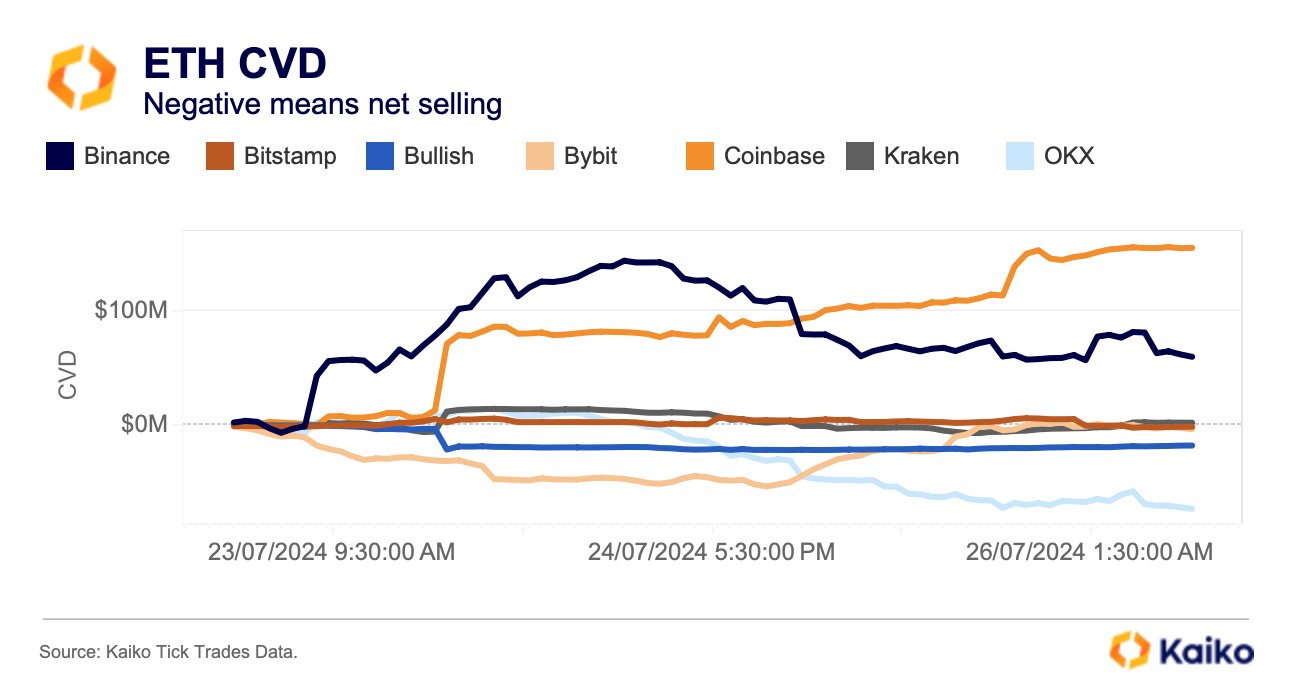

Data from analyst Kaiko shows that the second largest crypto asset, Ethereum, has seen increased demand after the launch of its long-awaited spot Ether exchange-traded fund (ETF). The report, shared on Friday, shows that the accumulation of Ethereum across centralized exchanges has ramped up since July 23.

Two of the leading global exchanges, Binance and Coinbase, were seen to have the most improved buying-to-selling ratios after the ETF launch on Tuesday. Bitstamp, Bybit, and Kraken also maintained a bullish ratio, with OKX being the only exchange with more sellers than buyers.

Kaiko’s analytics utilized the cumulative volume delta (CVD), an indicator that showed the bullish/bearish ratio according to on-chain trading activities.

Investor Interest Surges Post-ETF Launch

The CVD indicator showed a net inflow of over $100 million in ETH into Binance on Tuesday and Wednesday before a decline to the $70 million to $80 million region on Thursday and Friday. On the other hand, net inflow into Coinbase grew from $80 million on Tuesday to over $150 million on Friday.

Other aforementioned exchanges also saw moderate increases in buying pressure, but OKX saw net sales of over $30 million. Kaiko attributed the negative outflow on the exchange to some investors cashing out gains.

“Selling outweighed buying on OKX, indicating some traders are taking profit,” the analytic firm tweeted.

