JupSOL, fully known as Jupiter Staked SOL, is a liquid staking token that tracks the value of SOL staked to Jupiter’s Solana validator. For newcomers, the whole concept might sound confusing and make it difficult to decide whether or not to buy JupSOL or stake to Jupiter’s validator.

In this short article, we explain JupSOL in more detail, making it easier for Solana users to understand its role in the ecosystem and how it compares with competitors. If you do not know even what Jupiter is, you can read our Jupiter guide before diving into this JupSOL explainer article.

What is JupSOL?

JupSOL is a liquid-staked version of SOL. To understand what this term means, it is pertinent to first understand how native staking on Solana works. Basically, you select a validator, delegate SOL to them, and your SOL gets locked up, until whenever you choose to withdraw the staked amount, plus staking rewards.

However, liquid staking is different. When you stake your SOL, you receive a Solana-based token that represents your staked assets. The token increases in value proportionate to the staking rewards that it receives. Its value also fluctuates as the price of SOL goes up or down, allowing you to capture the staking rewards as well as any increase or decrease in the price of SOL.

In the case of JupSOL, this is the token you get when you stake to Jupiter’s validator. You can, in turn, use this token to participate in Solana’s decentralized finance (DeFi) ecosystem on platforms that support them. For instance, you can borrow, lend, or swap JupSOL using Solana-based dApps.

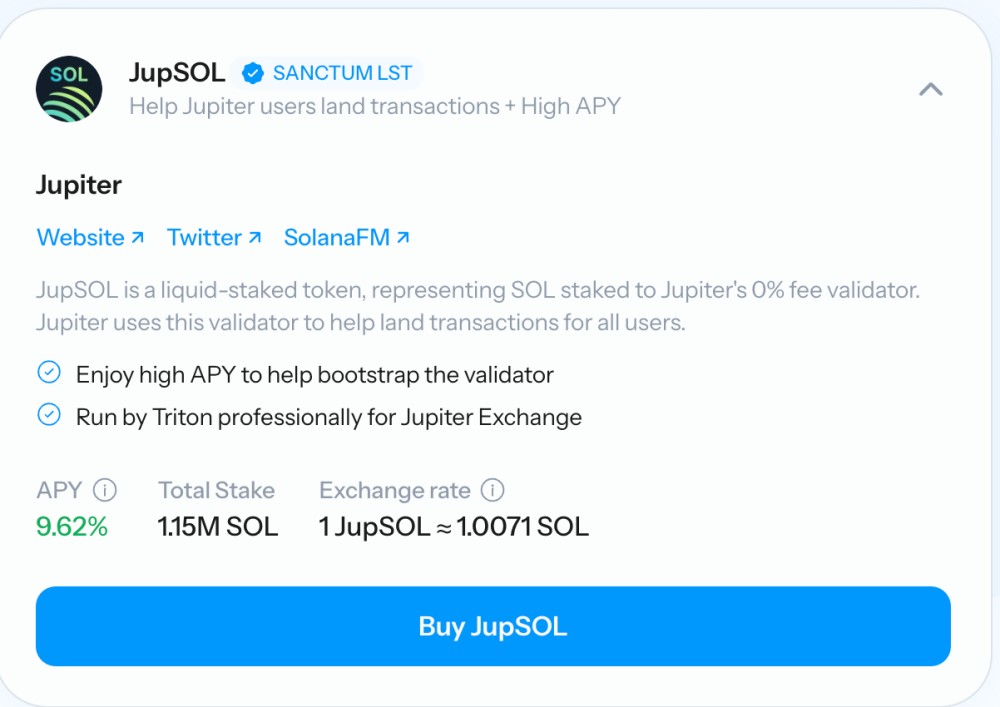

It is noteworthy that Jupiter has two major partners for the JupSOL token. Triton Labs, a Solana infrastructure provider, runs the Jupiter Validator. Meanwhile, Sanctum, another Solana-based DeFi protocol, manages the issuance and distribution of JupSOL using the time-tested SPL stake pool program.

JupSOL vs Other Solana-based LST Tokens

There are many Solana-based liquid staking tokens (LSTs). Some of the most popular names include Marinade Finance Staked SOL (MSOL), Blazed Staked SOL (BSOL), and Jito Staked SOL (JitoSOL). Each LST has its unique selling points, including low fees, higher yield, and reputation.

In this vein, JupSOL aims to set itself apart by claiming to be the highest-yield-bearing LST on Solana. The Jupiter validator does not charge any fee and also pays back 100% of fees earned by maximum extractible value (MEV) to stakers. Additionally, the validator has a 100,000 SOL donation from Jupiter, which earns additional free yield to JupSOL holders.

Announcing JupSOL – the highest yield LST on Solana, with trustless delegation to Jupiter’s Validator.

This validator has 0% fees and 100% MEV kickback and currently has an additional 100K SOL delegated to increase the yield on JupSOL.This will likely make JupSOL the highest… pic.twitter.com/vsEYqG5bxh

— Jupiter 🪐 (@JupiterExchange) April 16, 2024

Beyond the benefits it brings to JupSOL holders, the LST could play a more significant role in the Jupiter ecosystem. By having its own LST and significant amounts of SOL delegated to it, Jupiter can boost the success rate and latency of user transactions on its platform.

The reason is not far-fetched. A validator is involved in network consensus, confirming and verifying user transactions. By running its own validator, Jupiter can get the right to process more transactions and prioritize using this opportunity to help its growing ecosystem, which is set to include a mobile app

Is JupSOL Safe to Hold?

As previously mentioned, Jupiter SOL uses the same SPL stake pool program as most other liquid staking tokens on the Solana network. Hence, if you’re comfortable holding other Solana-based LSTs such as MSOL, BSOL, and JitoSOL, then it should be relatively easier to make a choice to use JupSOL, which seems to have a similar risk profile.

It is also worth mentioning that all LST holders run the risk of these tokens having lower liquidity when compared to holding native SOL. Large swaps on decentralized exchanges or significant selling demand may temporarily lead to a minor or major deviation in the value of an LST, relatively SOL. However, the design of these assets means market participants have an incentive to buy back the LST, helping restore its beg within a short time.

In the end, readers must weigh their risk appetite and choose accordingly.

Where to Buy JupSOL

Solana users can buy JupSOL on Jupiter to get the best prices. Alternatively, you may choose to use the Sanctum UI to trade SOL for JupSOL.