Bitcoin whales are individuals or institutions that hold large amounts of Bitcoin (BTC) in their portfolio therefore, they have the potential to influence the market. They are considered major players in the crypto space because their buy or sell action in large volumes is capable of influencing the price of Bitcoin.

Therefore, it is necessary for investors or anyone seeking to venture into the crypto world to closely monitor the activities of these whales who make money for themselves while impacting the price of Bitcoin. This article demystifies the concept of Bitcoin whales and addresses some frequently asked questions about these entities.

Bitcoin Whales Explained

Bitcoin whales are individuals or organizations holding a substantial share of BTC. With the large amounts of Bitcoin in their wallet, they have the potential to significantly impact price movements with their trading tactics.

Just as mammalian whales are the largest creatures in the ocean known for creating waves that affect other fishes, similarly Bitcoin whales are very influential in the crypto scene due to the size of their holdings when compared to other traders in the market. The trading activities of BTC whales in large volumes can cause waves that greatly affect traders in the crypto market.

Consequently, the crypto traders and investors closely monitor whales ’ accounts since the movement of massive BTC holdings in their wallets gives them the upper hand to sway Bitcoin’s supply and demand with their trades, triggering price fluctuations.

When whales add to their Bitcoin stash, prices tend to soar due to the size of their trades because it gives the public the impression of a high demand for the asset. Conversely, if a Bitcoin whale opts to exit their position by selling a portion of their holdings, the price tends to respond with a decline.

However, it is not in all cases that the movement of whales’ funds signals a sell-off. Sometimes, they could be changing wallets or exchanges.

While whale’s activities are often open to the public, with their wallets tracked by the trading community, there are occasions when they opt for over-the-counter (OTC) crypto trading to minimize their impact on prices.

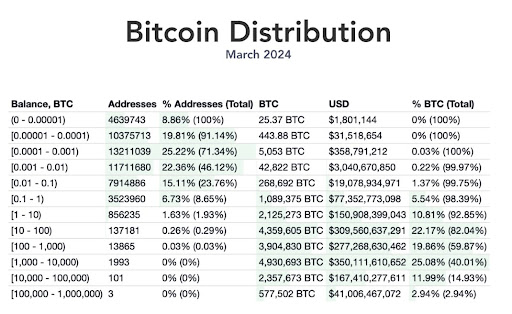

Whales are known to hold a significant share of the total circulating supply. As of March 2024, the distribution of Bitcoin ownership is highly concentrated. Only three Bitcoin addresses hold between 100,000 and 1 million BTC, totaling 577,502 BTC. The next 108 largest owners possess a combined total of 2,437,765 BTC, with individual holdings ranging from 10,000 to 100,000 BTC. These 111 wealthiest addresses collectively account for approximately 15.34% of the total Bitcoin supply.

Strategies Used by Bitcoin Whales

Bitcoin whales use various strategies to reap benefits and wield significant influence over its market dynamics. Here are a few of those strategies:

Accumulation

Whales can gradually accumulate large amounts of Bitcoin over time by making calculated purchases at low prices or during market downturns. They can take advantage of market cycles and generate considerable profits by buying during periods of low prices and selling during periods of high prices.

Market manipulation

Bitcoin whales occasionally engage in a pump-and-dump strategy, which involves artificially inflating the price of BTC by buying large quantities of the coin at one time to drive up its price and then selling it at a higher price to make a profit, leaving other investors with a loss.

Arbitrage

In this scenario, Bitcoin whales take advantage of price differences between different exchanges. By buying Bitcoin at a lower price on one exchange and selling it at a higher price on another, whales can profit from the price discrepancy.

Portfolio Diversification

Apart from Bitcoin, some whales invest in other digital assets to diversify their cryptocurrency holdings. This strategy allows them to mitigate risk and to

potentially profit from various areas of the cryptocurrency market while minimizing potential losses.

Long-term holding

Whales may also engage in ‘hodling,’ which refers to holding onto their Bitcoin for the long term, believing in its future value appreciation. By holding the asset for an extended period, the whales can protect themselves from inflation or possibly benefit from potential long-term price increases and avoid short-term market volatility.

Short and long hunting

When Bitcoin whales predict a price drop, they can use short-term strategies to sell large amounts of the cryptocurrency, scaring away smaller investors and driving the market lower. Conversely, they can use long-term strategies by strategically acquiring Bitcoin over time, which will generate positive momentum and encourage smaller investors to join the market, thus driving up the price.

