The world’s largest payment processing company, PayPal, launched its stablecoin (PYUSD) in August 2023. The move was heralded as a sign that the cryptocurrency industry was becoming mainstream. At last, a traditional financial player was coming to rival incumbents such as Tether (USDT) and Circle (USDC), potentially onboarding millions into the crypto world.

For newcomers, however, it can be a little confusing to understand how PYUSD works or why most industry players are excited about PayPal’s entrance into the stablecoin scene. This article discusses these points and reveals where readers can buy PYUSD and how to get the most out of the stablecoin.

What is PYUSD Stablecoin and How Does It Work?

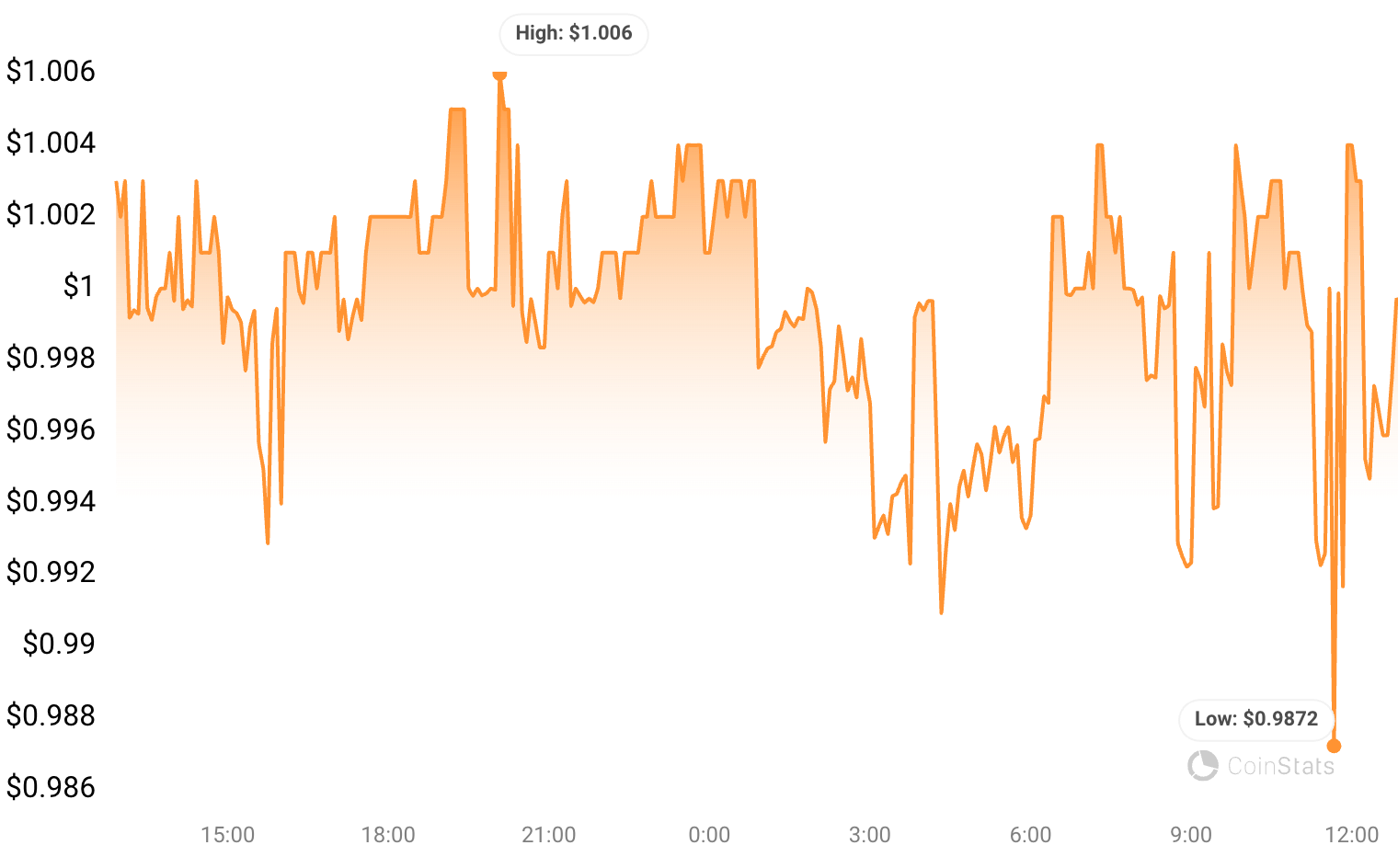

PayPal USD (ticker PYUSD) is a stablecoin backed by payment giant PayPal. Being a stablecoin means that its value is pegged to the US Dollar. In other words, 1 PYUSD is equivalent to 1 USD.

