Although Ethereum is still more than 20% away from its all-time high, data from IntoTheBlock shows that 90% of the wallets holding the asset are already profitable. This was spurred by the recent surge in Ether price on Monday, which saw the token add more than $500 in less than two hours.

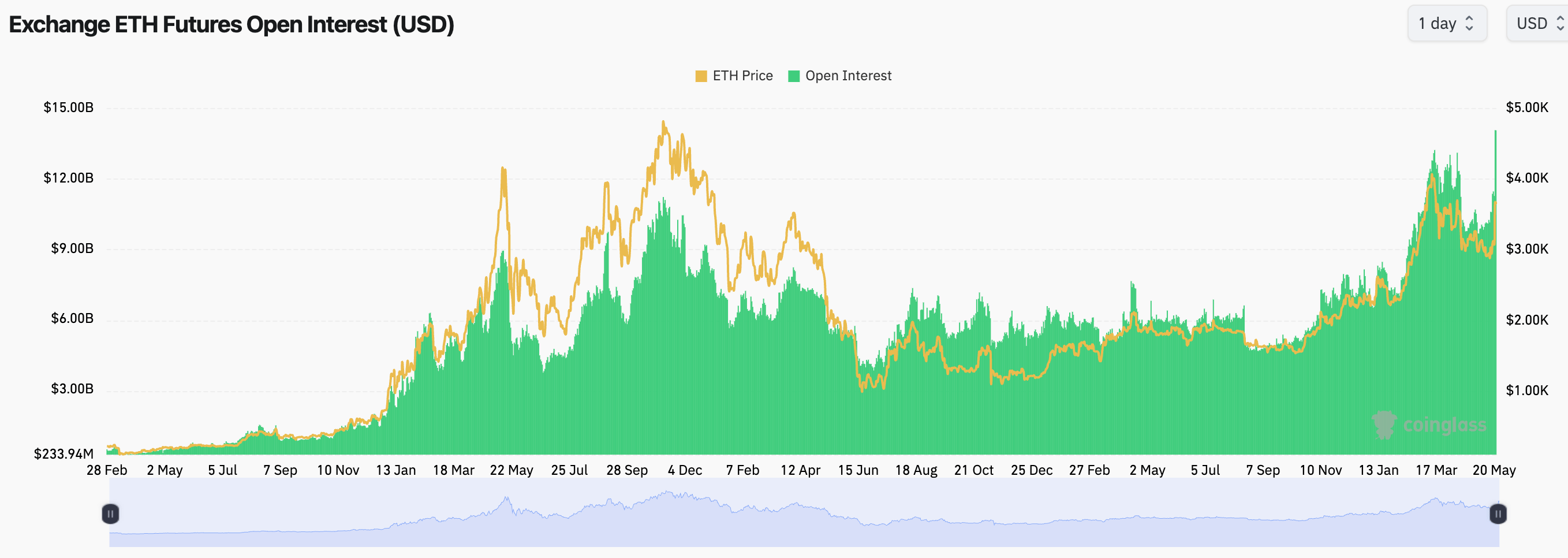

Amidst spot holders’ gains, data from Coinglass also shows that derivative interest is booming. The Ethereum mad rush meant that open interest across centralized exchanges had reached a record high of $15.25 billion, up 30% in the past 24 hours.

The past 24 hours have witnessed an astonishing 18% growth for Ethereum. This surge was triggered by the Securities and Exchange Commission’s (SEC) request that Ether ETF applicants update and refile their 19b-4 document, a move that significantly impacted the asset’s value, pushing it from $3,000 to as high as $3,700.

Red-hot Ethereum

Ethereum’s derivative trading volume has skyrocketed a whopping 226% in the past 24 hours, with traders looking to leverage the ongoing bullish rampage. Spot trading volume almost blew up 260% to $40.11 billion.