Social media

Whales may start rumors on social media to give the public the impression of a high demand for the asset which will potentially push up the price to attract smaller investors to join in. Bitcoin whales eventually sell, which causes a price decline and losses for small investors. By analyzing social media trends and news sentiment, whales can identify potential market movements and adjust their trading strategies accordingly.

How to Spot and Monitor Bitcoin Whales

Bearing in mind how influential whales are, it has become common for crypto traders and investors to monitor their activities to make informed investment decisions.

Identifying and monitoring BTC whales is possible because the blockchain is a public ledger that documents the activities and crypto balances of users. However, it is vital to note that it is only possible to determine the real-world identities of the owners of wallet addresses when they publicly reveal this information. Here are some ways to stop and monitor whales:

Blockchain Explorers

Bitcoin’s public ledger allows observers to see how much whale address holds, how often it moves, and the destination of the funds. As a result, traders and investors anticipate their moves based on their previous decisions which will aid the community to make investment decisions.

Some of the blockchain explorers include Whale Alert and blockchain.com.

Analyzing Trade Activities and Patterns

Analyzing whale trading patterns is essential in monitoring them, especially the large trades that might lead to sudden price spikes or dips. Furthermore, some whales engage in unusual patterns such as Spoofing which occurs when traders place large orders with the intent to cancel them before they are executed. This tactic creates artificial market movements, misleading other traders and potentially manipulating prices.

Social Media Presence

Some of the bitcoin whales are very active on social media, announcing all their major activities in space through their handles. They share their opinions, investment strategies, and the bitcoin market. Small traders and observers can infer some insights from their potential trading activities and use this information.

Search for large transaction

Large trades made by whales frequently cause abrupt drops or increases in price. When a large amount of cryptocurrency moves, it is usually because whales are transferring it between wallets or exchanges. Bitcoin’s public ledger can help access all whale transactions and identify large amounts of Bitcoin being moved.

Watch for unexpected market movements

If unexpected market movements occur without clear news or events to explain them, it could signal the presence of a whale swimming somewhere close. Whales typically cause market fluctuations by purchasing or selling large amounts of cryptocurrency.

How to Become a Bitcoin Whale

A person or organization needs to possess a significant amount of Bitcoin in his digital wallet to become a whale; however, the threshold for this classification is not set. The widely acknowledged benchmark for being considered a Bitcoin whale stands at a minimum of 1,000 BTC.

According to data from a website called Bitinfocharts, among the 100 richest wallets in its list, there are over 100 wallets with 10,000 coins or more. Owning one of these wallets would make one a billionaire.

Frequently Asked Questions

How do Bitcoin Whales Make Money?

Crypto whales stand out from ordinary investors because they take a long-term view of the cryptocurrency market and often use advanced investment tactics.

Most of their holdings come through mining, early investment, hodling, and other methods. Their access to substantial Bitcoin holdings provides them with the capabilities to control and manipulate the market through major asset purchases or sales that can lead to price fluctuations.

Who are Some of the Richest Bitcoin Whales?

The first on the list is the pseudonymous creator of Bitcoin, Satoshi Nakamoto. He is believed to hold approximately 1 million BTC which is about 5% of the asset. The wallet has remained inactive for years. Others include Changpeng Zhao, the Winklevoss Twins, Microstrategy, Michael Saylor, and Tim Draper.

Do Whales Always Make a Profit?

While it’s true that whales can have a significant impact on market movements, it does not mean that the market is always favorable to them or that profit opportunities are exclusively reserved for them.

Whales may have an advantage due to their significant holdings it is however important to remember that the cryptocurrency markets are highly dynamic and constantly evolving. There are opportunities for traders of all sizes to profit from market movements, provided they approach trading with a disciplined mindset, sound strategies, and the right tools.

Conclusion

Bitcoin whales often command attention from other market participants due to their significant holdings and the impact of the movement of their funds on the price. While monitoring their activities can help make wise decisions in the market it is however important to remember that they can make emotional decisions without rationality or some movement might be aimed at manipulating the market.

Therefore, it will be vital for investors to exercise caution when monitoring whales’ activities to avoid prey to some schemes. It is also necessary to conduct thorough research when making investment decisions.