While there may be slight variations in this pegged value due to adverse market conditions, the price of 1 PYUSD should always trade close to a dollar. For instance, at the time of writing, 1 PYUSD is equivalent to $0.9994.

(Source: CoinStats)

How Does PYUSD Work?

Similar to most stablecoins, PYUSD uses an issuance and redemption mechanism. This means that before any unit of PYUSD is created, the issuing company, known as Paxos Trust, must keep the USD equivalent of the token in a bank account or USD-denominated investments such as government-backed bonds.

Hence, if, for example, there are perhaps 100,000 PYUSD in circulation, Paxos (PayPal’s official PYUSD partner) must have $100,000 or more worth of cash in a bank account or government bond to back the issued tokens. These funds, referred to as stablecoin reserves, ensure that Paxos can always pay back the USD equivalent to users who hold PYUSD in adverse cases.

Meanwhile, anyone (mainly individuals or institutions trading millions of US Dollars) can contact Paxos to mint and redeem PYUSD. Paxos customers receive PYUSD tokens equivalent to the amount they deposit (plus any fees) and can always redeem the tokens to receive the USD equivalent from Paxos.

Meanwhile, anyone can access PYUSD for transactions on supported blockchain networks, including Ethereum and Solana. They can also buy the stablecoin for exchanges that support PYUSD trading pairs.

PYUSD contract address Ethereum: 0x6c3ea9036406852006290770bedfcaba0e23a0e8

PYUSD contract address Solana: 2b1kV6DkPAnxd5ixfnxCpjxmKwqjjaYmCZfHsFu24GXo

PayPal USD (PYUSD) Competitors

PayPal’s stablecoin venture faces a highly competitive market. The market leaders, including Tether (USDT) and Circle (USDC), dominate the competition with a combined $144 billion market cap at the time of writing. Their market share represents over 88% of the total stablecoin market cap of $163 billion.

On the other hand. PayPal USD currently has a market cap of $403 million. This leaves significant room for growth, which PayPal will hope to catch up on in the coming months and years.

Where to Buy PayPal USD

PayPal’s influence means that just a few months down the line, PYUSD is already available on some of the most popular centralized and decentralized exchanges. Users can currently access PYUSD through the following platforms.

Centralized Exchanges

Decentralized Exchanges

Where to Store PYUSD

You can hold PYUSD on cryptocurrency wallets that support the ERC-20 token standard or Solana-based SPL tokens. Some of the popular options include:

What Can I Do With PYUSD?

Similar to most stablecoins, you can use PayPal USD for various purposes.

- Online Purchases: You can use PYUSD to buy things online on supported PayPal platforms, including Venmo.

- Trading: You can use PYUSD to hedge against crypto volatility, namely, converting your cryptocurrencies to PYUSD to secure profits or prevent further losses.

- USD Savings: PYUSD is a blockchain-based version of the US Dollar, making it an alternative to holding US dollars in a bank. Using a supported exchange, you can convert PYUSD back to cash at any time.

- Lending: Besides saving, you may lend your PYUSD to exchanges or decentralized lending platforms to earn interest on your holdings, as you would US dollars in a bank account. Granted, this lending option is not widely available in these early days of PYUSD. However, you can access PYUSD lending on Solana-based Kamino Finance.

Is PayPal USD Safe?

One might instantly conclude that PayPal USD is relatively safe. Such a conclusion would not be far-fetched, given PayPal’s strong reputation and the fact that Paxos is regulated by the New York Department of Financial Services (NYDFS).

However, it is worth mentioning that PYUSD faces the same risks as most widely used stablecoins. One of these risks is the potential to lose its peg, especially for relatively short-term spells. For instance, its pegged value may drop as much as $0.98. In such cases, users may hold the stablecoin until its peg recovers.

Lastly, it is possible that PayPal USD will cease to be used due to a regulatory change or ruling. If such an outcome plays out as it did for Binance USD (BUSD), users may expect to get sufficient time from PayPal to convert their PYUSD to cash or other cryptocurrencies.

Rounding Up

PayPal USD (PYUSD) represents an effort by PayPal to grab its share of the pie in the ever-growing stablecoin sector. After all, stablecoins have proven to be one of the biggest use cases for blockchain, and PayPal, with its track record, could help spur adoption.

In the meantime, market observers will be keen to see whether or not PYUSD lives up to billing and eventually rivals the big players such as USDT and USDC. However, the early signs have been good, and the competition will only get tense as the market evolves.