Jupiter, a decentralized exchange aggregator, is one of the most widely used applications on the Solana network. It has since become the major destination for users to swap between Solana-based tokens, thanks to its ability to offer users the best possible prices on the network.

Understanding how the Jupiter Protocol works can be relatively confusing for newcomers. At the same time, the Jupiter ecosystem has grown massively in the past few years, with many features that improve the on-chain trading experience significantly.

In this article, you will learn about Jupiter, its numerous features, the JUP token airdrop, and why Jupiter has grown into one of the most used apps in the entire crypto ecosystem. We begin first with a basic introduction to the protocol’s underpinnings.

What is Jupiter?

Jupiter is a decentralized exchange aggregator on Solana, developed to help users swap tokens seamlessly at the best possible price. If you have used Uniswap on Ethereum or any decentralized exchange on other networks, then you can understand Jupiter better.

Basically, a decentralized exchange like Uniswap has liquidity pools and leverages automated market maker (AMM) technology to allow users to swap tokens. Jupiter, however, does not have liquidity pools.

Instead, it aggregates or consolidates liquidity from different DEXes using a novel technology that routes users’ orders across these platforms. By so doing, users can get the best price on their swaps using Jupiter, then when they go to swap on DEXes directly.

Meanwhile, Jupiter does more than offer instant swaps. The aggregator includes other features such as limit orders and dollar-cost averaging (DCA).

In terms of history, Jupiter was introduced in 2021 by an anonymous developer, “Meow,” to address the varying liquidity conditions and price differences across decentralized exchanges on the network. The platform was built on the principles of providing cost efficiency, optimizing protocol utilization, and driving the adoption of the Solana blockchain within the decentralized finance (DeFi) community.

Jupiter launched its native token, JUP, on January 31, 2024. Its market debut followed an airdrop to users who had interacted with the Solana ecosystem in the past. JUP was subsequently listed in exchanges like Binance and Coinbase after its market debut and has grown into billions of dollars in market capitalization.

Understanding Jupiter: Solana’s Leading DEX Aggregator

While there are several decentralized exchanges built on Solana, none is as popular as Jupiter. Instead, most of these DEXes plugin into Jupiter to attract liquidity to their pools, making it one of the network’s most utilized applications.

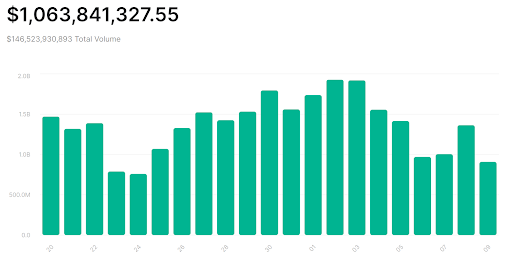

According to data from Jupiter’s Research Station, the platform now boasts an average daily trade volume of $1 billion, with over 284,000 unique wallets.

Since its market debut in 2021, it has facilitated a total trading volume surpassing $141.2 billion, with about $47.5 billion in March 2024. The platform effectively consolidates fragmented liquidity across Solana decentralized exchanges, delivering a cohesive trading experience for users.

Functioning as a bridge between users and various decentralized exchanges (DEXs), Jupiter consolidates data on liquidity conditions, asset prices, and fees from multiple exchanges into a single interface. With access to this core information, Jupiter determines the optimal route for each user transaction, potentially routing it through numerous liquidity pools called “hops.” A single swap transaction may traverse up to three hops.

By leveraging this system, traders can seamlessly access the most efficient and cost-effective facilities for their transactions. Jupiter proudly claims connectivity to over 28 DEXs and automated market makers (AMMs) within the Solana ecosystem. It also boasts several high-profile partnerships with top exchanges and wallet providers from across the cryptoverse.

It is also noteworthy that Jupiter has grown to be a major force in the decentralized exchange sector. The Solana-based aggregator has surpassed industry leader Uniswap on several occasions to rank as the number one DEX in the crypto space.

You will learn how Jupiter works next, with a deep dive into how the aggregator manages to get the best prices for users across multiple decentralized exchanges.

