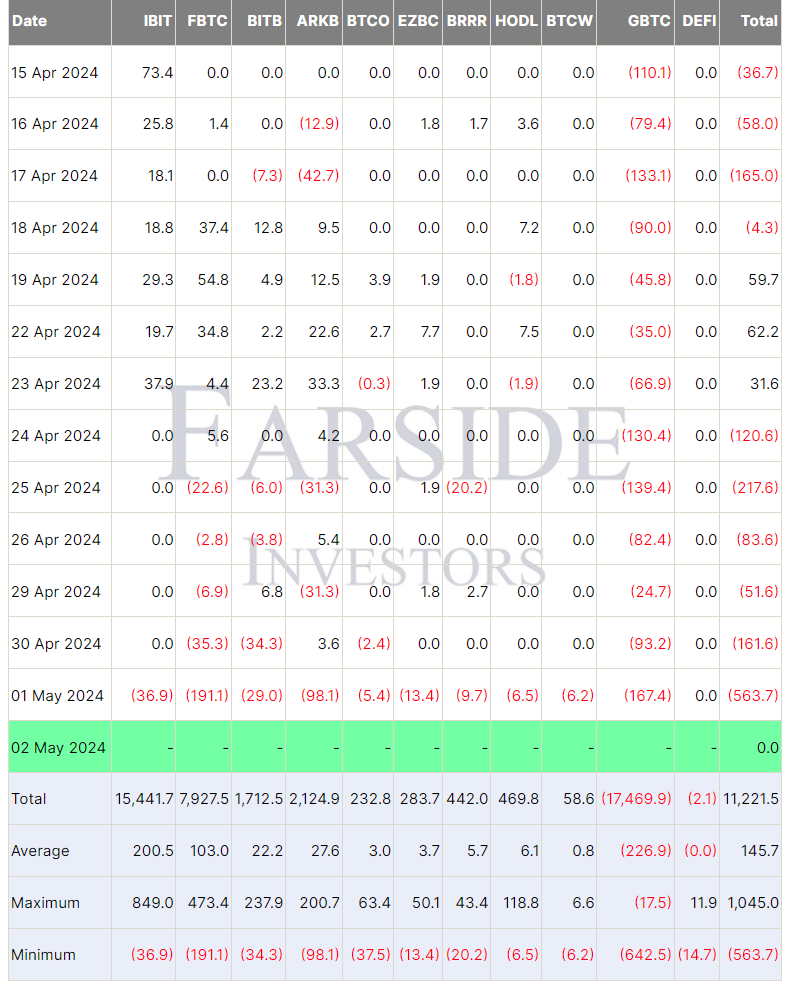

The US exchange-traded funds (ETFs) saw their highest outflow on Wednesday, shedding over $563 million as selling pressure persists. The net outflow continued a five-day streak despite Bitcoin and Ethereum rebounding in hopes that the Federal Reserve System (FED) would not hike interest rates further.

Surprisingly, Fidelity’s FBTC led the outflow charge on May 1, bleeding $191 million. Grayscale’s GBTC saw an outflow of $167 million, while BlackRock’s IBTC sold its bitcoin for the first time since January 11. The Larry Fink-led asset manager saw an outflow of $36.9 million on Wednesday.

All other ETF providers saw net outflows, with Ark Invest’s ARKB seeing a $98.1 million negative flow and Bitwise’s BITB bled $29 million.

Selling Pressure Persists

The recent market downtrend, which has created selling pressure, has continued to force investors to pull funds from Bitcoin and the crypto market. Since April 24, the 11 US Bitcoin ETF products have seen a net outflow of $1.2 billion.

ETFs have been a major source of inflows for the Bitcoin market, aiding the asset’s movement from mid $40,000 to a new all-time high of $74,000 on March 13. The depleting inflow from these products has raised concerns among bulls as the fourth bullish cycle is expected to be in play.

Macroeconomic Boost

Amidst dwindling inflows from US ETFs and Hong Kong’s newly launched products still not living up to the billing, the crypto market got a nudge from Fed Chair Jerome Powell’s positive stance of an interest rate cut soon enough.

