Bitcoin has repeatedly seen rejections around the $63,000 to $65,000 region recently. This area has proved to be pivotal for the crypto asset and will determine its next move.

Insights from IntoTheBlock reveal that the $65,000 price mark is pivotal for Bitcoin, especially considering the significant bid orders filled in the area. Approximately 3.5 million addresses acquired Bitcoin at this point, leading to heightened volatility.

The uncertainty surrounding the market’s true intentions may cause some of the addresses that acquired Bitcoin around that level to sell off when they break even. Hence, the analysis suggests that for the price to flip fully bullish, Bitcoin would have to break above $65,000.

Resistance Persist

Bitcoin has failed to hold above $65,000 since April, continually ranging between that region and $60,000. At some point, the asset broke below the $60,000 support but quickly rebounded following positive macroeconomics.

With unfavorable conditions like a reduced inflow from US exchange-traded funds (ETF) and clampdowns from the crypto market regulator, the 3.5 million wallets holding at a loss seem poised to leave the market at break-even, causing constant rejection around the area.

While Bitcoin continues its push to break the resistance, $60,000 remains a strong support. Analysis has shown that if Bitcoin loses that support area, investors might resume panic sales, leading to market capitulation.

Bitcoin Looks to CPI for Boost

With the market literally flat, Bitcoin would be looking to the US Consumer Price Index (CPI) data for a macroeconomic boost. The CPI, slated for May 15, shows the changes in prices of goods and services in the country and is a crucial parameter that the Federal Reserve System (Fed) uses to track inflation.

Improving CPI data would mean the Fed would consider cutting interest rates, which would be beneficial for risk assets like Bitcoin. Meanwhile, the Producer Price Index (PPI) is expected on May 14.

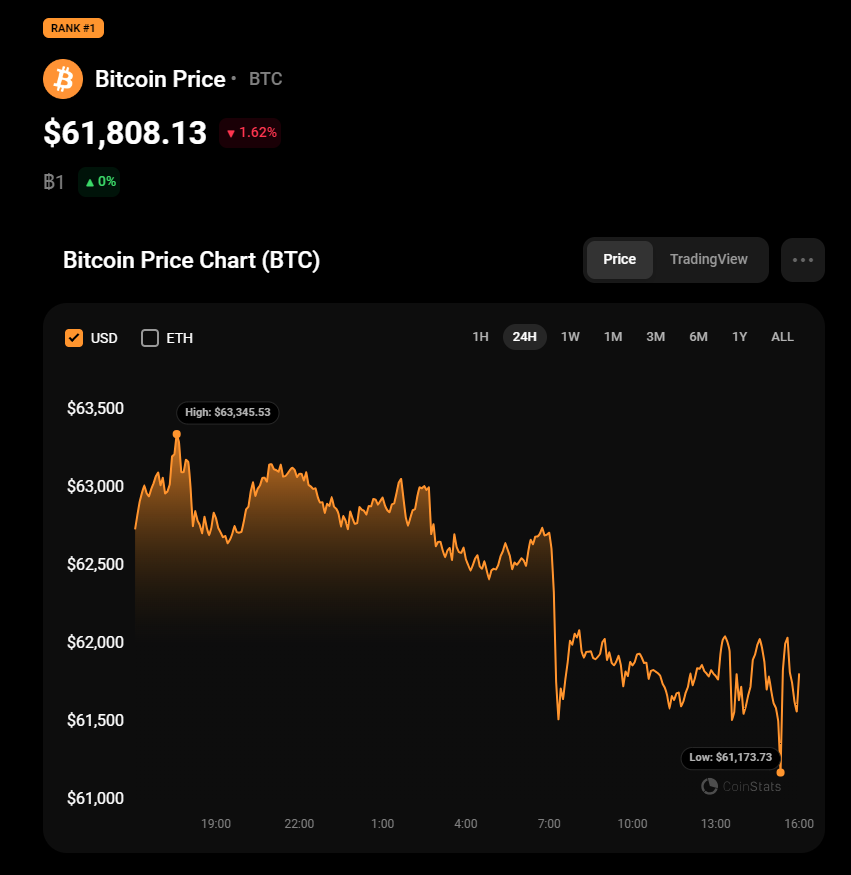

Bitcoin failed to hold onto $62,000 at press time and is down 1.625 in the past 24 hours. Meanwhile, memecoins have continued to shine, with Pepe coin leading the pack.