Bitcoin rebounded from a massive decline on Friday. It led the market in a massive nosedive as it plummeted to $92k.

The apex coin closed the session at its opening price as the bulls staged buybacks. The bullish sentiment spilled into Saturday, causing a surge to $100k. However, the asset lost momentum, retracing to $96k, dipping further at the time of writing.

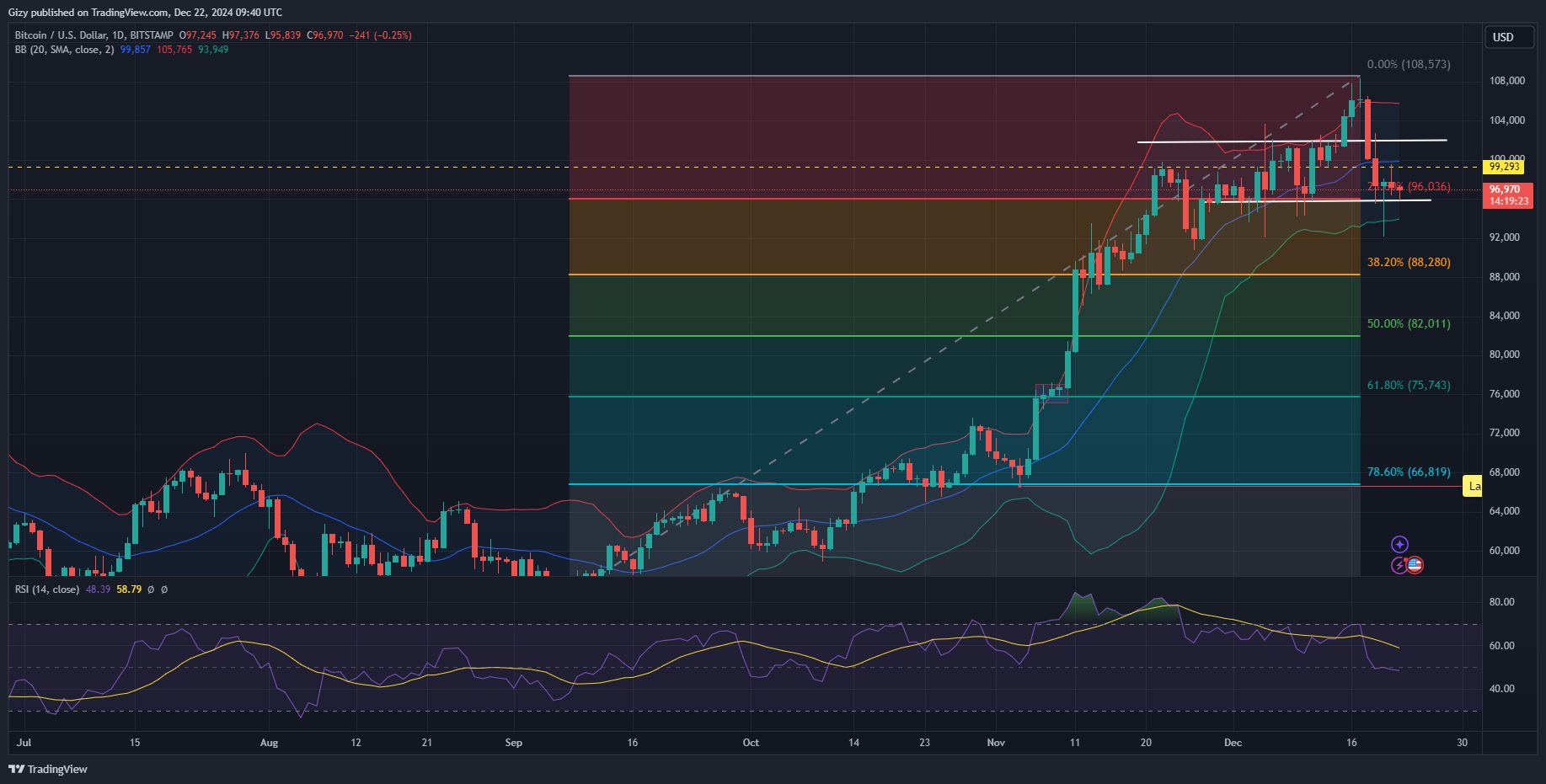

Although it still holds the $96k support, it risks losing it. Current prices suggest lesser demand concentration around the 23% Fibonacci retracement level.

