Bitcoin’s recent price decline has created fear, uncertainty, and doubt among investors, with many calling for even lower prices. U.S.-based Bitcoin ETFs have seen significant outflows, while major altcoins have dropped by double-digits in the past week alone.

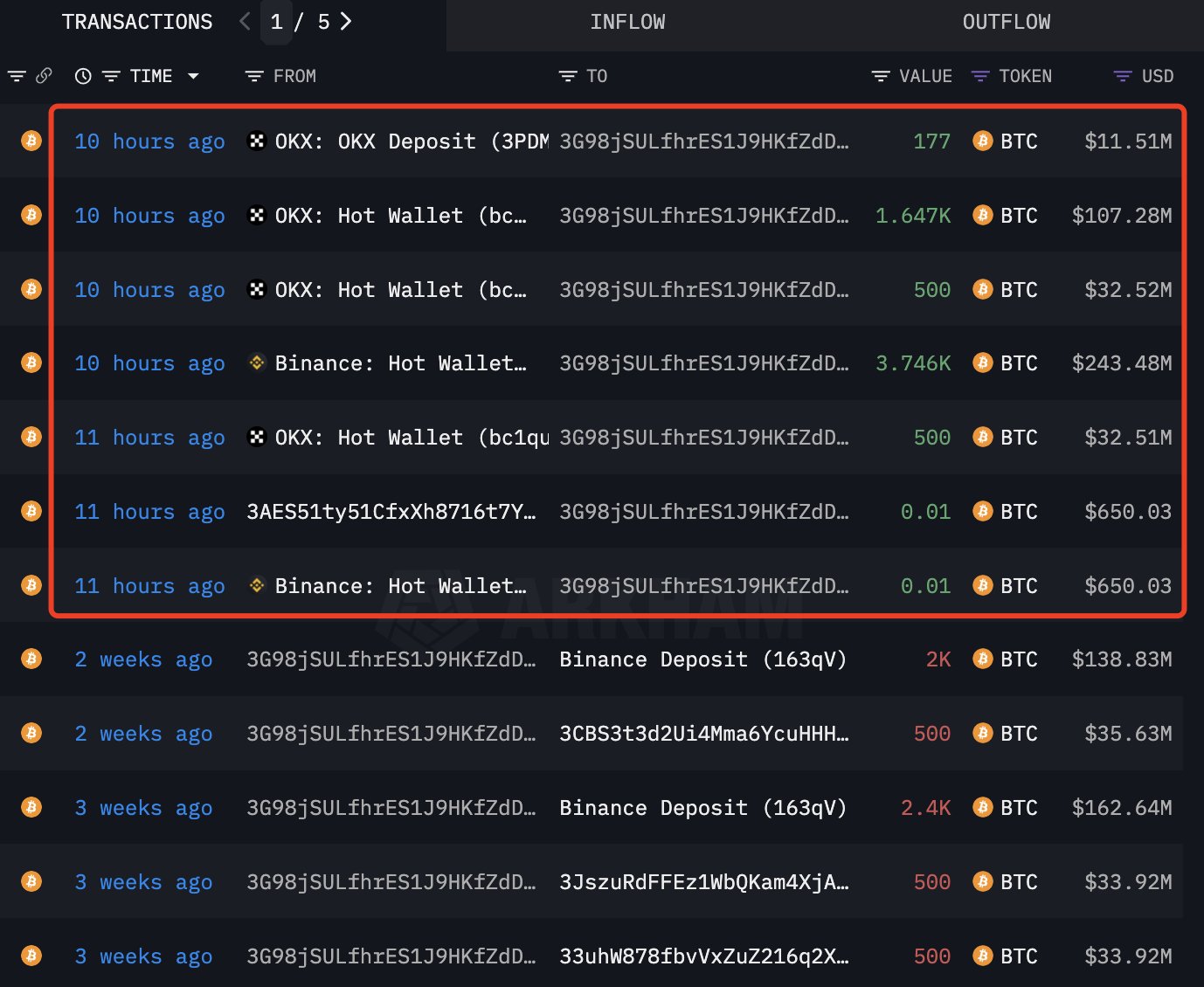

Amid the drop, however, on-chain data shows that a Bitcoin address that has historically made correct calls on when to buy and sell BTC has made a large purchase. Uncovered by Lookonchain, the address purchased 6,070 BTC (valued at approximately $395 million) across two exchanges, Binance and OKX.

(Source: Lookonchain)

The purchase is notable as it is the first time that the whale has bought Bitcoin in the past 18 months. Before now, the whale has been partially selling Bitcoin, with most of its sales being at price highs. As the above image shows, the whale sold a large chunk of BTC in the past 21 days, shortly before Bitcoin’s most recent decline.

Additionally, the “smart” whale has already made significant gains in the current market cycle. During the 2022 bear market, the whale scooped up 41,000 BTC (approximately $794 million), of which they have now sold at least 37,000 BTC (approximately $1.7 billion), realizing a profit of roughly $1 billion.

Evidently, the latest buy after a lengthy period of selling means that the whale is optimistic about a price increase in the near future. Additionally, such whale wallets are often managed by hedge funds and large investors, who use sophisticated resources to analyze market conditions before making such commitments.

Will Bitcoin Recover Soon?

While Bitcoin’s drop below $65,000 certainly raised market fears, technical data suggests that the cryptocurrency has now reached a strong support level that could lead to a major recovery. At the same time, if sustained bearish pressure persists, Bitcoin could drop as low as $60,000 before a continued uptrend.

It is noteworthy that while bearishness may persist in the short term, market participants remain generally bullish on Bitcoin, especially after a successful fourth block reward halving. Historical data tips the cryptocurrency to soar as high as $180,000 before the end of the current market cycle.