How Does Jupiter Work?

Token prices are subject to rapid fluctuations, making the best-priced trade not consistently available on one decentralized exchange (DEX). Jupiter’s DEX aggregator protocol overcomes this setback and provides the best prices for its users. Here is how the aggregator does it.

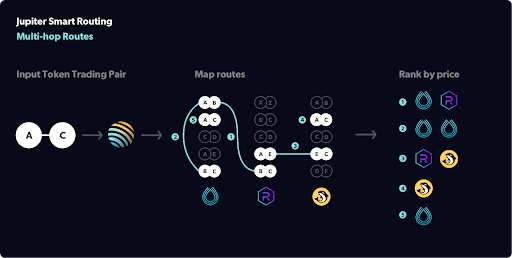

Jupiter utilizes a smart routing tool. Smart routing involves two processes: multi-hop routes and the trade splitting method. The aggregator might utilize one or both of these techniques to ensure users get the best prices to swap.

Using the multi-hop technique, Jupiter finds the best prices by exploring intermediary tokens. For instance, if a user wants to swap SOL for USDC, Jupiter would explore pairs like mSOL/USDC, compare liquidity, and then utilize that path to get the best price for the user.

Under the trade splitting method, Jupiter splits a user swap order into smaller parts and executes them on different decentralized exchanges. For instance, the aggregator might split a $1000 swap order on its platform into 60%, 30%, and 10% and fill it on exchanges like Raydium, Orca, and Lifinity. The trading splitting technique helps with large swap orders and tokens with little liquidity spread across decentralized exchanges.

Aside from aggregating liquidity from multiple decentralized exchanges, Jupiter has other usefulness to users. The platform has incorporated other features that attract users to centralized exchanges, creating an interface that makes interaction with the platform worthwhile.

Jupiter DEX Features

Limit Orders:

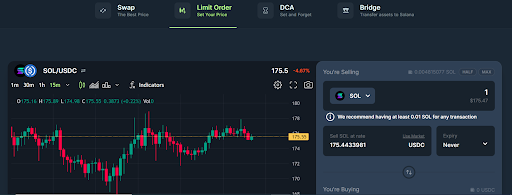

Traditionally associated with centralized exchanges (CEXs), limit orders are becoming increasingly prevalent on decentralized exchanges (DEXs). These orders allow traders to specify the price at which they want to execute trades, ensuring they don’t overpay for token purchases.

Jupiter leverages robust data from partners such as Birdeye and TradingView to provide users with accurate information. Users can simply place a limit order on Solana and receive their tokens directly in their wallets once the order is executed.

When a user sets a limit order on Jupiter, the protocol retains the order details, including parameters like buying/selling price and quantity. It then fetches prices from supported decentralized exchanges and monitors price changes. The protocol executes the trade once the market price matches the trader’s set point. If on-chain liquidity is insufficient, it executes trades in smaller portions until completion.

Jupiter claims that its decentralized limit order feature operates with the same efficacy as centralized ones despite lacking market makers, an order book, and centralized control.

Perpetual Futures:

The platform hosts a decentralized perpetual trading platform where users can speculate on asset prices. Traders can take long or short positions on perpetual markets such as SOL-PERP, ETH-PERP, or WBTC-PERP, similar to the operations of GMX on Ethereum. This position is taken while liquidity providers lock up assets in the perpetual vault. This vault supports WBTC, USDT, USDC, SOL, and ETH.

Traders commit collateral and obtain funds from the vault based on their collateral and chosen leverage multiplier. The platform ensures zero price impact and slippage and offers deep liquidity by utilizing LP pool liquidity and the Pyth network’s oracle for price feeds.

