DeFi, an acronym for decentralized finance, is an umbrella term with a broad meaning. Being a well-known term in cryptocurrency, it is important to know what DeFi is and its role in the industry.

Can you make money with DeFi? Are there risks associated with it? Look out for the answers to these questions and many more as we dive deeply into this complete A-Z guide.

What is DeFi and How Does it Work?

Decentralized finance (DeFi) is a general term for the various decentralized, open, and peer-to-peer (P2P) financial products and services that run on smart contracts and blockchain technology. DeFi allows users to connect with other users and make transactions directly on a blockchain network, instead of going through a traditional bank.

Pronounced as ‘dee-fy’, DeFi is the decentralized version of TradFi (traditional finance), synonymous with CeFi (centralized finance), because it allows users to lend, borrow, trade, and do much more without third-party involvement.

The products and services on DeFi do not rely on financial intermediaries to function. This makes financial transactions on DeFi faster, cheaper, transparent, more flexible, more secure, and more efficient.

In contrast to TradFi where financial transactions can be canceled or reversed, transactions on DeFi, once verified, cannot be altered. They are immutable.

In addition, decentralized finance is open and censorship-resistant, as no central authority can block a transaction or prevent anyone from participating. DeFi can be accessed by anyone with an internet connection.

Again, operation hours in traditional finance are limited per day whereas the DeFi market is open for operation 24 hours every day.

DeFi Applications and Ethereum

Notably, most DeFi applications, known as decentralized applications or dApps, are built to operate on the Ethereum network. Why?

It is simply because decentralized applications (dApps) are powered by smart contracts. Beyond performing simple financial transactions, the Ethereum network is the first blockchain with a platform for smart contracts.

Smart contracts are special computer programs that can perform automated transactions when certain criteria are met, based on rules written on them. They are designed to serve as an alternative to traditional financial institutions.

The rules that regulate DeFi applications are written as codes on the smart contracts. The codes allow the contracts to execute tasks on their own without involving a central authority.

The Ethereum network has programming languages specially designed for such. This enables developers to build dApps on the network.

Due to this, Ethereum houses some of the largest DeFi applications. Another blockchain platform that supports decentralized applications (dApps) and smart contracts is Solana.

Categories of DeFi Applications

Explained below are some categories of DeFi applications:

Decentralized Exchanges (DEXs)

Decentralized exchanges are blockchain-based platforms that help users and traders exchange fiat currencies for cryptocurrencies. For instance, U.S. dollars can be exchanged for an equivalent amount of bitcoins using DEXs.

They are decentralized because they allow users to buy cryptocurrencies at will and trade them directly with other users without depending on an intermediary or disclosing personal data.

Decentralized exchanges are built on existing blockchains and are designed to support assets created on the same network. For example, DEXs built on the Ethereum blockchain support the exchange of ERC-20 tokens because they are assets created on the network.

One example of a decentralized exchange is Uniswap, a Decentralized Autonomous Organization (DAO) created on the Ethereum blockchain in 2018.

Decentralized Lending Applications

Decentralized lending applications are platforms that allow users to connect with other users and participate in lending and borrowing on the blockchain. This is done without going through financial organizations, such as banks, that serve as middlemen.

Decentralized lending platforms also allow users to earn interest when they participate. It is similar to depositing money into a savings account in a traditional financial institution and earning interest in the form of extra money after a particular time frame has passed.

In some cases, the interest rate is determined by market demands. This means that the higher the demand to borrow a certain digital asset, the higher the interest rate.

More to that, lending platforms on DeFi allow users to lend out their assets or lock up their funds without giving out confidential information about themselves.

Stablecoins

A stablecoin is a cryptocurrency whose value is pegged to the value of a fiat currency, like the U.S. dollar or the euro, or a stable asset, such as gold. This is done to ‘stabilize’ the cryptocurrency’s price, prevent it from being highly volatile, and make it easier to trade. Hence, the name ‘stablecoin’.

For example, Tether (USDT), the largest stablecoin by market capitalization, is tied to the U.S. dollar. This means that the value of one USDT is equal to the value of one U.S. dollar.

Other examples of stablecoins include USD Coin (USDC) and Dai (DAI).

- Wrapped Bitcoin (WBTC): Wrapped Bitcoin (WBTC) is an ERC-20 token that represents bitcoin on the Ethereum blockchain. Although the Bitcoin blockchain does not support decentralized finance, wrapped bitcoin can be referred to as DeFi for Bitcoin. This is because WBTC allows users to send and trade bitcoins on the Ethereum blockchain, making it possible for them to earn interest when they lend tokens to other users.

- Prediction Platforms: Prediction platforms on DeFi allow users and traders to place bets on the outcome of upcoming events, such as price movements, without relying on a third-party service provider.

Top Five (5) DeFi Applications

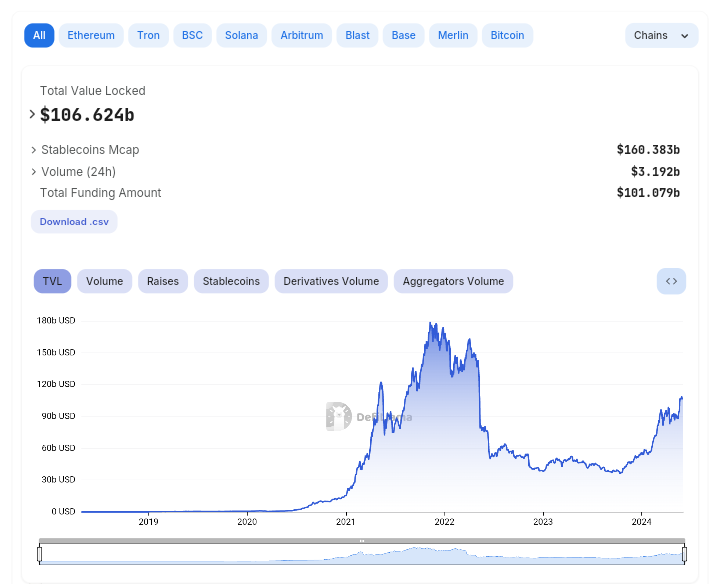

Under this sub-heading, we will discuss the top five DeFi applications by TVL (Total Value Locked).

