What comes to mind for most crypto enthusiasts when Toncoin is mentioned is the social platform Telegram. However, Telegram’s abandonment of the project in 2020 meant that the token Toncoin and the messaging app have existed independently till now.

Toncoin is the native token of The Open Network (TON), a decentralized layer-1 blockchain that utilizes the Proof of Stake (PoS) consensus. It is a community-driven network that allows millions of users to transfer funds in a quick, cost-effective, and energy-efficient manner.

This article will explain in detail what Toncoin is, how the concept came about, and why the token is gaining traction again after a failed Telegram launch back in 2020. Let’s quickly give you a brief history of the Toncoin.

A Brief History of Toncoin

The Open Network (TON) concept dates back to 2018 when Telegram declared its intention to dive into blockchain technology and create a network that would allow for seamless and quick fund transfers between users on-chain. Telegram released the project’s white paper and lite paper, and called the native token for the project Gram.

The concept, intended to rival the Ethereum network, quickly attracted investors. Telegram raised a large amount of money through private sales of Gram to potential investors. In April 2018, Gram became the second most-sold coin, realizing over $1.7 billion in sales. TON soon gained traction with private and public companies worldwide, as the sector further raked in billions of dollars in Gram sales to Telegram to fund the network development.

However, the booming Telegram Open Network project soon attracted the US’s top regulator, the Securities and Exchange Commission (SEC). Since Telegram intended to launch the Gram token in the US market, it had to ensure full compliance with the SEC regulations.

Telegram intended to prevent the regulator from seeing Gram as a security by airdropping the token to presale buyers when the token launches. However, the SEC already perceived the early investors as underwriters and classified the token as securities.

The Wall Street top regulator sued Telegram in 2019 for offering unregistered securities to US investors. The case lingered for months in court before Telegram lost the case in May 2020. Afterward, Telegram’s founder Pavel Durov noted Telegram would end its participation in TON and make early investors whole. The company also paid a $18.5 million fine to the SEC.

Notably, Telegram’s dissociation didn’t spell the end of the TON concept. The network’s dedicated community rallied around the Gram token and helped it maintain relevance. Since the network was open-sourced, developers easily got the code for the network on Github and further improved the blockchain. In June 2020, all Toncoin tokens were made available for mining, and after two years, the last coin was mined.

In May 2021, a majority of users voted that TON testnet2 be launched in the mainnet. The blockchain was renamed from Telegram Open Network to The Open Network, and coins were distributed through Proof of Work (PoW) Giver contracts. Ton migrated back to PoS in June 2022 and expanded the number of validators and the coins involved in validation.

Toncoin and The Open Network (TON) Explained

Toncoin (formerly named Gram) is the native token of The Open Network (TON). The TON blockchain was designed to solve some issues that major crypto networks face. TON looks to be a scaling solution for Bitcoin’s complexity and slow transaction speed, with Ethereum’s high gas fees.

TON developers fashioned the ecosystem not just to be an asset for investors but also for on-chain utility. It aims to make transacting in Web3 easier, super fast, and cost-effective. The network boasts several use cases, which include:

- Transaction processing fees for smart contracts

- Cross-chain transaction fees

- Payment services offered by apps on the platform

- Contributing to network security through staking

- Validator’s stake required to maintain the network

- TON’s on-chain governance program

- Payment of blockchain-based domain names (DNS)

- Payment for decentralized data storage

The Open Network (TON) functions with the help of blockchain sharding, a mechanism for utilizing multiple subnetworks, or shards, on the same blockchain to quickly accomplish tasks. The shard prevents large backlogs of unverified blocks on the network.

TON has a flexible architecture, making it super scalable and able to facilitate fast transactions using its cross-shard integration. This dynamic sharding feature allows the TON ecosystem to continually process millions of transactions per second without using performance.

Furthermore, TON utilizes the PoS consensus model, a mechanism where all transactions on the blockchain are validated using Toncoin. The network also allows validators to borrow Toncoin from nominators and rewards nominators for the transaction. For a nominator to be able to lend his token, he will have to join a pool and stake his Toncoin tokens.

Features of the TON Ecosystem

To further enlighten you on the nook and cranny of the TON blockchain, we will dissect the major features of the network for you. Some of them include:

TON VOTE

TON VOTE is the decentralized autonomous organization (DAO) governance platform for the TON network. Launched in 2023, it is managed by Orbs, a layer 3 blockchain infrastructure firm. The TON VOTE allows Toncoin holders to actively participate in decision-making and vote in the ecosystem.

After a series of votes, the first major decision that the TON VOTE executed was a communal agreement that the ecosystem froze Toncoin in inactive wallets from the mining era. Notably, activity surged on TON after the adoption and launch of the VOTE DAO.

TON Wallet

TON created the TON wallet, a self-custody wallet based on the network. With over 700,000 unique wallets, the cold storage wallet allows users to store their crypto assets and make on-chain payments without intermediaries.