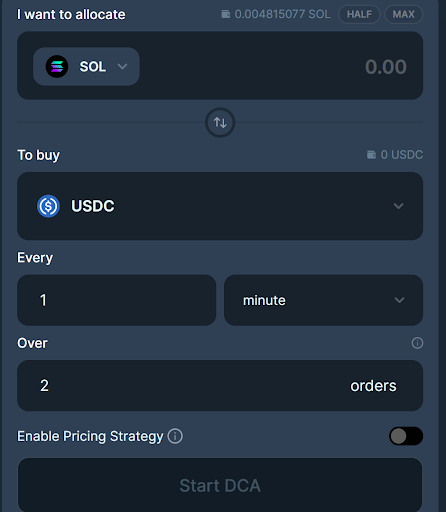

Dollar Cost Averaging (DCA):

Dollar-cost averaging (DCA) is a popular strategy for mitigating the risk of overpaying for tokens. With DCA, traders spread out their transactions over time, aiming to capture various peak points for sales and lows for purchases rather than executing all trades simultaneously and at a single price point.

Through Jupiter’s DCA feature, traders allocate their capital to the trade and specify different price points or price ranges at which they wish to make purchases, along with the corresponding amounts for each interval and the desired time interval for the trade.

For example, a trader might choose to buy $2,500 worth of Solana (SOL) over a period of twenty-five days, with the flexibility to adjust the interval to hours or minutes. They may decide to commit $250 every day at specific price levels.

The protocol then allocates $2,500 to the DCA program, held in the trader’s vault. As each trade is executed, the purchased assets are transferred to the trader’s wallet. For assets other than SOL, traders must create an Associated Token Account (ATA) to facilitate the automatic transfer of purchased tokens to their wallet.

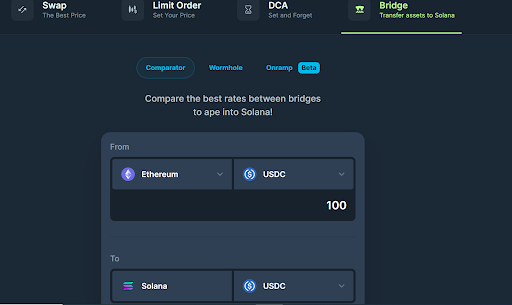

Cross-Chain Bridging:

Jupiter facilitates seamless asset movement between Solana, Ethereum, BNB Chain, and five other chains, providing traders and developers with a vital tool for their activities.

It presents users with available routes for bridging their transactions, including route details and a suggested route based on current conditions. Users select their preferred route and are redirected to the chosen bridge to complete the transaction. Supported bridging facilities include Mayan Finance and Debridge.

Having seen the features on the Jupiter platform, here is how to use the aggregator to swap or trade.

How to Use Jupiter DEX Aggregator

Visit the official Jupiter website. Select “Connect Wallet” from the landing page to link your wallet to the platform.

Once connected, you can execute a Direct Swap, configure Limit Orders, or seamlessly leverage the DCA feature for your swaps on Jupiter.

To execute a Direct Swap on Jupiter, follow these steps:

- Navigate to the Swap section on the platform.

- Choose the assets you want to swap.

- Enter the amount you wish to exchange.

- Select “Market” from the swap interface to set transaction priority.

- Adjust the priority to expedite your transaction, though a higher priority may incur increased fees.

- Define the slippage tolerance for your transaction.

- Click “Swap” to proceed.

- Approve the transaction from your connected wallet to finalize the swap.

To execute a Limit Order Swap on Jupiter, follow these steps:

- Go to the Limit Order section on the platform.

- Choose the assets you want to swap.

- Define a sell price for your order.

- Specify an expiration period for the order.

- Indicate the amount you wish to exchange.

- Click “Place Limit Order” to proceed.

- Approve the transaction from your wallet to finalize the swap.

To utilize Dollar-Cost Averaging (DCA) with Jupiter, follow these steps:

- Visit the DCA section on the platform.

- Choose the assets you want to swap.

- Set an interval for the DCA swaps.

- Specify the number of orders for the swap.

- Optionally, activate the pricing strategy by toggling the Switch icon and entering a price range for your swap.

- Click “Start DCA” to proceed.

- Approve the transaction from your wallet to finalize the DCA process.