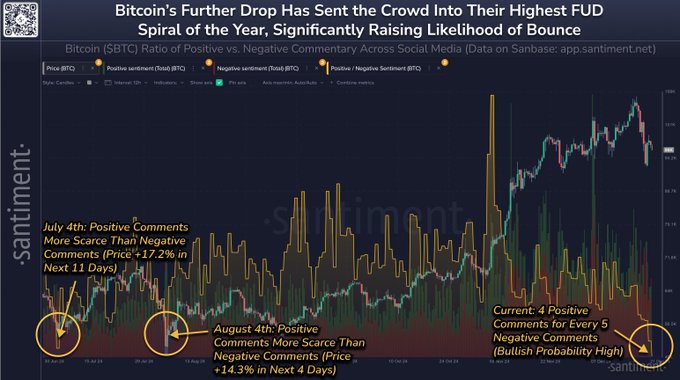

Data from Santiment shows that investors have yet to get into the ‘buying mood’ as FUD grows. The chart below shows that bullish psychology dropped. The blockchain data firm said it was at its lowest level since 2024.

The apex coin experienced a notable decline in this metric in August, resulting in a notable dip. It had a similar event earlier in July, with the same effect. However, prices recovered shortly after such declines. It took eleven and four days, respectively, after the drop.

Greed Played a Huge Role

Bitcoin may recover, but current data rules out a full recovery in December. In both highlighted cases, traders anticipated different events. For example, the July drop came after a series of price corrections, and August’s plummet followed a 14% dip the previous week.

