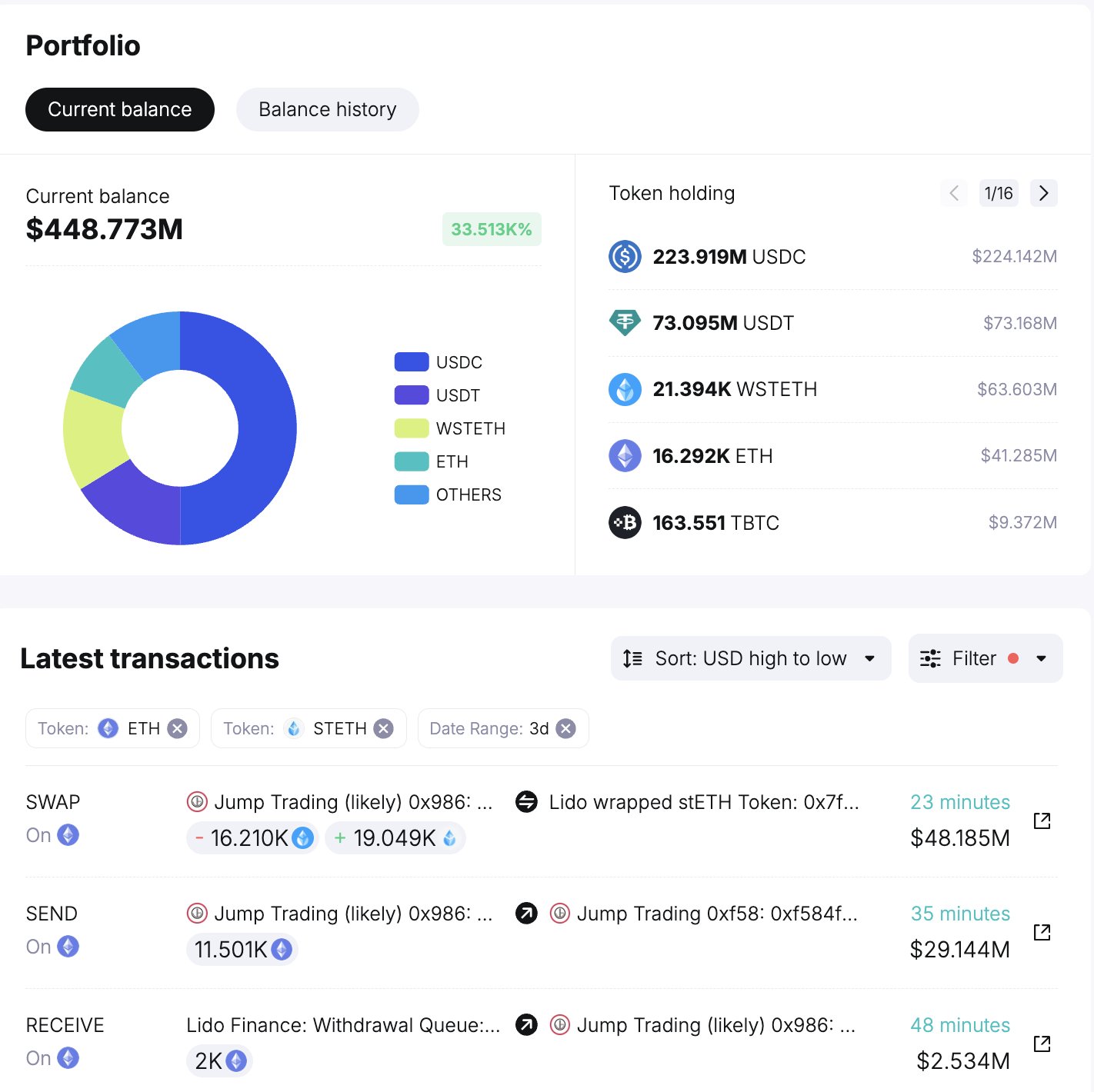

Ethereum traders may have a few things to worry about as the platform Jump Trading seems to have resumed sales. Data from Spotonchain revealed that the firm transferred 17,049 ETH ($46.44 million) for sales.

On Wednesday, Jump Trading claimed the ETH from Lido Finance, Ethereum’s largest staking platform, and immediately transferred it to the selling address “Oxf58.” The trading platform has sold over $500 million worth of Ethereum since the start of August.

More to Come?

Further analysis showed that Jump Trading converted its remaining 21,394 wrapped-staked ETH (wstETH) to 25,156 staked ETH ($68.7 million). However, unlike others, it did not immediately withdraw the asset from Lido.

