The liquidation heatmap on the crypto market has surged considerably in the past 24 hours following Bitcoin’s downward pressure. Data from Coinglass shows that leveraged traders have suffered substantial losses, specifically worth $567.78 million, in the past 24 hours.

Notably, the heightened position liquidation follows Bitcoin’s drop to $93,000. The pioneering cryptocurrency dropped over 5% in the past 24 hours, fuelled by profit-taking whales and other macroeconomic factors.

Liquidation Breakdown

Meanwhile, Bitcoin led proceedings in the CoinGlass liquidation heatmap. The premier asset’s 5% drop ensured that positions worth $160.73 million were chalked off the derivative market.

Notably, Bitcoin bulls were the highest casualties, as long positions valued at $181.73 million were liquidated. The liquidation spree also caught late shorts, incinerating $28.86 million worth of trading positions.

Ethereum traders also suffered substantial liquidations following a broader market downturn. The altcoin king held its own compared to Bitcoin, dropping a meager 2.5% in the past 24 hours.

However, about $92.30 million in trading positions were affected, with $61.4 million bulls and $30.9 million bears. Ethereum is trading at $3,376 at the time of writing.

Other notable liquidations came from Dogecoin and Solana, with traders losing $33.6 million and $24.65 million, respectively. XRP and ADA traders were also liquidated for $22.71 million and $8.62 million, with most positions betting on higher prices for the assets.

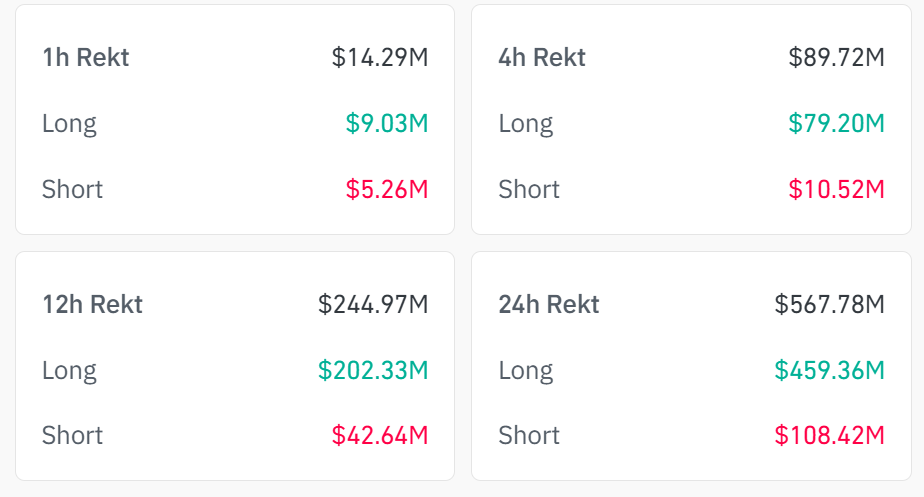

In total, the market capitulation took with it $459.36 million in bull positions and $108.42 million in bear bets, aggregating to the $567.78 million aforementioned. Notably, the highest single position liquidation saw a whale lose $4.67 million trading BTCUSDT on Binance.

Bears Gain Short-Term Market Control

Meanwhile, bearish momentum has dominated the crypto market since the start of the week, with Bitcoin’s bullish trajectory losing steam. Notably, the largest cryptocurrency by market cap failed to reach the psychological $100,000 milestone analysts widely anticipated following its break above $99,000.

Data from Glassnode alleges that profit-taking long-term Bitcoin holders spurred the downtrend. The analytics firm shared in a Monday tweet that Bitcoin selling pressure touched -366,000 BTC/month, its highest since April.

Furthermore, a faction of the crypto community argues that “Mad Money” host Jim Cramer’s Bitcoin endorsement catalyzed the downtrend. The CNBC presenter called Bitcoin “a winner” last week, with the asset capitulating substantially since the comment.