It is no longer news that the cryptocurrency space has become increasingly popular as more people join the investor bandwagon. While an increased adoption of cryptocurrencies is good, it also translates to the prevalence of crypto fraud. This is because some people join the community not just to invest but to rob other people of their investment funds.

The good news is that you can report a cryptocurrency scam and increase your chances of recovering your stolen assets. This article will teach you all the steps you need to take to achieve these. As a bonus tip, you will also learn so much about crypto scams and how to avoid being a victim.

This guide is packed. So, if you want to protect your investments, keep reading!

What is a Cryptocurrency Scam?

A cryptocurrency scam is any illegal or fraudulent activity involving cryptocurrencies or blockchain technology. It may take many forms or patterns, but the goal is the same: to steal from investors.

Crypto scams often use offers (that are mostly too good to be true) to lure people to send their digital assets to compromised crypto wallets or gain access to their private keys. They may also use fake mining applications or platforms to achieve this.

As an informed investor, here is one thing you should always bear in mind: If an “investment” opportunity or offer sounds too good to be true, it probably is. Not all crypto-based opportunities that seem lucrative are real.

Furthermore, crypto scams may not always be obvious, even to seasoned and long-time users. Thus, you must always exercise extra caution, do careful research, and not allow the fear of missing out to blur your thinking.

Cryptocurrency Scammers

Cryptocurrency scammers are individuals or groups that scheme to defraud investors and eventually carry out the scheme. They use different methods that make these scams look legit at first glance.

One of the most effective tactics of crypto scammers is to create a false sense of urgency around the scam by urging people to grab the opportunity before they miss out. Some scammers may even go as far as using fake testimonials to trick the public. Many people who fall victim to these methods lose their investments and suffer devastating effects.

How Common are Crypto Scams?

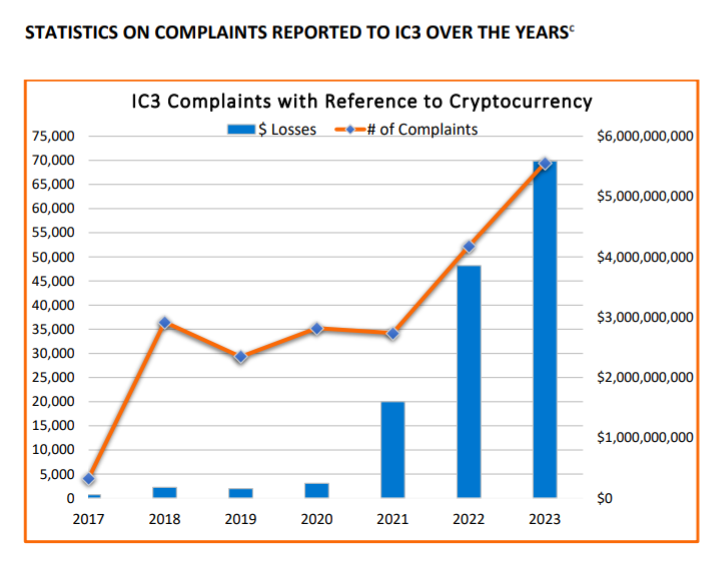

Crypto scams are pretty common, but they are on the rise because blockchain technology is becoming increasingly popular. The Federal Bureau Investigation’s Internet Crime Complaint Centre (FBI’s IC3) revealed that in 2023, a total loss of $5.6 billion from crypto scams was reported, with a 45% increase from 2022.

Statista reported that over $15 billion was lost due to cryptocurrency fraud between 2021 and 2024. Some users do not know how to report crypto scams, so some fraudulent occurrences go undocumented. This has been of great concern to investors, and rightly so.

Some Popular Types of Crypto Scams

Explained below are six common types of cryptocurrency scams:

Ponzi Scheme

The Ponzi scheme is a fraudulent investment program named after an Italian businessman, Charles Ponzi. Also referred to as ‘rob Peter to pay Paul,’ Ponzi schemes are investment scams that promise investors huge and steady profits with little or no risk. They create an illusion of profitability and legitimacy by paying early investors with proceeds obtained from later investors. This type of scam eventually collapses when the flow of new investors slows down.