A review of Jump Trading’s Ethereum portfolio revealed that the firm still holds $148 million worth of the asset. It holds 24,993 ETH ($68.3 million) in wallet Oxf58 and 29,093 ETH ($79.5 million) staked with Lido Finance.

Ethereum Resilient

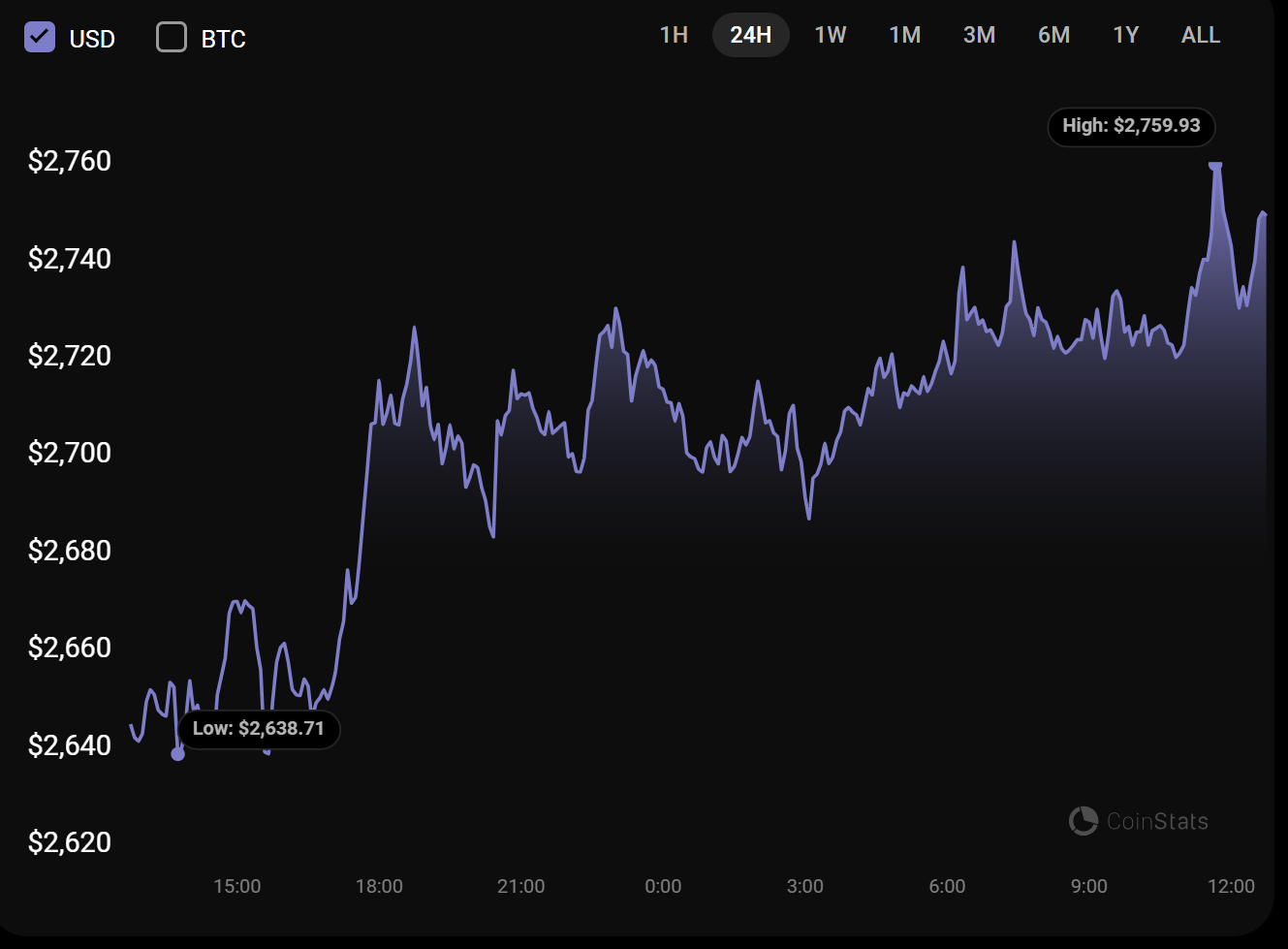

The selling pressure saw Ethereum drop slightly from $2,759 to $2,732 but rebound quickly to trade at $2,750 at press time. Ethereum faces major resistance at that level, having failed to break above it since August 5.

Ethereum rebounded from an August 5 market crash that saw it drop to $2,241. The asset is up over 10% from the past week and 3.54% in the past 24 hours.

A significant source of Ethereum’s bullish momentum is its US ETF product, which saw a $155 million inflow last week. The fund saw an inflow of $4.9 million on Monday and $24.34 million on Tuesday as investors showed interest in the Ethereum product.