Ethereum declined further on Sunday after showing signs of the bearish sentiment dying off earlier in the day. During the descent, it dropped below its pivot point.

The asset shares the broader sentiment across the market as Dogecoin led the losses, losing over 5% in the last 24 hours. Bitcoin sank lower, dipping and losing over 3%.

The market sheds more gains as the festivities draw closer. Many investors may decide not to trade this year and withdraw as they close for the Holidays, which is traditionally the psychology around this period.

Data from CryptoQuant expresses the same notion that the asset sees lesser buying pressure from several areas. Asian investors are bearish on spot ETFs, resulting in a significant decline in buying volume. Korea Premium is red in response to this trend.

US traders are yet to resume buying amidst the massive selloff. Institutions are yet to soak up the excess supply as Coinbase Premium is negative at the time of writing. Exchange-traded funds see significant outflows. Data from SoSoValue shows outflow exceeded $60 million on Thursday and $75 million on Friday.

However, Monday came with fresh investments for the largest altcoin. It had a slight recovery, hitting a high of $3,462 from a low of $3,213. It closed with gains exceeding 4%, fostering beliefs that the worst is over.

Onchain data remain the same despite the uptrend. The asset continues to see lesser buying pressure from key regions, which may hamper its bid for a full recovery.

Ethereum Risk Further Descent

Transactions worth over $100k are on the rise. However, many indications suggest they are bearish. One such is the most recent whale transfer from one Bithumb wallet to another. An anonymous user transferred 110,000 ETH from one wallet to another. The reason for the transfer is unknown. Nonetheless, some traders anticipate a selloff.

Funds out of exchanges soared over the last seven days. The net flows were negative, at $766 million, during this period—over $160 million left trading platforms during the previous intraday session. Active addresses increased by over 6% on Monday—however, the number of transactions dropped by over 3%.

The derivatives market sees more bears’ participation. Short positions account for more than 51% of all open orders.

Growing Bullish Sentiment

Other onchain values point to a possible upside in the coming days. Exchange reserves increased on Saturday but are reducing at the time of writing. It decreased by 0.19% in the last 24 hours and almost 1% in the previous seven days.

Investors are gradually becoming less bearish. On Monday, ETH inflows into these trading platforms plummeted by over 66%, and transfers between addresses reduced by over 46% during this period.

The derivatives market is thriving with life as funding remains relatively low. However, the buyers are more dominant, settling to pay off the sellers. Open interest increased by 3%.

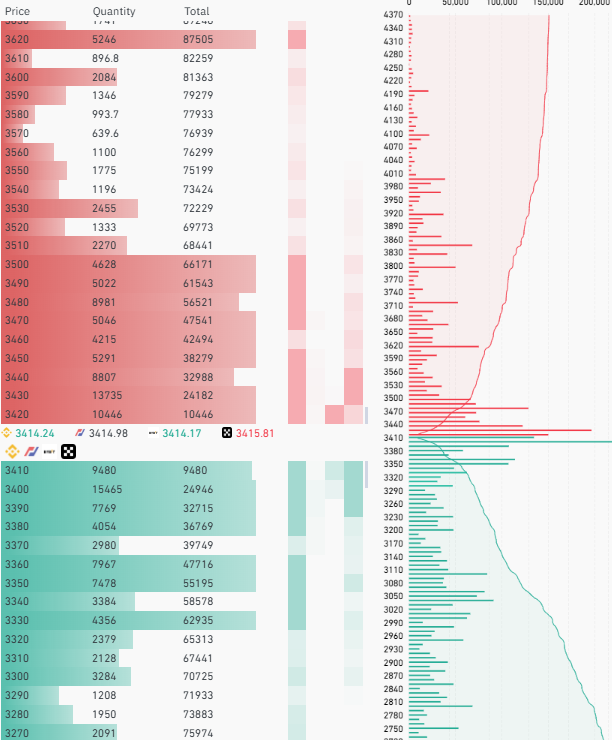

While these factors only hint at an uptick, Ethereum must break above a cluster of resistance. The order books from Coinglass suggest massive sell orders between $3,400 and $3,500. Current buying pressure may not guarantee an immediate push-through.

Nonetheless, the metric shows ongoing aggressive buying actions. It also points to several levels at which prices may hover in the event of a trajectory change. The relative strength index points to a similar reading. It trends at 43 after it slipped below 40 a few days ago. The current reading suggests increasing buying pressure.

Ethereum slipped below the lower bollinger band during its massive decline. The indicators hint at an upside that will look to climb above the middle band at $3,700.