The Jupiter (JUP) Token Overview

On January 31, 2024, the Jupiter token was officially launched via an airdrop to almost one million Solana wallets that had interacted with the Jupiter platform before November 2, 2023. Jupiter airdropped $700 million worth of JUP tokens to Solana users via the airdrop, making it one of the largest in the crypto space. According to JUP’s tokenomics, the total supply of JUP tokens is 10 billion, with an even split between team usage and community engagement initiatives.

Jupiter Labs stated that the total supply of the JUP token is 10 billion. Also, JUP tokenomics shows a 50-50% token allocation for the team and the community.

Jupiter (JUP) Tokenomics

Team Allocation – 50%

20% – Team members

20% – Strategic Reserve

10% – Liquidity Provider (LP)

Community Allocation – 50%

40% – Airdrops ( 4 rounds)

10% – Contributors and grants

About 20% of the total token supply entered circulation upon launch, with 10% airdropped to users and 10% allocated for liquidity provision. This launch event took place on January 31.

However, at the time of writing, JUP has reached a market cap of $1.8 billion. Also, while JUP launched at $0.58, its price hit an all-time high of $1.78 on April 1, 2024.

The JUP DAO

Jupiter’s decentralized autonomous organization (DAO) functions similarly to most DAOs in the cryptocurrency and DeFi ecosystem. JUP token holders get to vote on important decisions surrounding Jupiter’s products.

Following the initial launch of the JUP DAO, token holders have the chance to stake JUP to vote on projects that will be listed on Jupiter’s launchpad platform, LFG. Users would be rewarded with a portion of tokens from projects that launch on LFG. At the same time, voters would qualify for future airdrops of the JUP token.

Jupiter first funded its native DAO on March 27, giving the independent entity an initial deposit of 10 million USDC and 100 million JUP. According to Jupiter, the funds would help fund community initiatives and reward its long-term contributors.

https://twitter.com/JupiterExchange/status/1773007030460236060

Jupiter also pledged to replenish the DAO wallet from its reserves and cold wallets at the end of every year to ensure that it never runs out of cash to continue funding critical initiatives like the Working Groups, public goods, and community efforts..

Frequently Asked Questions About Jupiter

Does Jupiter Limit Order charge any fees?

Jupiter’s Limit Order charges a 0.2% platform fee to users making transactions. Partners who integrate with Jupiter Limit Order can receive a 0.1% share of referral fees, while Jupiter retains the other 0.1% as platform fees. The program handles these fees, which partners can claim whenever they choose.

Does Jupiter Swap charge any fees?

Jupiter does not levy any charges. The transaction fees displayed are Solana fees (gas fees). Furthermore, when swapping to a new token or utilizing a new DEX/AMM, there may be a nominal deposit or rent fee for creating Associated Token Accounts (ATA). These fees are reimbursed upon account closure.

My swap fails, reporting a slippage error. What should I do?

- Slippage occurs due to changing market conditions between transaction submission and verification.

- Your slippage rate acts as a protective measure. If the price falls below your slippage rate, the transaction will fail to prevent you from receiving fewer tokens than intended.

- You have the option to adjust your slippage rate. By default, it is set to 0.5%, meaning the trade will not be completed if the price slips more than 0.5% of your quote.

How do I get my new project token to be available to trade on Jupiter?

To ensure your new project token is tradable on Jupiter, follow these steps:

- Mint your token

- After setting up your token and liquidity pool, ensure that you maintain a minimum liquidity of $500. This threshold is necessary for Jupiter to recognize and list your token.

By adhering to these steps and maintaining the specified liquidity requirements, you can increase the visibility and accessibility of your token on the Jupiter platform.

The Jupiter beginner guide explains how the DEX works and why it has become increasingly popular on Solana. Readers also learned about the various features of the Jupiter ecosystem, the Solana Jupiter airdrop, and the JUP DAO.

In summary, Jupiter has already shown significant potential for the Solana ecosystem and the growth of decentralized exchanges. Time will go on to reveal whether it continues to live up to this potential and become an even more dominant force as the industry matures.