A Decentralized Autonomous Organization (DAO) is a blockchain-based community owned and managed by its members and not controlled by a central authority.

With an estimated figure of 13,000 DAOs in existence as of May 2023, these organizations play a significant role in the decentralized space. Thus, the article you are presently reading provides a complete breakdown of what DAOs are and how they work.

To begin in earnest, let us go back in time and take some history lessons. How did DAOs start?

A Brief History of DAOs

One of the first Decentralized Autonomous Organizations (DAOs) was created in 2016. Its name was The DAO.

Being the first of its kind, The DAO was designed in a way that would enable users to invest in the project and earn profits in return. Investors could buy DAO tokens, and get rewarded in either of these two ways:

- by earning dividends, or

- by getting profits when the tokens increase in value.

After The DAO’s launch on April 30, 2016, many investors bought DAO tokens. You may wonder, though, how they did it.

Well, investors paid for the tokens in the form of Ether. So, depending on how many tokens were bought, the equivalent amount of Ether was moved to The DAOs smart contracts. As a result, the project raised a large sum of $150 million worth of Ether.

At this point, one would imagine that the project recorded more successes. However, this was not the case at all.

A few days after the token sale commenced, some events occurred, leading to the ultimate failure of The DAO. So, what happened?

Some developers found that there was a glitch in the project’s smart contracts. This was a really big problem.

Fearing that the glitch could tamper with the security of the project, members of The DAO raised a proposal to rectify the issue. While this was ongoing, a malicious individual hacked the wallet and made away with $60 million worth of Ether.

This had negative effects on both The DAO and the Ethereum network, considering that they were still new creations. The DAO was only a few days old while the Ethereum network had only been in existence for about a year.

As mentioned earlier, the project failed. On the other hand, certain arrangements were made to roll back the Ethereum network’s history to before The DAO’s attack. This allowed investors to withdraw their investments from the smart contracts and keep their funds.

What is a DAO?

Pronounced as “dow,” a DAO has no central authority. It is an entity where decisions are collectively made by its members and are based on rules set on a blockchain.

Is The DAO the same as DAOs or a DAO? Not at all.

DAO, with its plural being DAOs, means Decentralized Autonomous Organization. The DAO, on the other hand, is one of the first DAOs created as explained in the preceding subheading.

Members of a Decentralized Autonomous Organization (DAO) make decisions when they vote for what they want. For instance, a member of a DAO can access the treasury only when other members give their approval.

Decentralized Autonomous Organizations can be used as funding mechanisms to determine the distribution of funds in projects such as Decentralized Science (DeSci).

As will be explained later, there are some popular examples of DAOs. For now, though, let us consider how they work.

How Does a DAO Work?

DAOs are transparent organizations because they are built on open-source blockchains. All financial transactions made in the organization are recorded on the blockchain, making it possible for anyone to access the transaction history and do some auditing.

Since a Decentralized Autonomous Organization (DAO) is owned by, not one, but all its members, hierarchy does not exist there. You can buy a token to become a member of a DAO and participate in it.

As a blockchain-based organization, a DAO runs using smart contracts. Rules guiding the organization are set on smart contracts. These rules are automatically enforced when certain criteria specified in the smart contracts are met.

To have a say in some DAOs’ decision-making process, a member needs to stake their tokens. This process makes the member a validator.

Although members collectively own a DAO, staking avails them the opportunity to vote on and influence governance proposals raised in the organization. This arrangement helps to prevent having a DAO filled with random proposals.

Also, as obtainable everywhere with decisions that involve voting, the majority carry the vote. The majority is then determined based on the specifications in the smart contracts.

Steps Involved in Launching a DAO

There are three major steps involved in launching a DAO. They are explained here.

- Smart Contract Creation: The first step for launching a DAO is to create the smart contract behind it. This is done by a developer or group of developers.

The rules guiding a DAO are set in the smart contracts and cannot be changed except when the members collectively approve of the change. Hence, developers need to put the contracts through thorough testing before launch.

- Funding: Funds need to be raised to keep the project running. This is the next step after creating the smart contracts.