Ponzi schemes have been around for a long time. They are among the most common types of scams in the cryptocurrency market because of their “huge returns and less risk.” Ponzi schemes lack clear investing strategies and rely heavily on referrals from investors. Victims of Ponzi schemes suffer substantial financial losses, which may vary depending on how much funds they put into them.

It is worth noting that individuals found guilty of this crime are usually made to suffer legal implications once caught. A notable example is David Carmona, founder of IconTech, who was sentenced to 10 months in prison after pleading guilty to marketing his Ponzi scheme as a crypto mining and trading company. Details of his sentence can be found in this published news.

Phishing Attack

Phishing attacks are another common type of crypto scam. Phishing attackers trick victims into revealing personal information relating to their crypto wallets. They try to gain investors’ trust and parade themselves as legitimate by impersonating an actual website or crypto project. They aim to gain access to your digital wallet by stealing sensitive login information, such as your private keys. Once they get the information they need, they will clear your assets.

Phishing in crypto has become increasingly common, targeting both wallets and exchanges. Attackers usually start by sending a message containing a link to a fake website to likely victims, probably through a phishing bot. Once a person clicks on that link and provides their information, the attacker gains access to their account. Sadly, many investors have fallen prey to this technique. A CoinTab report revealed that investors lost more than $127 million in cryptocurrencies during the third quarter of 2024.

Rug Pull

Rug pulls occur when scammers who claim to be developers sell assets to their investors, steal their funds after a while, and abandon the project, crashing the price to zero. This usually happens with ICOs and new crypto projects.

An ICO (Initial Coin Offering) involves selling tokens to investors to raise funds for building a project. Some scammers have taken advantage of this by accumulating funds from investors with no intention of building any project. In the end, they disappear and take their investors’ funds with them while their victims are left to suffer. An example of a rug pull from October 2024 involves the collapse of the Artic (ARTIC) memecoin, which raised more than $24 million in SOL from investors

Airdrop Scam

Another type of crypto scam involves using fake airdrops to defraud people. Airdrops are like free gifts in the form of tokens or coins. New projects usually organize airdrops to promote their assets, especially before launch.

Airdrop scams occur when users are offered free tokens in exchange for their personal information or private keys. Some fake airdrop teams also share phishing links that require users to connect their digital wallets to malicious websites.

Pump and Dump Scheme

A pump-and-dump scheme occurs when a malicious individual or a group of scammers artificially spreads false information to inflate the price of a low-value digital asset’s price.

For example, a scammer may buy a considerable amount of a low-priced or less-known coin or token, create fake hype around it, and encourage many people to invest in it. As more and more unsuspecting investors start buying this asset, its price and trading volume will increase. This may attract more people to join the investment train, leading to a sudden market surge.

After a while, the scammer may decide to sell their holdings. Being the investor with the largest holding, their action will cause the price to crash once carried out. So, while the scammer will gain a lot of profit, the other investors still holding the asset will record huge losses.

Fake Cryptocurrency Exchanges or Wallets

A scammer can create a fake cryptocurrency platform, such as a fake digital wallet or exchange, and trick users into storing their assets there. Others may impersonate a crypto exchange and claim to be from their support team to trick users into sending their funds to them.

A famous example of fraudulent activity by a cryptocurrency exchange involves FTX, founded by Sam Bankman-Fried (also known as SBF). SBF and his staff at FTX defrauded investors, which attracted a conviction case. He was found guilty of wire fraud, among other charges, and sentenced to 25 years in prison. At the time of this writing, Bankman-Fried has spent eight months behind bars.

Identifying a Cryptocurrency Scam: Red Flags

Crypto scams, especially phishing attacks, can be challenging to spot as hackers regularly refine their tactics and make them look legitimate. Here are some red flags that give these scams away, as sophisticated as they may look:

- Huge and Risk-Free Returns: Most cryptocurrency scams trick their victims by promising them unrealistically huge profits with a 100% guarantee. Real investments, on the other hand, offer no guarantee to investors. The crypto market is volatile and filled with both risks and rewards.

- Intense Pressure: Crypto scammers usually pressure victims to make decisions without due diligence. They do this by creating a sense of urgency around their offer, making it seem as though it is too good to miss and that they need to jump on it quickly before it is too late.