On Wednesday, the Fed kept the interest rate unchanged at 5.25%, stating that inflation was still hot enough to cut rates. Powell debunked rumors of a possible rate hike and stated that the agency was working to rebound the U.S. economy soon.

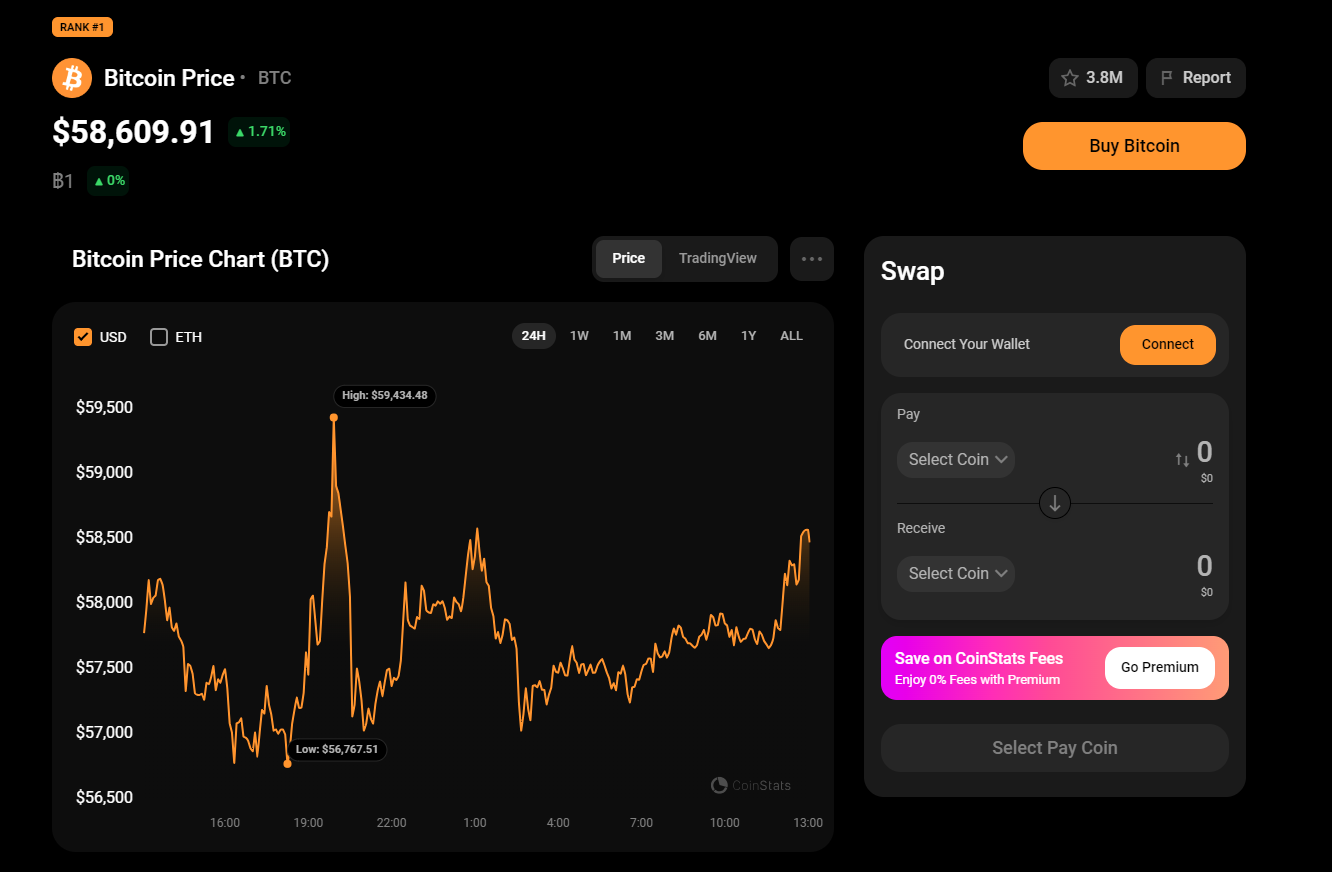

Following the event, Bitcoin showed signs of life, moving from Wednesday’s lows of $56,767 to touch $59,400. At press time, the asset was trading at $58,609, up almost 2% in 24 hours.