In the history of decentralized payment systems, bitcoin is the world’s first and most popular cryptocurrency.

You are going to learn a lot about Bitcoin in this article. As you read, kindly look out for the answers to these questions: What is a cryptocurrency? Why is Bitcoin so popular? How does Bitcoin work? How can you invest in it? Is Bitcoin safe? And so on.

Introduction to Bitcoin

Bitcoin is a digital currency or a cryptocurrency. It is also referred to as BTC, which doubles down as the ticker for the asset.

What is a cryptocurrency? A cryptocurrency is a digital asset that can be transferred from one person to another worldwide in a secure, transparent, and verifiable manner. As will be explained later in this article, all cryptocurrency transactions are stored on a ledger technology known as a blockchain.

Bitcoin is a virtual currency that can be transferred from one person to another without needing to go to the bank or through an intermediary. Unlike physical money, also called fiat currency, bitcoin is a form of money that cannot be seen, touched, or felt. It can only be transacted on the internet.

Bitcoin is said to be a form of money because it possesses three properties of money, namely, it can be used as a medium of exchange, store of value, and unit of account.

The electronic transfer of bitcoin from one person to another cannot be controlled by a single individual or a central authority. The currency itself is not owned by anybody. Its supply is not issued by the government or managed by the bank. Due to these reasons, bitcoin is referred to as being decentralized.

Bitcoin has a limited supply of only 21,000,000 coins. This limited supply is an important part of the currency’s existence because it aims at making the digital asset a highly attractive one in the future.

In the future, the demand for bitcoin will exceed its supply. This will lead to an increase in its monetary value and popularity.

Brief History of Bitcoin

Bitcoin is the first successful and widely known cryptocurrency that has ever existed. To fully understand bitcoin and how it works, let us briefly go down memory lane.

Bitcoin was created in 2008 by a pseudonymous person or group of people known as Satoshi Nakamoto. That year, Satoshi Nakamoto published a white paper which contained the principles that guide the digital currency.

It is important to note, though, that to date, the true identity of Nakamoto remains unknown. We do not know whether they are a single individual, a male or female, or a group of people. We also do not know whether they are still alive or dead.

What we do know is that when Bitcoin was launched, it served as a notable breakthrough in computer science. This is because the invention provided a solution to a pressing issue: privacy.

How?

As a medium of exchange, you can transact and make payments with bitcoins around the world without the involvement of any central authority. This makes it easy for people to maintain their transaction privacy without being monitored by a financial institution or an external body.

Bitcoin Wallet

A Bitcoin wallet is a software program that runs on a computer or another electronic device. It functions to secure, send, and receive bitcoin.

The currency, itself, is not stored in a wallet. Instead, the wallet secures the cryptographic keys that prove that a user owns a specific amount of bitcoin on the network.

There are two types of cryptographic keys required to own and transact bitcoins. We have the private key and the public key.

Both keys (private key and public key) are made up of unique characters; letters and numbers. These keys can be described as your password to access your bitcoins. It is, therefore, important, not to lose them as that will mean losing access to your coins.

The private key is first generated by the Bitcoin network. The public key is then created from the private key using a one-way mathematical algorithm. The one-way mathematical algorithm makes it impossible for the private key to be regenerated from the public key.

Finally, the blockchain creates a shortened version of the public key. This shortened version is known as the public address or Bitcoin address.

There are two types of digital wallets where you can store your bitcoins, namely, hot wallet and cold wallet.

The major differences between these two types of wallets are:

- A hot wallet is connected to the internet while a cold wallet is not connected to the internet.

- Hot wallets are more commonly used than cold wallets.

- Cold wallets are considered to be safer than hot wallets because they are not connected to the internet.

- To download bitcoins into a cold wallet, you need a hot wallet.

Bitcoin Address

A Bitcoin address is a distinctive set of 58 characters (letters and numbers) used to recognize the destination of a Bitcoin transaction. It can be likened to the home address of the recipient which tells where to send their package or their email address which tells you where to send an email.

To execute a transaction on the Bitcoin blockchain, you need to provide your private key and public key. You also need to provide the recipient’s Bitcoin address. At the recipient’s end, they need their private key to claim their received bitcoins.

While you can share your Bitcoin address with anyone who wants to send you some coins, you should never share your private key with anybody. Your private key should be for your eyes only and should be safeguarded carefully just as you would safeguard your debit card’s PIN.

How Does Bitcoin Work?

Bitcoin is an open-source technology that allows anyone and everyone with an internet connection to participate in it. It does not depend on individuals or private organizations to process transactions. Rather, it runs on its blockchain.

What is blockchain? Blockchain is a public digital ledger that records cryptocurrency transactions made on it. Once recorded on the blockchain, a transaction cannot be reversed, nor can its record be altered.

A blockchain can be likened to a big exercise book that contains many pages. One page inside the book is a block of transactions while one line on the page is a transaction. Hence, the combination of many transactions is known as a block of transactions while a blockchain is a combination of different blocks.

