One of the most widely known events in Bitcoin’s history is set to take place in the next few hours. While the code that executes Bitcoin’s halving is almost guaranteed to work as designed, one facet of the event always remains an issue for debate within and around the halving.

Market participants seek to gauge just how much of an impact the halving would have on Bitcoin’s price. While some argue in favor of a substantial short-term increase, many agree that the impact is likely to be felt within a year, and history tends to support this notion.

Bitcoin Primed For a Surge to At Least $180,000 Within One Year

The Bitcoin network has had three halvings to date, in 2012, 2016, and 2020. The pre-scheduled event typically creates a supply shock as the number of newly released bitcoins gets cut in half. As long as demand for Bitcoin is sustained in the weeks and months after the halving, price actions tend to trend northward.

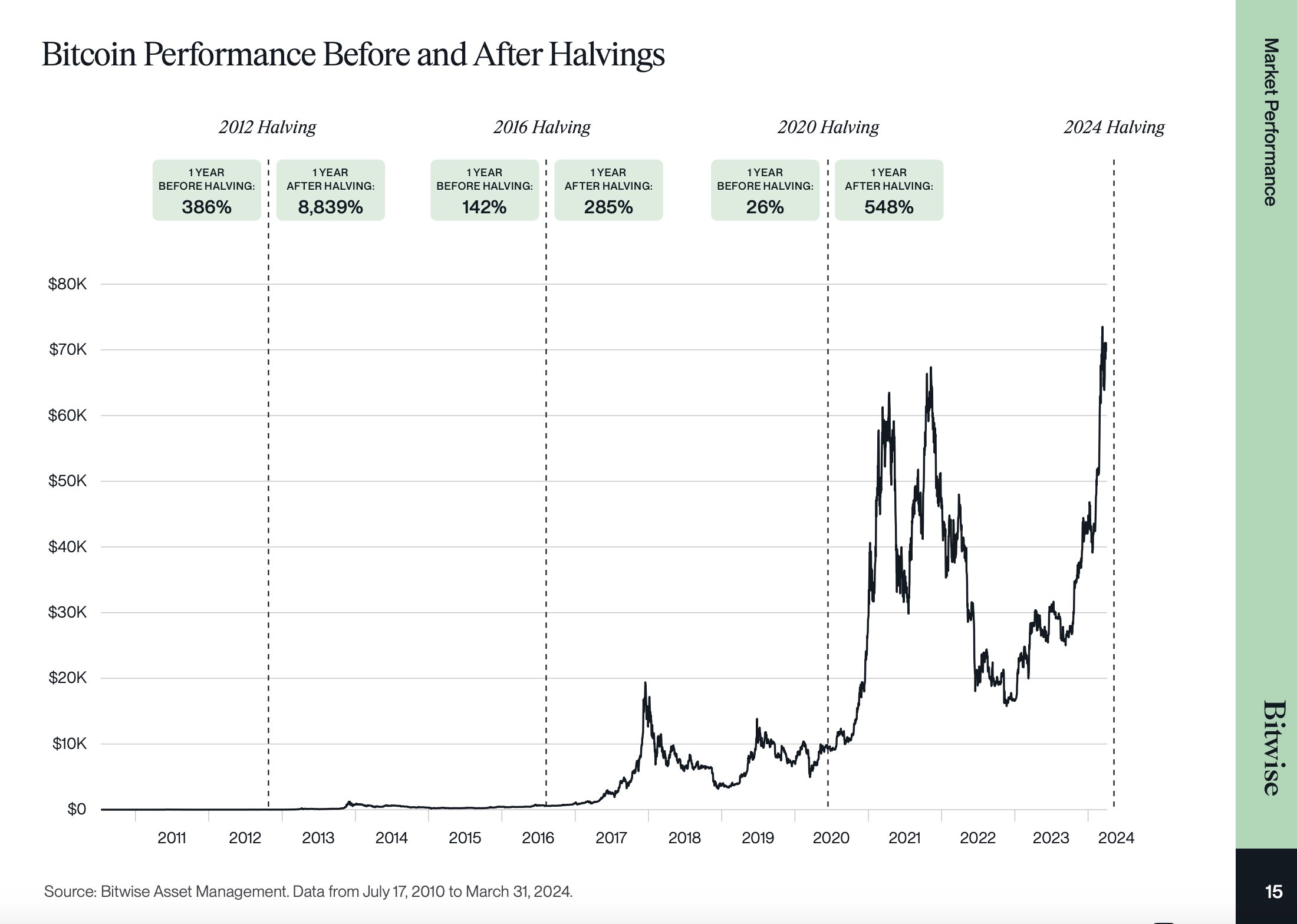

As the chart below from Bitwise shows, Bitcoin has gained 8,839%, 285%, and 548%, respectively, within one year after the previous halving.

Bitcoin is currently trading at around $64,000 at the time of writing. Hence, using a conservative estimate of a 200% gain in the next year, the leading cryptocurrency could trade at a minimum value of $180,000 based on its previous historical surges after the halving. Another estimate by a prominent market analyst, Plan B, favors a rise as high as $300,000 by the end of 2025.

Improved Market Infrastructure Also Favors an Increase

Beyond the historical impact of the halvings, Bitcoin’s underlying market infrastructure has improved since the last halving. Significantly, the United States has welcomed the first set of Bitcoin ETFs, which opens a new familiar channel for mainstream retail and institutional investors to gain exposure to BTC.

The Bitcoin ETFs have already gotten off to a fine start, propelling Bitcoin to a new all-time high before halving for the first time in the cryptocurrency’s 14-year history. Although inflows have slowed recently, the funds now hold over 4% of the entirely circulating bitcoin supply and could scoop up an even larger amount if market conditions remain positive for the next few months.

Barring bearish macroeconomic conditions such as war tension in the Middle East and sustained inflation, Bitcoin looks primed to repeat its historical performance within the halving year. However, nothing is completely written in black, so investors must prepare for the best outcomes while remaining cautious of the crypto market’s potential to ring surprises.