TON DNS

The TON Domain Name System (DNS) feature allows users to rename wallets, smart contracts, and dApps on the ecosystem. It functions like traditional DNS but with a decentralized twist.

TON DNS works with several social media platforms, simplifying user interaction and making the blockchain more accessible. With this feature, users do not have to remember complex cryptographic addresses but can change to whatever name they can remember.

TON Storage

The TON storage has a huge similitude with the Dropbox but with an added decentralized feature. The on-chain file storage facility allows users to store large files on the blockchain, increasing the transfer speed and reducing the chances of data loss.

TON Proxy

The TON Proxy promotes anonymity, allowing users to access the ecosystem with a masked IP address. The feature offers decentralized VPNs for users to boost the security of their on-chain interactions and avoid strict censorship in some regions.

Toncoin Tokemonics

According to TON’s official website, its native token, Toncoin, has a total supply of 5,105,368,322 TON, with about 3,471,083,200 TON already in circulation. TON also has a 0.6% annual inflationary rate.

TON’s reemergence to the limelight has seen an increase in the number of active wallets on the network. At the time of writing this piece, TON has almost 15 million accounts, recording 414% growth in the last six months.

Toncoin has also surged significantly, moving almost 200% since the start of 2024. TON reached a new all-time high of $7.47 on April 11 and is currently trading at $4.745 at the time of writing.

Toncoin Competitors

Despite the unique qualities of the TON ecosystem, it is faced with a handful of strong competitors. Some of them include:

Ethereum

With a market cap above $370 billion, Ethereum is the second-largest crypto asset. Like TON, the network uses the PoS consensus model and is a strong favorite for smart contract platforms. The Ethereum Network existed far before TON and has gained popularity among developers and dApps. However, a significant disadvantage of the network is its high transaction fees. The Ethereum network has resorted to layer 2 solutions like Optimism, Arbitrum, and Base to solve these high transaction issues. If TON stands a fighting chance against Ethereum, it will have to exploit its high upscaling and high transaction fee weaknesses.

Cardano

The Cardano network is ranked as one of the most decentralized ecosystems in the crypto sector. The network is also popular for its high scalability, fast and cheap transactions, and robust security. Although Toncoin flipped Cardano in the crypto ranking in April 2024, the Open Network still has a lot to catch up with Cardano. Cardano has existed far longer than TON; hence, its higher popularity is understandable. The only advantage TON has over Cardano is its cheap transaction fees. Transacting on TON is about 30 times more affordable than on the Cardano network.

Solana

The Solana network is the fastest-growing blockchain in the crypto sector. The “Ethereum killer” emerged as the network with the highest investor interaction in the first quarter of 2024. Its low network fee, scalability, and fast transaction fee have distinguished it from others. Transacting on the Solana network is eight times faster and five times less expensive than the TON ecosystem.

