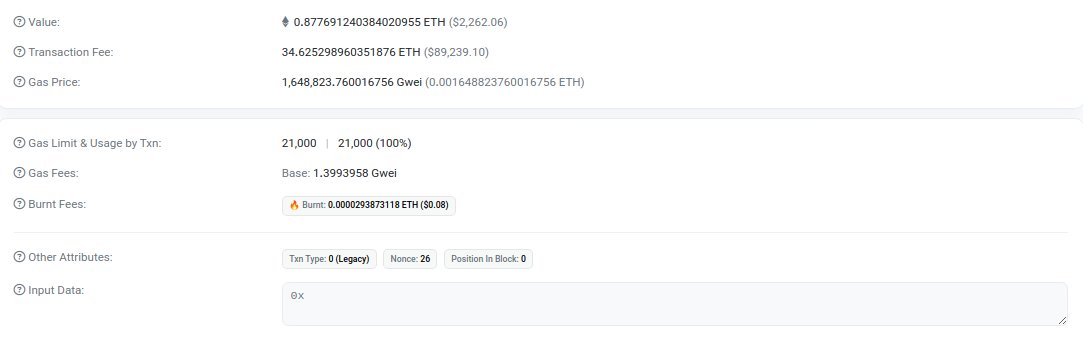

An unidentified user on the Ethereum network made a costly transaction blunder on August 11 while making an on-chain transfer. Data from Etherscan, shared by pseudonymous user DeFiac, showed that the wallet paid 34.26 ETH (worth $89,239) as a gas fee to move a mere 0.87 ETH (worth $2,262).

The user spent over 40x of what he transferred on gas fees, a ploy popularly known as fat finger. This type of error is not new in the crypto sector, especially on the Ethereum network.

The Sunday blunder is miles away from the most expensive transaction fees ever paid on the Ethereum network. Earlier in the year, Bitfinex paid $23.5 million in gas fees to move just $100,000.

There were also other occasions when users paid deafening transaction fees. In October 2023, an NFT buyer spent 1,055 ETH (worth $2.8 million in today’s market) in gas fees to purchase a collection worth $1,000 then.

The outrageous $90,000 transaction fees come at a time when transaction charges have reached their lowest point on the Ethereum network. Base fees on the blockchain hovered around 1 Gwei and 2 Gwei, one of the lowest Ethereum has seen in history.

Dwindling Fees Impact Burn

The declining gas fee on Ethereum has severely impacted the burn rate on the network. Analysis showed that the daily amount of Ether burned reached its lowest since the year, solely because of the reduced base gas fees.

Just 210 ETH was burned on Saturday, taking the net ETH emission to 2,100 ETH. This has made the network inflationary.

A possible logic for these reductions in gas fees is declining on-chain activities. This may be due to user migration to Layer 2 scaling solutions, which were made extremely cheap by the Dencun Upgrade earlier in the year.

Ethereum stayed strong on Monday amidst broader market uncertainties. The second-largest crypto asset is up 3% in the past 24 hours and was trading at $2,713 at press time.