The role of the recently launched Bitcoin ETFs in the United States is becoming increasingly crucial, serving as a key indicator of investors’ appetite for BTC. Over the past five days, these funds have witnessed net negative outflows, a trend that is accurately mirrored by Bitcoin’s 12% loss on the weekly chart.

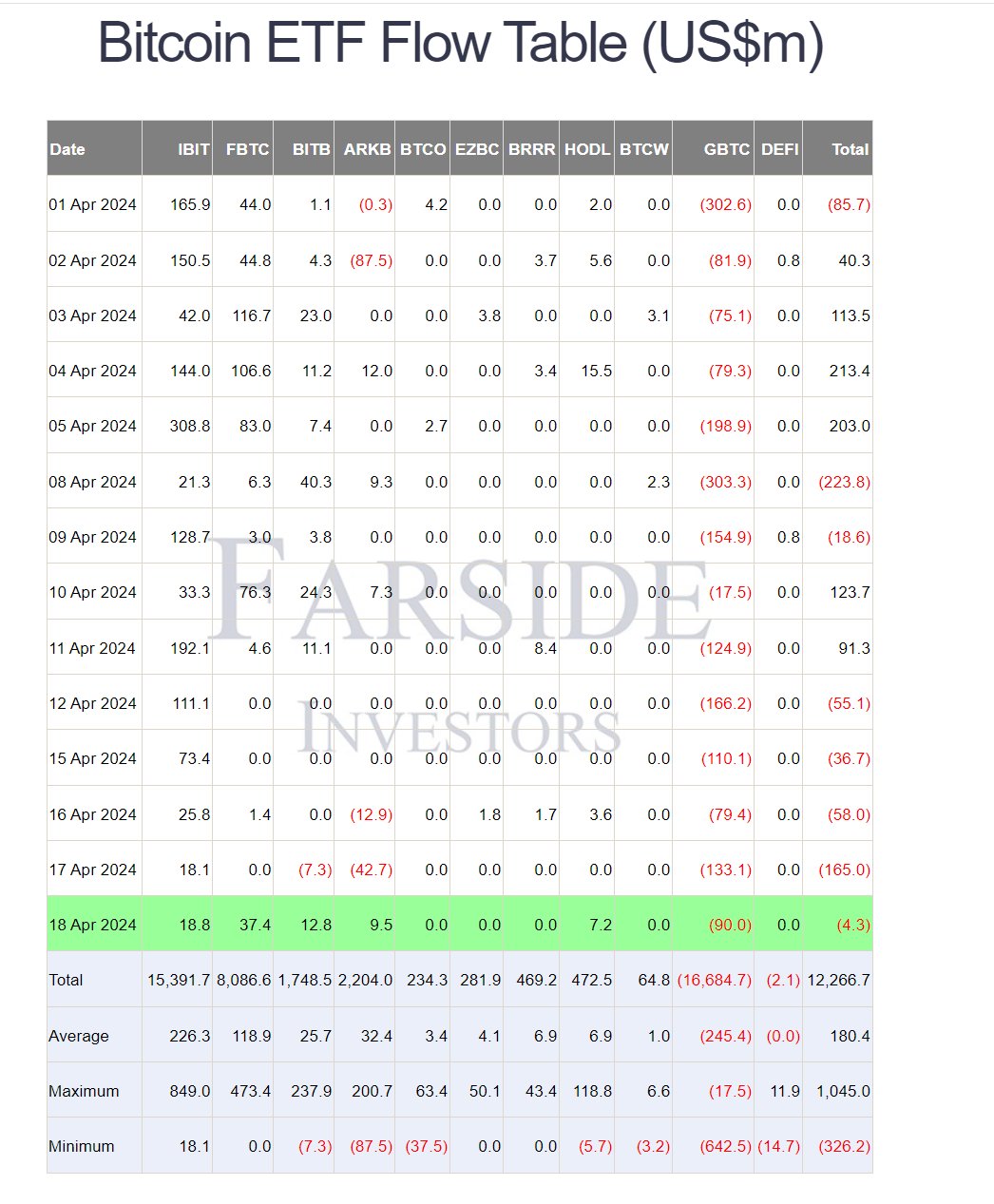

In this April 18 Bitcoin ETF report, data from Farside shows that the funds posted another day of net negative outflows, with $4.3 million withdrawn. The decline, however, does not completely reflect investor actions on the day.

For instance, popular Bitcoin ETFs such as BlackRock, Fidelity, Bitwise, Ark Invest, and VanEck all saw positive inflows. These funds attracted a combined $85.7 million in inflows, with Fidelity and BlackRock bringing in the most at $37.4 million and $18.8 million, respectively.

However, these inflows were more than matched by the $90 million withdrawn from Grayscale’s Bitcoin ETF, resulting in a net negative outflow. Recall that Grayscale’s Bitcoin ETF has largely seen outflows since January as investors flee for more fee-friendly funds.

Meanwhile, bullish Bitcoin investors may find a glimmer of hope. The aggregate value of a net $4.3 million in outflow posted on April 18 represents the lowest figure out of the most recent five days of negative performance. This may be considered an indicator that outflows are slowing down and could potentially turn positive in the coming days.

Bitcoin Briefly Dips Below $60,000

While Bitcoin’s steady price on April 18 represented the mild outflow in the ETFs, the leading cryptocurrency briefly fell below the crucial $60,000 mark in the hours leading up to press time. The decline was largely attributed to escalating war fears after Israel reportedly attacked Iran again. As CoinTab reported, Bitcoin dropped 8% last week following news of an initial attack.

At the time of writing, Bitcoin’s price has rebounded from its most recent lows. BTC is trading around $62,200, bouncing back to price levels seen before the latest war news from Iran.