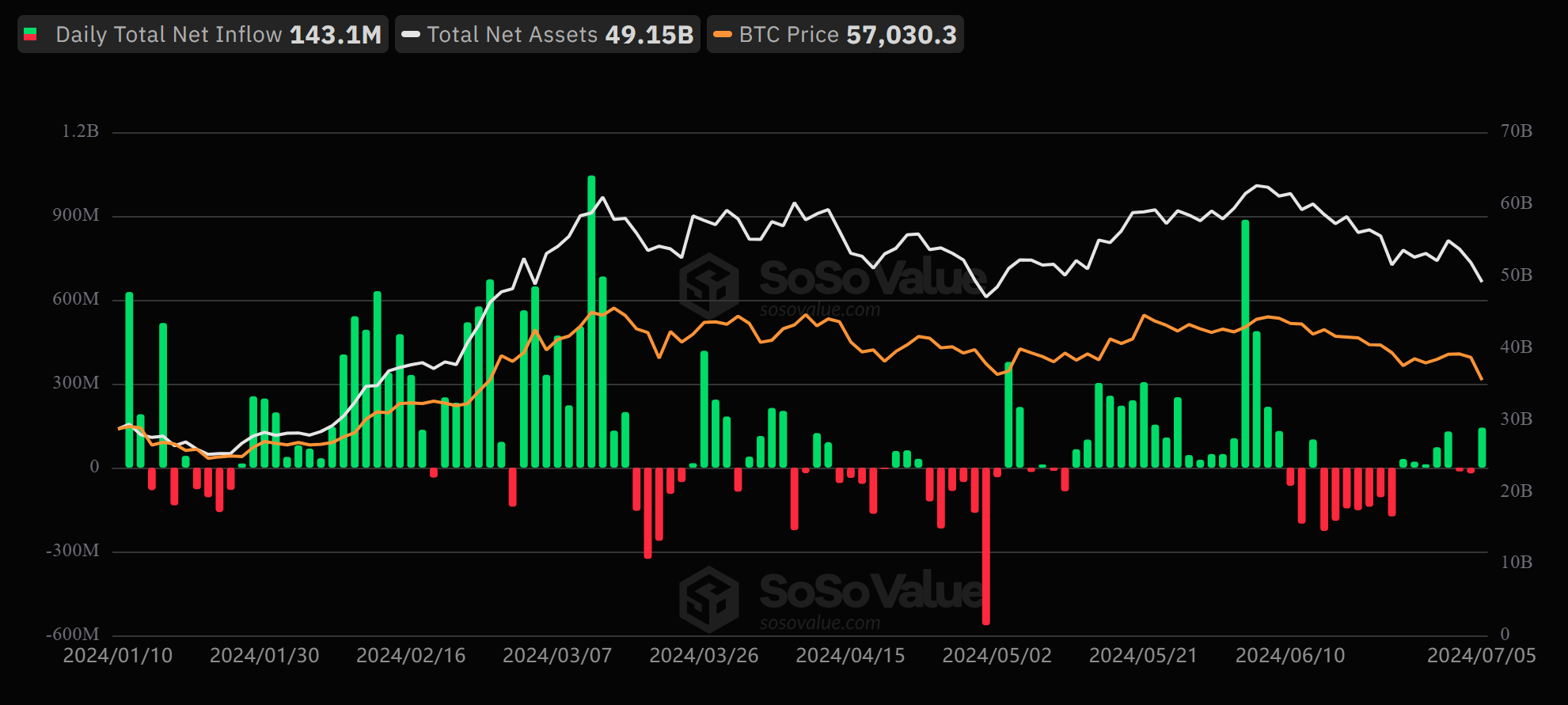

Bitcoin’s recent downtrend seems to have not bothered investors, as one of the asset’s investment vehicles saw a massive cash influx on Friday. Data from SoSovalue showed that the US spot Bitcoin ETF saw a net inflow of $143 million, its highest single-day positive flow since June 6.

The Friday influx brought the net inflow from the US Bitcoin ETF this week to $311 million, a huge improvement from last week’s net outflow of $216 million. Since its launch almost six months ago, the Bitcoin spot ETF has seen a net inflow of $14.76 billion.

Fidelity, Bitwise Shines

Fidelity’s FBTC led the inflow on Friday, attracting a single-day inflow of $117 million. The asset manager’s recent performance has been stellar, outshining even industry giants like BlackRock in terms of investor attraction.

Bitwise’s BIBT followed closely with a $30 million net inflow, its best inflow day since the start of the month. HODL and Ark Invest’s ARKB recorded $13 million and $11 million, respectively. This significant investment suggests investors remain bullish on Bitcoin’s long-term potential despite short-term market capitulation.

In contrast, Grayscale’s Bitcoin Trust, GBTC, experienced a single-day outflow of $29 million, while BlackRock’s IBIT, Invesco’s BTCO, and Valkyrie’s BRR, among other issuers, recorded no inflow or outflow.

Bitcoin’s Capitulating

According to analysts, Bitcoin’s recent price downtrend can be attributed to the currency becoming oversold. The decline of digital currency over the past 48 hours was largely driven by selling pressure from defunct exchange Mt. Gox and the German government.

This news led to a sharp sell-off, causing Bitcoin to plummet to its lowest point in over four months. However, the oversold conditions have since triggered a rebound, with Bitcoin prices recovering somewhat as investors buy back into the market.

Bitcoin prices rebounded yesterday after falling to their lowest in over four months amid weak market conditions. At the time of reporting, bitcoin was up 2.55%, trading at $56,729.