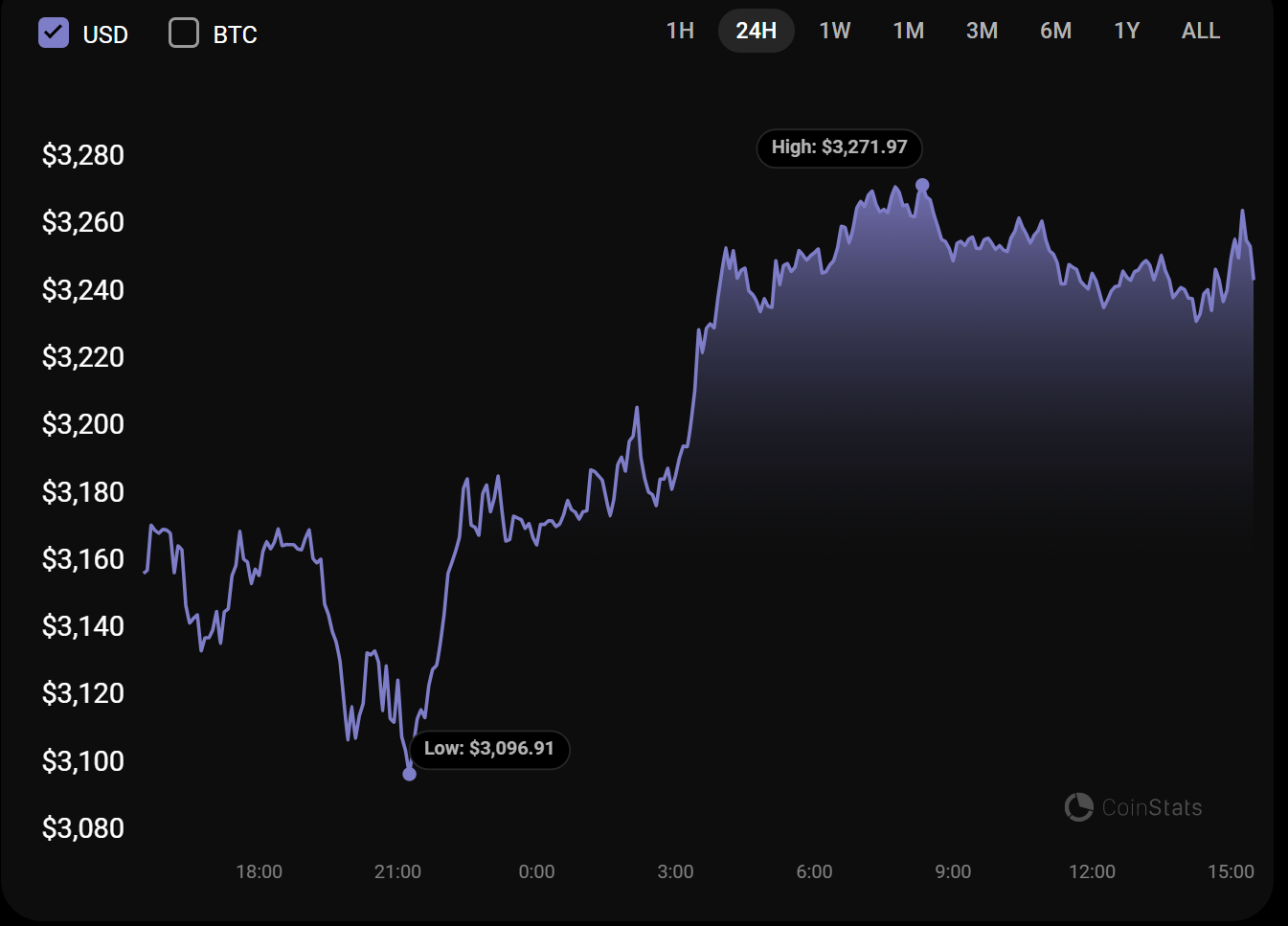

Ethereum Shows Signs of Life

The Ethereum price responded to the hype around it after the ETF launch, rebounding over 3% on Friday. ETH dumped 10% in two days, with Grayscale dumping over $1.1 billion worth of ETH in just three trading days.

Ethereum traded at $3,234 at press time, with a 24-hour volume of $46 billion. The asset remains 33% away from its all-time high of $4,878.