In most cases, funds are raised by requiring investors to buy and hold tokens. The token holders are then rewarded by giving them governance rights.

- Deployment to the Blockchain: The final major step for launching a DAO is deploying it on the blockchain.

Once deployed, developers who created the smart contracts can no longer alter the rules guiding the project. Only the members of the DAO have the joint right to own and manage it.

Examples of DAOs

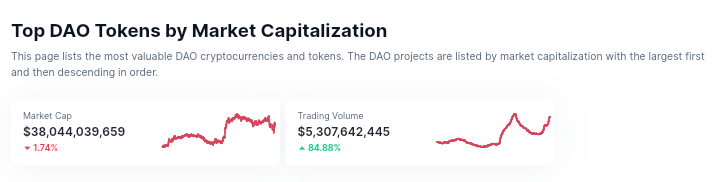

At the time of writing, the total market cap of DAO tokens is over $38 billion. Also, DAO tokens hold over $5 billion in trading volume.

Discussed below are three popular DAOs and their tokens.

- Uniswap (UNI): Uniswap is an open marketplace that provides liquidity and trades ERC-20 tokens on the Ethereum blockchain. It is owned and managed by UNI (the Uniswap token) holders.

Consisting of users, developers, designers, and educators, Uniswap was designed to be free from censorship, with no third-party custody, or intermediaries.

- Aave (AAVE): Aave is a decentralized protocol where users can participate as suppliers or borrowers. Governed by the AAVE token holders, Aave is an open-source organization that allows anyone to interact directly with the smart contracts on the Ethereum network.

Interacting with the protocol involves making transactions which, in turn, attracts transaction fees. Transaction fees vary, depending on how complex the transaction is and how fast the network is.

- MakerDAO (MKR): MakerDAO is a Decentralized Autonomous Organization, an open-source project built on the Ethereum network.

Its governance token, MKR, allows holders to manage the project. During a decision-making process, a token holder’s influence is determined by how many tokens they have locked in the contract.

It is important to note that this is not an exhaustive list of DAOs and their tokens. The list continues.

Benefits of a DAO

Being a decentralized entity, a DAO has some advantages over traditional entities. Explained below are some of the benefits.

- A DAO Solves the Principal-Agent Dilemma: The principal-agent dilemma refers to a conflict that occurs between the principal and the agent. In this context, the principal is a person or group of people while the agent refers to those who make decisions on behalf of the people.

In a traditional setting, the principal (the stakeholders) usually allows the agent (the CEO) to make certain decisions for the company. Sometimes, though, the CEO may take some moves that may completely favor them at the expense of the agent’s interests. This action usually results in a conflict, known as the principal-agent dilemma, between the two parties.

The collective ownership and governance obtainable in a DAO solves this issue. This is a very important advantage.

Investors do not need anybody to act on their behalf. Rather, they are part of the decision-making processes. Depending on the project, some investors have as much influence as the amount of tokens they hold and have locked in the smart contracts.

What is more, token holders are rewarded for interacting with the projects, making it difficult for them to act against the growth of the network.

- The Lack of a Hierarchical Structure Makes it Possible For Anyone to Participate in the Network: Any token holder can raise a revolutionary idea or a proposal which other investors can decide to vote for or against.

Since the projects are governed by rules set in the smart contracts, automated tasks can be accomplished without waiting for a high-ranking staff to provide their go-ahead.

Demerits of a DAO

- Security Concern: The events that led to the failure of The DAO show that a Decentralized Autonomous Organization is not completely immune to a security breach. Also, bugs discovered in a smart contract may be difficult to fix due to its immutable nature.

- It is Relatively New: Although a DAO has some potential for continuous growth and success in the future, it is still relatively new and is yet to gain the complete trust of some.

What is the Future of DAOs?

With the concept behind DAOs getting clearer and clearer, DAOs have gained traction over the years. This is evident in how the number of these projects has increased.

It is equally important to recognize that, although some projects are yet to reach full decentralization, they are still new and may be able to achieve the goal in years to come. Due to the potential of DAOs to improve community management and governance, more organizations may embrace the model in the future.

Get Trending Crypto News as It Happens. Follow CoinTab News on X (Twitter) Now