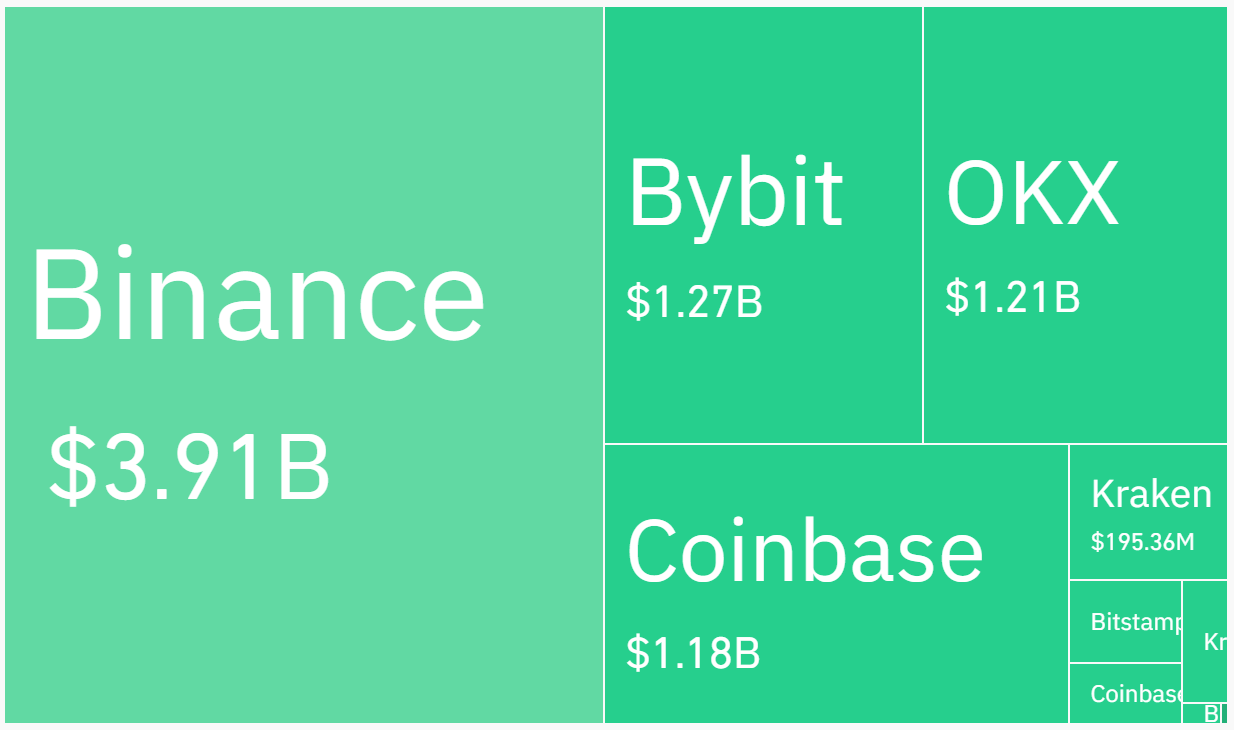

A good number of Ethereum’s spot and derivative trading volume has come from leading crypto exchange Binance, which accounted for $5.9 billion and $28.53 billion of their entire volume, respectively. OKX, Coinbase, and Bybit have produced an admirable share of Ethereum’s volume, churning in $1.21 billion, $1.18 billion, and $1.27 billion, respectively.

Wen Move?

If Ethereum followed Bitcoin’s path pre-approval, the asset could reach a new high soon enough. Bitcoin moved over 50% last year on increased confidence that the SEC would approve its spot ETF by January.

If Ethereum achieves a similar feat, the token will trade above its all-time high of $4,800 soon enough. Ethereum is trading at $3,785 at press time, with a market cap of $445 billion.

Meanwhile, the odds of the SEC approving the Ether ETF continue to heighten after Standard Chartered analyst Geoff Kendrick stated on Tuesday that the Wall Street top regulator would approve the product this week.