Bitcoin (starting with capital letter B) is the blockchain on which bitcoin, the native cryptocurrency (which starts with small letter b), runs. In simpler words, Bitcoin is the blockchain while bitcoin is the cryptocurrency.

Every time a Bitcoin transaction is made, that is, whenever bitcoin is sold or bought, it is recorded on the Bitcoin blockchain for transparency. Apart from storing transactions, the Bitcoin blockchain verifies and validates transactions made on it to prevent counterfeiting.

Bitcoin users who wish to exchange their digital assets with others can choose to download a copy of the public ledger which contains all the bitcoin transactions recorded on the blockchain. Whenever new transactions are validated and stored on the public ledger, the Bitcoin network reflects the changes automatically on every user’s copy.

As a result, all Bitcoin users can track transactions validated on the blockchain in real-time. This arrangement makes it difficult for users to engage in double spending.

Double spending is a fraudulent activity where users may try to transfer just one particular fraction of bitcoin to two people at the same time with the hope that the system will not notice it.

Proof-of-Work Consensus Mechanism

To validate any transaction made on the blockchain, the entire network of Bitcoin users need to verify the authenticity of each block of data and unanimously agree that it should be added to the blockchain. This unanimous agreement is known as consensus.

To achieve this, the blockchain uses a consensus mechanism called proof-of-work (PoW). proof-of-work is a process used to validate transactions on the blockchain and secure the Bitcoin network.

Proof-of-work is not the only consensus mechanism that exists. However, it is the most common type for cryptocurrencies that run on blockchains.

Proof-of-stake (PoS) is another type of consensus mechanism used to validate transactions on certain blockchains such as Ethereum. Compared to Proof-of-Work, though, Proof-of-stake is said to consume less energy.

The Proof-of-Work (PoW) consensus mechanism allows certain Bitcoin users who have greatly contributed to the network to become bitcoin miners and earn rewards.

Bitcoin Mining Explained

Bitcoin mining is the process of adding new blocks of transactions to the blockchain and minting new bitcoins. It is a decentralized and complex process through which new bitcoins are generated on the network. The process involves very tedious mathematical calculations using complex and specialized computer hardware known as mining machines.

Apart from being tedious, the process of mining is a very competitive one as the first person to solve the mathematical problem is the one who gets to add the next block to the blockchain. Again, mining consumes lots of energy and incurs high electricity costs.

Individuals who perform the mining tasks are known as miners. They verify, validate, and confirm new bitcoin transactions.

These miners are duly rewarded each time they are successful in validating a transaction. How are miners rewarded?

Bitcoin’s supply is limited to only 21,000,000 units. This means that only 21,000,000 bitcoins will ever exist.

Approximately every 10 minutes, bitcoin miners add one new block of transactions to the blockchain. Currently, each time a new block is added to the blockchain, 6.25 BTC is minted.

These newly minted bitcoins serve as a block reward for the miner who completed the transaction validation. This reward is in addition to the transaction fees the miner earns for processing the transaction.

All bitcoin users are expected to pay a transaction fee every time they want to process a transaction on the network. The goal of paying a transaction fee is to get your transactions processed faster.

Since the mining process incurs high electricity costs and is energy-intensive, miners usually process transactions with the highest transaction fees first before those with lower transaction fees to make more money. So, it is safe to say that the more transaction fees you pay, the faster your transactions will be processed.

Bitcoin Halving

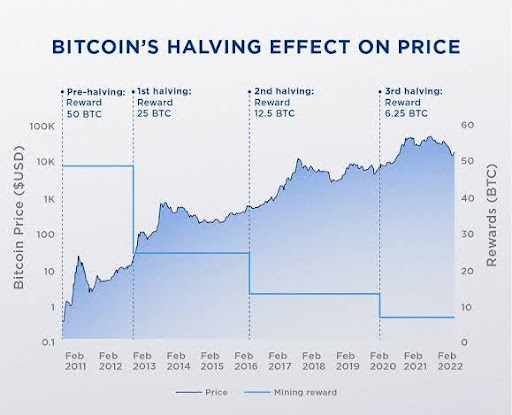

The Bitcoin halving is a pre-programmed change to the network that reduces the block reward that miners receive in exchange for their mining activity. The reward is reduced by half approximately every four years or after every 210,000 blocks.

When Bitcoin was first launched, the block reward for bitcoin miners was 50 BTC per new block. 210,000 blocks or roughly four years later, the block reward was reduced by half, making it 25 BTC per new block. Four years after that, the block reward was reduced by half again until now.

Presently, the block reward for bitcoin miners is 6.25 bitcoins per new block. Later this year, 2024, the figure is set to change again. This time, it will be reduced from 6.25 BTC to 3.125 BTC per new block.

An important point to note is that the block reward for miners is the same as the number of bitcoins minted approximately every 10 minutes. This means that, currently, 6.25 bitcoins are released into the network every approximately 10 minutes.

