HBAR, the native token of the Hedera network, experienced a thrilling surge of over 100% in just 24 hours. This surge was triggered by a misinterpreted announcement that BlackRock was directly involved in the tokenization of its money market funds (MMF) on the Hedera blockchain.

The misconception started when Hedera announced in an X post on Tuesday that BlackRock’s US Treasury MMF has been tokenized on the Hedera blockchain in partnership with blockchain trading and infrastructure firm Archax and Ownera. The Hedera enthusiasts and some X influencers started sharing the news, claiming that the world’s largest asset manager was directly involved in the partnership, causing a pump in the HBAR price.

Today we witness #RWA history as @BlackRock’s ICS US Treasury money market fund (MMF) is tokenized on @Hedera with @ArchaxEx and @OwneraIO, marking a major milestone in asset management by bringing the world’s largest asset manager on-chain 🏦 pic.twitter.com/1Kye8cjAJx

— HBAR Foundation (@HBAR_foundation) April 23, 2024

Widespread Propaganda?

The video showing Hedera’s announcement was structured to make users believe that BlackRock was actively involved in the tokenization. A part of the X tweet even claimed that the partnership was “a major milestone in asset management” that brought the “world’s largest asset manager on-chain.”

The announcement got some of the key players in the crypto sector talking. Cardano’s Ghost Fund DAO founder Chris O’Connor stated that BlackRock had nothing to do with Hedera’s latest development and criticized the announcers for fashioning the announcement deceitfully.

“These kinds of misleading marketing pump my token pieces are gross. Lol, HBAR pumped 35% based on a non-event. Guess who gets Rekt’d’ in the few days as insiders take profit?” O’Connor stated in an X post.

In response, Archax CEO Graham Rodford stated that it was the firm’s choice to put BlacRock’s funds on Hedera, and everybody involved in the announcement was aware.

Hey @TheOCcryptobro it was indeed an @ArchaxEx choice to put on @hedera and, given our reg status we are one of the only places that can create, custody & trade these. It was our choice but everyone involved was aware. (1/2)

— Graham (@Grodfather) April 23, 2024

HBAR Begins Plunge

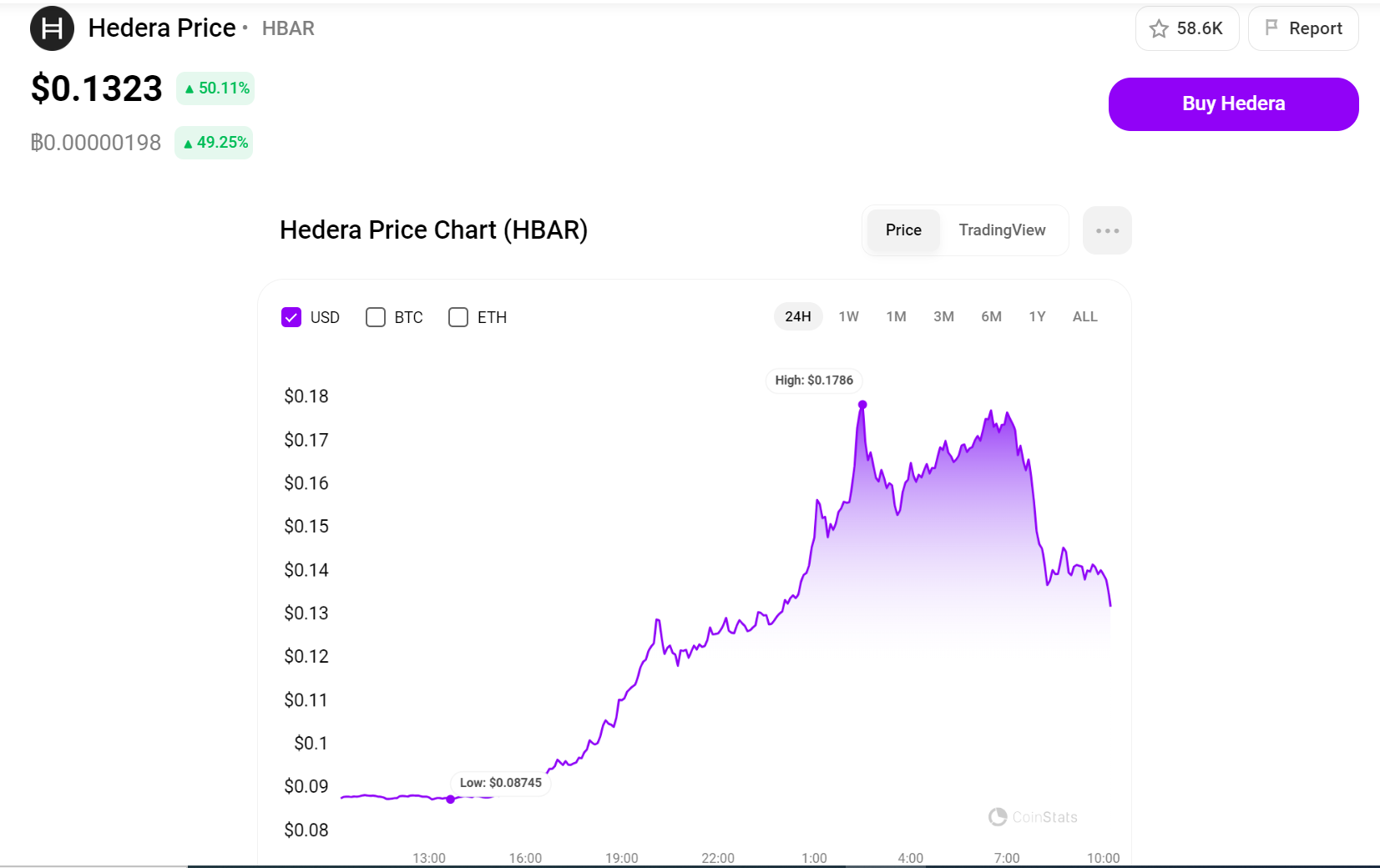

HBAR began to plunge following the uproar, giving back over 30% of the 107% it gained after the announcement. HBAR soared to a two-year high of $0.1786 on Wednesday morning but was trading at $0.13123 at press time, according to Coinstat.

Data from Coinglass also shows an increased short bid across major derivative exchanges, insinuating a sell-the-news bearish bias among traders. Despite this, the open interest on the HBAR trading pairs has remained above 400% ($151 million) in the past 24 hours.