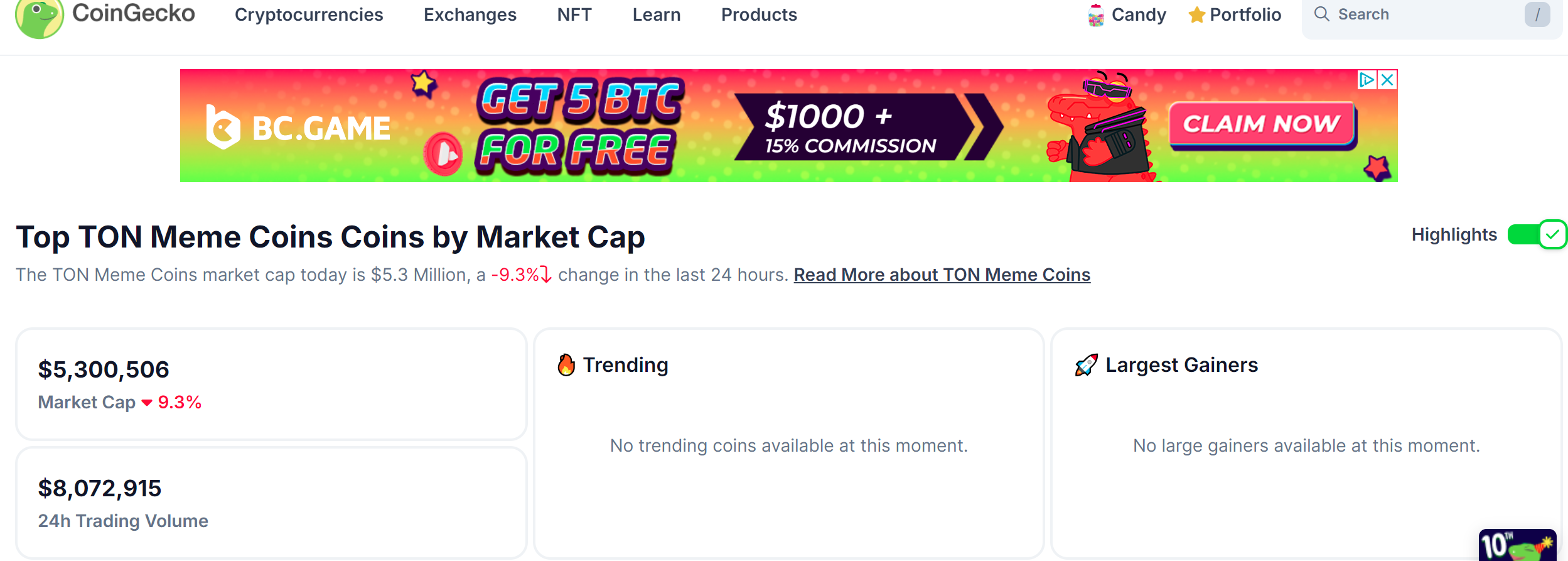

Top Memecoins on TON Network

The memecoin sector has become a strong narrative for retail traders. Major networks like Solana, Base, and Ethereum have benefited from the frenzy, raking in millions of dollars in trading volume daily.

The TON blockchain’s memecoin sector has a market cap of $5 million, and we will list the top 10 memecoins on the network.

- Dogwifhood (WIF)

- Resistance Dog (REDO)

- Mumba (MUMBA)

- Tonk Inu (TUNK)

- Tney The Duck (TONY)

- Toon of Meme (TOME)

- Akita Inu (AKITA)

- Uniton Token (UTN)

- Toge (TOGE)

- The Resistance Cat (RECA)

Is Toncoin a Good Investment?

The significant surge in Toncoin’s price has drawn the crypto community’s attention to the token. Many investors might wonder if having a slice of the TON project is a good investment; here are some things that can help you decide.

The biggest thing happening in the TON ecosystem now is the partnership with the social messaging app Telegram. The firm announced in April 2024 that it had ditched the Euro for TON as a means of payment for in-app advertisements and crypto payouts.

The partnership saw TON move over 100% and increased the number of active addresses in the TON ecosystem. With Telegram boasting over 1.5 million users, such a partnership meant visibility for Toncoin and, consequentially, more adoption. Hence, investing in Toncoin would not be a bad idea.

Also, as discussed earlier in the article, the TON ecosystem possesses a good number of use cases, so the project could supposedly stand the test of time. However, with increased competition from other blockchains like Solana and Cardano, TON would have to keep up to stay afloat in the congested crypto payment sector.

Over the past month, the price of TON has surged by an impressive 78.46%, resulting in an average increase of $5.48 to its current value. This rapid growth suggests that TON has the potential to establish itself as a stable asset, particularly if this upward trend continues.

According to Coincu’s price prediction, TON’s price will reach an average of $25.87 at the end of 2024, rise to almost $45 by 2025, and surge to $115.65 by the end of 2030.

However, investors must know that buying cryptocurrency carries a high level of risk due to its volatility and speculative nature. Deciding whether it’s a good investment depends on individual goals and risk tolerance. Conduct thorough research, diversify your portfolio, assess your risk tolerance, and only invest what you can afford to lose.

Frequently Asked Questions About Toncoin

This section addresses most of the questions that users and investors typically ask about Toncoin and its ecosystem.

How Can I Buy Toncoin?

Toncoin is available across most centralized and decentralized exchanges. Investors can buy the token on Binance, Coinbase, Uniswap, Pancakeswap, and other swapping and trading platforms.

However, users must do due diligence before buying and remember that there are rug-pull tokens with the same ticker as TON that could result in a total loss of money if acquired, especially in decentralized platforms.

Can I Stake Toncoin?

Yes, staking Toncoin (TON) traditionally involves locking up a certain amount of TON in a wallet to support the network’s operations and earn rewards. However, TON doesn’t support staking directly due to its Proof of Work consensus mechanism.

Platforms like DappRadar offer an alternative by allowing $TON holders to participate in DeFi protocols on other blockchains. These protocols may offer staking-like opportunities, where users can provide liquidity or collateral to earn rewards.

It is essential to understand the risks involved, such as smart contract vulnerabilities, impermanent losses (for liquidity providers), and market volatility. However, with careful research and management, staking Toncoin through DappRadar can provide passive income opportunities in the decentralized finance space.

What is the relationship between Toncoin and Telegram?

Aside from the recent collaboration with Telegram, there are no direct affiliations between the TON ecosystem and the messaging app. Telegram was the initial pioneer of the TON blockchain but abandoned the project when the SEC lawsuit came in 2020.

Toncoin is the primary digital currency of The Open Network (TON), also known as the TON blockchain, which operates as a decentralized layer-1 network. Telegram, a messaging platform with a massive user base of 800 million, introduced a unique advertising revenue-sharing system. This system allows owners of Telegram channels to earn revenue solely in Toncoin. Channels on Telegram collectively garner over 1 trillion views each month.

Under this system, owners of public channels with at least 1,000 subscribers can receive 50% of the revenue generated from advertisements displayed within their channels. Channel owners can monetize their content by sharing in the advertising revenue, with payments made in Toncoin.