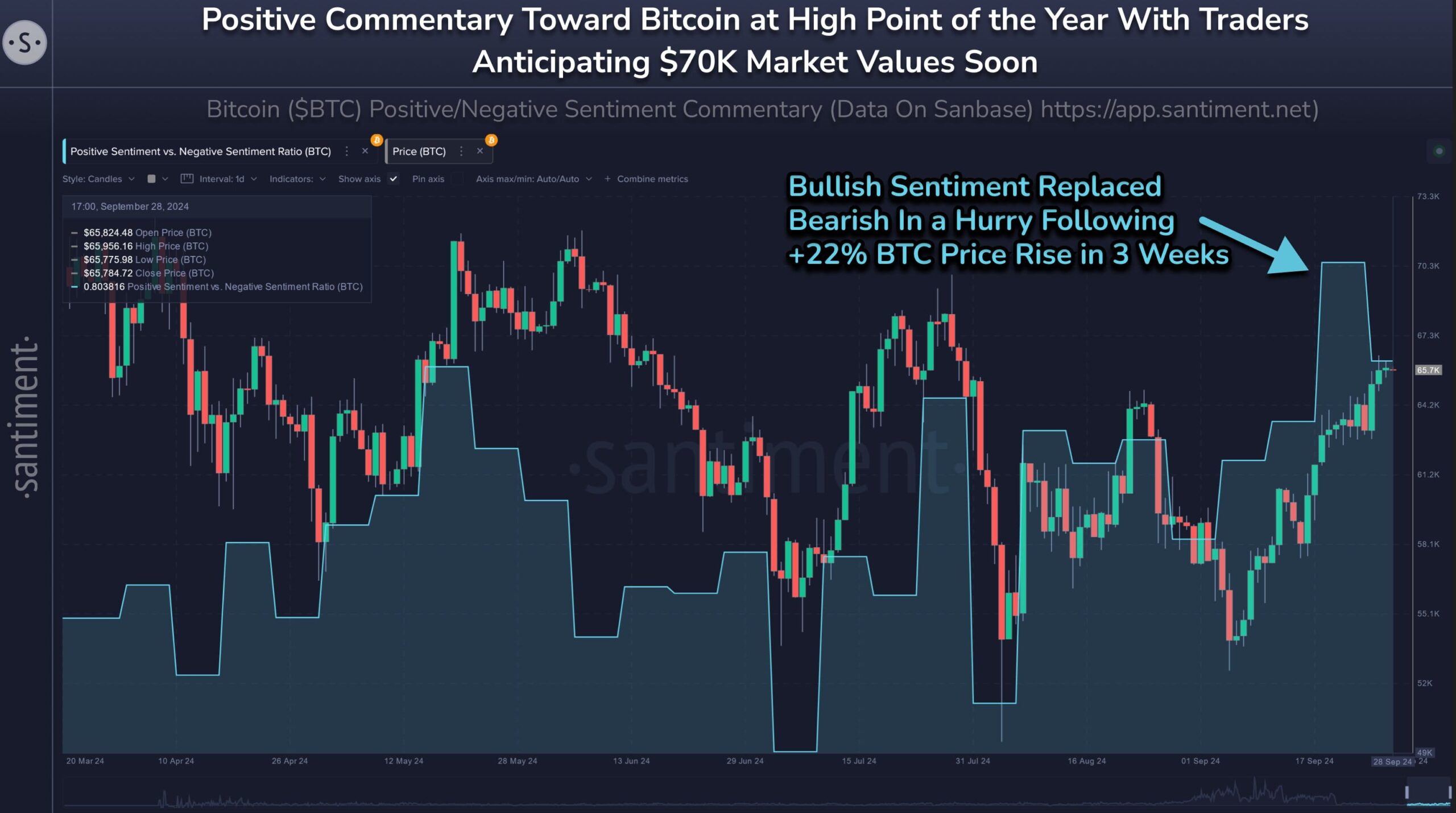

With Bitcoin experiencing a notable surge in recent weeks, crypto enthusiasts are anticipating big price moves in the coming month. However, data from the blockchain market intelligence firm Santiment suggest that the leading crypto asset might not reach a new record high anytime soon because market sentiment is overly optimistic.

Overly Bullish Sentiment Unfavorable for Bitcoin’s Uptrend

Analyzing social media activities, Santiment suggests that Bitcoin might be far off from attaining a significant price surge despite market expectations.

The market intelligence firm said that the ratio of bullish to bearish posts on Bitcoin currently stands at 1.8 to 1. Although this level of market enthusiasm may seem encouraging to some investors, Santiment stresses that historically, the market tends to move in the opposite direction of popular expectations.

Notably, this phenomenon could indicate that Bitcoin might face continued consolidation or even downward pressure until public expectations and sentiment are tempered.

“There are currently 1.8 bullish posts toward BTC for every 1 bearish post. Markets historically always move the opposite direction of crowd’s expectations,” Santiment stated.

Historical Trends Support the Caution

According to Santiment’s analysis, drawn from historical trends, Bitcoin’s price frequently moves contrary to popular sentiment.

During periods when social media and the broader community are heavily bullish, Bitcoin often experiences price corrections or consolidation phases. In contrast, when fear and uncertainty dominate sentiment, BTC has historically entered bullish cycles, reaching new highs.

An instance is the significant bearish sentiment observed in February. This was followed by a market rebound, with Bitcoin eventually reaching an all-time high of $73,750 about three weeks later.

Despite Bitcoin starting September on a low note, the asset began a significant upward trend two weeks ago peaking at above $66,000 on Sept. 28. However, the digital asset’s value has since readjusted to lower prices.

While Bitcoin’s future remains bullish in the eyes of many analysts, investors and traders should approach the market with caution, recognizing that sentiment-driven markets often move in unexpected directions.

Meanwhile, Bitcoin traded at $63,787 at the time of writing, representing a 2.92% decrease over the past 24 hours.