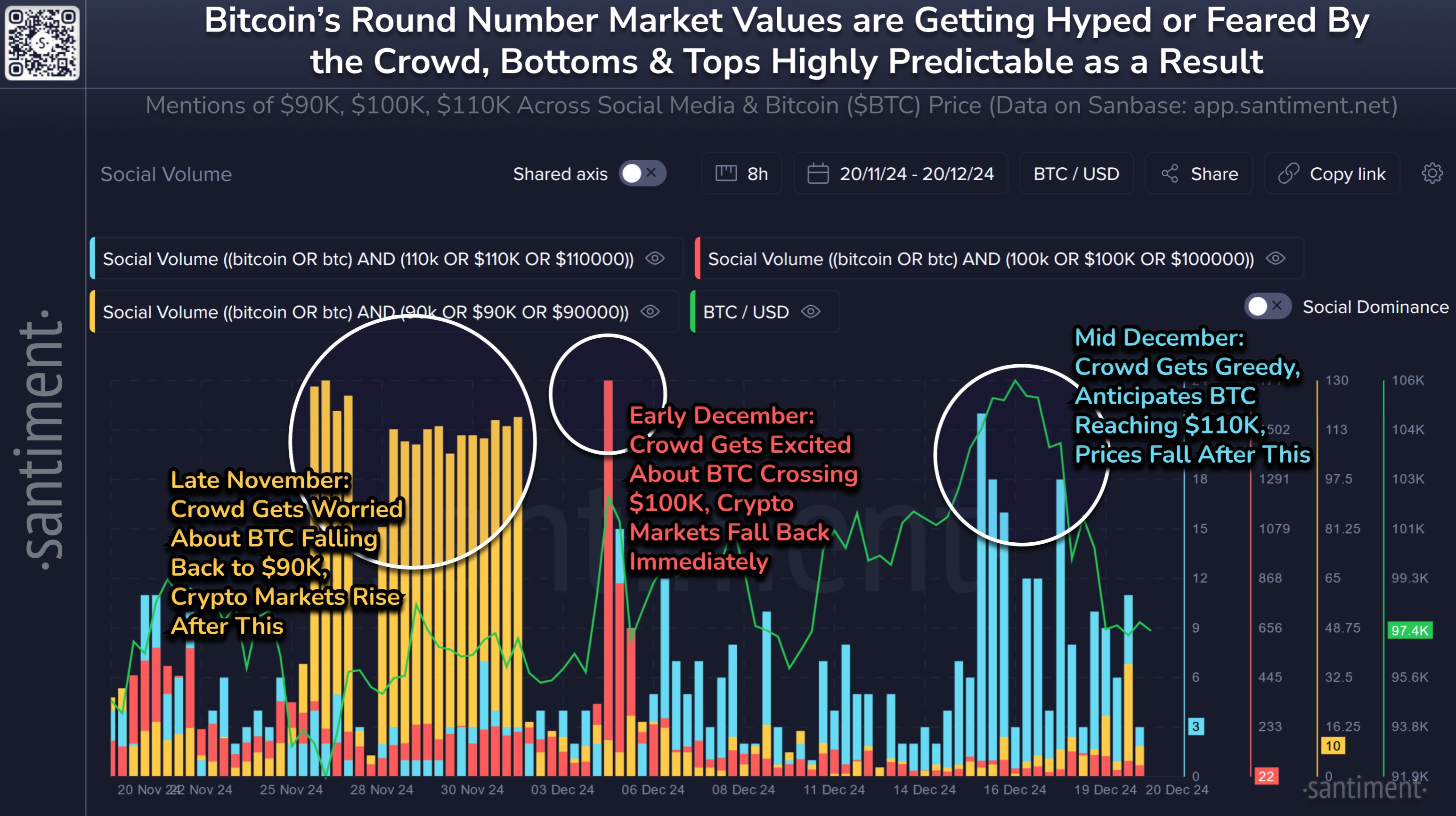

The most recent retracement happened after considerable uptrends. The above chart shows why this is different. Bitcoin price had small downtrends in late November as investors feared further decline but recovered shortly after. Traders were excited about a surge to $100k in early December, but the price retraced and rebounded afterward.

This time, fear or excitement was not responsible. Greed plays a massive role in the ongoing decline. Traders were greedy, anticipating a price surge above $110k, but they got the opposite. Almost two months of significant uptrends cheered the bulls on, as they anticipated more before fundamentals struck.

Most analysts blame Jerome Powell for the ongoing descent. It all started after he announced the ‘below expectations’ interest rate slash. He added the forecast of possible inflation in January, causing the first round of corrections.

Further geopolitical issues like Russia’s declaration of war and Israel’s strike on the Houthi rebels resulted in further declines.

Nonetheless, the crypto market sees notable downtrends, or reduced volatility, in December, mostly due to lesser trading activities as the holidays drew closer. Investors also take profit during this period. These trends are currently playing out at the time of writing.

What Does This Mean for Bitcoin?

Bitcoin is at a crossroads. Holding the $96k support will mean prices range between the support and $99k while poking at $100k. However, a further slip may send the coin as low as $88k. In this case, it may trend between the support and $92k.

The pivot point set at $87,700 may also be the halting mark for a further dip as the previous price movement shows significant demand concentrations around it. This mark is close to the 38% Fibonacci retracement level at $88,300, adding to its strength. These factors suggest the apex coin may not drop below the highlight mark this month.

Nonetheless, the accumulation and distribution chart shows growing supply and the buyers are yet to soak it up. The relative strength index shows that selling pressure is gradually reducing. It halted its quick descent, trending around 48.

The bollinger bands show notable recovery as the asset trades between the lower and middle SMAs after it dipped below the metric on Friday.