First, though, what is TVL?

Total Value Locked, or TVL, is the main metric used to measure the size of the DeFi market. It simply refers to the amount of capital locked in DeFi protocols.

Back to the top five DeFi applications and their tokens:

- Lido (LDO): Lido is a DeFi protocol that exists on five chains. This means that as a user, you can stake LDO on five different blockchains. They are Ethereum, Solana, Polygon, Polkadot and Kusama. The protocol’s native utility token, LDO, has a capped supply of one billion. It is a governance token used to reward its users. The more LDO tokens a user has, the more powerful their vote is in the decision-making processes of the protocol.

- EigenLayer (EIGEN): Eigenlayer is a DeFi protocol built on the Ethereum network. It allows users to stake (ether) ETH on many protocols in exchange for protocol fees. This process is known as restaking. EIGEN tokens are yet to be launched. Hence, they cannot be bought or traded.

- Aave (AAVE): Aave is a decentralized money market protocol. It allows users to lend and borrow cryptocurrencies. The platform supports up to 20 digital assets such as DAI and UNI. Aave exists on 12 chains. Some of the blockchains include Polygon, Arbitrum, Fantom, Harmony, Avalanche, and others. The protocol’s native token, AAVE, was launched in 2020. It is a governance token that allows its holders to collectively take part in making decisions for the protocol. As a user, you can stake your AAVE tokens to earn extra AAVE tokens. Lenders can also earn interest by providing liquidity to the market.

- Maker (MKR): Maker is a decentralized lending platform founded in 2015. It is an open-source platform available for anyone to participate in. Maker exists only on the Ethereum blockchain and has a native token, MKR. This token serves as a governance token. Holders of MKR can participate and vote when changes are being made to the protocol.

- JustLend: JustLend is a decentralized financial platform that runs on the Tron network. The platform allows users to borrow, lend, deposit assets, and earn rewards when they stake their tokens.

Frequently Asked Questions About DeFi

This section provides answers to frequently asked questions about DeFi. You may have asked one or two of these questions before. So, here is your chance to get detailed answers.

Who Invented DeFi?

There is no one inventor of DeFi. This is because Bitcoin can arguably be referred to as the first form of DeFi since it was the first decentralized cryptocurrency, that is, the first-ever digital money created, as well as the first decentralized platform built on blockchain technology.

However, the term DeFi was invented in 2018 in a discussion among a group of Ethereum developers and entrepreneurs. This discussion centered on the name to be used to describe the concept which serves as an alternative to traditional finance.

The group included Blake Henderson of Ox, Brendan Forster of Dharma, and Inje Yeo of Set Protocol. Among other options, they decided to pick ‘DeFi’ as it can be pronounced as DEFY.

DeFi applications were first built on the Ethereum network and several of them still run on the network.

How Can I Make Money With DeFi?

There are many ways to make money with DeFi. One such way is through decentralized lending platforms as explained earlier. Users can make money when they loan out their assets and earn interest in return.

Another way to make money in the world of decentralized finance (DeFi) is through a concept known as yield farming. Yield farming is a complex concept that broadly involves putting crypto assets or DeFi tokens to work by participating in liquidity pools to earn returns from them.

The returns are usually received in the form of governance tokens. This gives the users who participate the right to join in the decision-making processes of the DeFi protocol.

A user who participates in yield farming is called a yield farmer. As much as it generates more returns than lending, yield farming also involves more risks.

Yet another approach you can take to earn money in the DeFi space is staking. Staking is a process that involves locking your tokens in a smart contract for a specific duration in order to earn rewards in the form of extra tokens.

Is it Safe to Invest in DeFi?

Well, no DeFi protocol is completely safe and devoid of risks. Hence, the safety of your DeFi investments depends on your due diligence.

Let us now examine some risks associated with DeFi and how they can be avoided.

What are the Risks in DeFi?

Although investing in DeFi can help you make some money if done correctly, it is not without risks. This is so because every investment done in the finance industry comes with risks.

That being said, what are the risks in DeFi? Here are a few:

- Risk of loss: Given the high volatility and unpredictability of the cryptocurrency market, the market value of tokens may fall or rise without prior notice. As a result, users who lock their assets in a liquidity pool before the market value falls may experience some loss.

- DeFi Rug Pulls: DeFi rug pull is a type of exit scam where a DeFi developer with malicious intentions promotes a new project or newly released non-fungible token (NFT) and makes away with the funds of investors.

Rug pull schemes usually appear genuine and difficult to detect at first until the developers suddenly disappear with investors’ funds. Also, due to the decentralized nature of blockchain technology, the identities of these malicious individuals become unknown, making it difficult for them to be caught.

However, certain steps may be taken to reduce the risk of falling victim to DeFi rug pulls. Some of them include carefully reading through the project’s white paper, avoiding entirely new projects that do not have track records to prove they are genuine and being careful about projects with high returns that sound too good to be true.

As a potential investor, you need to always base your investment decisions on thorough research and not on investment advice, as those may turn out to be flawed.

Will these risks cease to exist in the future? Only time can tell.

What we do know now is that there are risks associated with investing in DeFi. It is, therefore, important to do your research, be well-informed, and carefully calculate the risks involved before making any investment.

Get Trending Crypto News as It Happens. Follow CoinTab News on X (Twitter) Now