- No Clear Details: Fake “investments” usually provide little or no information on their project and team members. They focus on huge returns and pressure people to invest. Real crypto projects, however, provide potential investors with all the information they need to help them decide.

- Suspicious Links: Some crypto scammers send people suspicious links that require them to connect the wallets containing all their crypto funds. If you find a link suspicious, do not be quick to open it. Take a step back and review it well.

Tips on How to Protect Yourself

Now that you know what to look out for to identify a crypto scam, here are tips on how to protect yourself:

- Thorough Research: The value of conducting proper diligence in the crypto community cannot be overemphasized. It is the most effective way of protecting yourself from scams. Before investing in any crypto project or storing your digital assets in a new wallet, do careful research and gather all necessary information on how it works. Avoid making impulsive decisions. Your research should include reading the project’s whitepaper (which should be thoroughly written) and identifying the team members. Remember, the more transparent a project is, the more legitimate it likely is.

- Avoid Get-Rich-Quick Schemes: A project that claims to offer high profits with no risk is most likely a scam. If you intend to protect yourself in the cryptocurrency market, avoid get-rich-quick schemes with all your might.

- Beware of Overly Hyped Projects: Do not allow market hype to cloud your judgment. Too much hype around a new cryptocurrency project is enough to make you wary and intensify your research. This also applies if you want to avoid losing money when buying memecoins.

Authorities to Report to

If you are a victim of a cryptocurrency scam, you can report it to one of these organizations and seek their help:

- The cryptocurrency exchange you use: Reporting a crypto scam directly to your exchange as quickly as possible will protect other users and increase your chances of recovering your funds.

- U.S. Securities and Exchange Commission

- Internet Crime Complaint Centre (IC3)

- Commodities Futures Trading Commission (CFTC)

- Federal Trade Commission (FTC)

- Consumer Financial Protection Bureau (CFPB)

The last five organizations listed above are available in the United States. These regulators have proven helpful, recovering up to 100% of their assets for crypto investors in the case involving the GSB group.

However, crypto users outside the U.S. can seek legal help from law enforcement agencies dealing with cybercrime and financial fraud, especially those involving cryptocurrencies, in the country where they live or where the scam occurred.

How to Report a Cryptocurrency Scam: Three Easy Steps

Follow these simple steps to report a crypto scam:

Step One: Gather Enough Evidence

Collect all relevant information about the fraudulent activity. The details should include the dates of all the transactions, the wallet address(es), the cryptocurrency exchanges involved, and the amount of money lost.

Also, take screenshots of all your interactions with the scammer and save their email addresses and website links. Include all other information you have that could help find the fraudster.

Step Two: Contact Relevant Authorities

Visit the website of a relevant authority and file a detailed report of the scam. The report should contain all the evidence you have gathered, explaining the incident chronologically.

Step Three: Follow Up

Communicate regularly with the authority you filed the report to and be quick to provide any other information they may require. These will help accelerate the investigation process.

Frequently Asked Questions (FAQs)

- Are There Fake Cryptocurrency Platforms?

Yes, there are numerous fake cryptocurrency platforms. Most do not last long because their founders close them down once the theft is complete

- How Can I Avoid Getting Scammed in Crypto?

To avoid falling victim to a crypto scam and losing your money, do careful research, read thoroughly written whitepapers, identify team members, run away from get-rich-quick promises, beware of overly hyped projects, and be cautious of suspicious links.

- Can I Recover all my Crypto Funds After Getting Scammed?

While there is no 100% guarantee of recovering all your crypto funds after being scammed, you can significantly increase your chances when you report an actual or suspected scam as soon as you spot it. The chances of recovering your stolen funds largely depend on the circumstances surrounding the fraud and how quickly the report was made.

Final Thoughts

While the cryptocurrency world is exciting due to its many potentials, you must be careful not to fall victim to scams. If you suspect or are sure you or someone you know has been scammed, you can file a report following the simple steps in this guide.

Crypto scams are prevalent and may sometimes be tricky. However, with the correct information, such as that contained in this guide and obtained from personal research, you can successfully manage your emotions and navigate the crypto scene.