It also means that an estimated value of 900 new bitcoins is minted every day. The next halving, which is set to take place later in 2024, will reduce this figure from 900 to around 450 new bitcoins per day.

The halving cycle will continue like that until the total supply of 21,000,000 bitcoins is exhausted and there are no more bitcoins left to be minted. This is expected to take place sometime around the year 2140.

What, though, will happen when all bitcoins are mined?

What Will Happen When All Bitcoins Are Mined?

When all bitcoins are mined, no major changes will occur on the Bitcoin network. However, it is difficult to predict with certainty what the Bitcoin space will be like then.

Two things, though, are sure to happen.

First, when all bitcoins are mined, the maximum supply of 21,000,000 units will have been reached. As a result, no new bitcoins will be minted.

Second, bitcoin miners will depend solely on transaction fees as they will no longer earn block rewards in the form of newly minted coins.

How Do You Make Money with Bitcoin?

There are some ways in which you can make money with Bitcoin. The first is through bitcoin mining. The other is through bitcoin trading and investment.

- Bitcoin Mining:

The role of bitcoin miners is to validate and confirm transactions on the blockchain and add new blocks of transactions to the ever-growing blockchain.

As a reward for bitcoin miners, newly minted bitcoins are released into the network every 10 minutes. These miners are then paid with the newly minted coins.

Apart from the block reward they receive, bitcoin miners also receive the transaction fees the users pay to get their transactions processed.

- Bitcoin trading and investment:

Another way to make money from Bitcoin is by investing. You can invest by buying the coins and trading or selling them later. The common rule to making profits from bitcoin trading is to buy low and sell high.

So, to make money from Bitcoin, you can decide to buy some coins when the value is relatively low and sell them when the value appreciates.

Is Bitcoin a Good Investment?

Since it is possible to make money from Bitcoin, one might wonder whether Bitcoin is a good investment. This question is valid, considering bitcoin’s recent high performance in terms of increase in value.

Before answering the question, however, it is good to look at some popular reasons why people invest in Bitcoin.

Popular Reasons Why People Invest in Bitcoin

First, Bitcoin is an open-source technology that allows anyone with access to the internet to participate in it.

Secondly, with bitcoin trading, you can make money by buying some coins when the value is low and selling them when the value increases.

In addition, Bitcoin transactions are cost-efficient and very fast compared to bank transactions.

Also, Bitcoin transactions ensure that the users’ privacy is protected as they do not require that users share their personal or sensitive information.

More to that, bitcoin runs on a decentralized system that is devoid of close monitoring and control from third parties. Hence, bitcoin users can be sure that their investments are secure.

Following Bitcoin’s growth since its launch, Bitcoin users believe that the cryptocurrency has the potential to grow even more in the future. For this reason, they buy and hold the asset.

Explained above are some of the pros of investing in Bitcoin. Now, let us examine the cons of Bitcoin investment.

Cons of Investing in Bitcoin

Bitcoin, as with other cryptocurrencies, is a highly volatile asset. Being unpredictable, the price of bitcoin can rise and fall at any time.

Data on the price history of bitcoin shows that 2023 began with the price of one bitcoin being a little over $17,000. At the end of March 2024, though, the price of one bitcoin was over $70,000.

Deciding whether you should invest in Bitcoin or not is a personal choice. Long-term investment in the digital currency can be profitable. However, the decision to invest should be based on diligent research not misguided emotions.

Another aspect of Bitcoin investment is its irreversibility. Once processed, Bitcoin transactions cannot be reversed.

Some Bitcoin users who lost their private keys have also lost access to some of their coins. This is because your private key is what grants you access to your bitcoins.

It is, therefore, very important for Bitcoin investors to keep their private keys in a safe but easily accessible place.

Frequently Asked Questions About Bitcoin

Let us now find answers to some frequently asked questions about Bitcoin.

Can You Convert Bitcoin to Cash?

Yes. You can convert bitcoin to cash.

Just like every other asset, you can convert your bitcoins to fiat currencies by selling them. You can also convert your cash to bitcoin by buying some coins.

As earlier mentioned, the value of bitcoin fluctuates. Hence, before buying or selling, it is important to check the price and know whether it is the right time to take action or not.

Is Bitcoin Safe?

As with other cryptocurrencies, investment in Bitcoin is a risky activity. The price action of the currency is highly unpredictable.

Before investing in Bitcoin, you need to make an informed decision by carefully examining the advantages and disadvantages associated with it. You also need the ability to tolerate high risks and do thorough research.

Furthermore, a bitcoin investor should be ready to lose some or all of their investments. This loss may result from poor decisions or fluctuating market prices.

How Can I Get Bitcoin?

The simplest way to get bitcoin is by buying some coins on a cryptocurrency exchange or a cryptocurrency wallet. There are many cryptocurrency exchanges and wallets available from which you can choose from.

You can also get bitcoin if you are a business person or a service provider that accepts bitcoins as a mode of payment. So, instead of paying you using fiat currencies, your customer or client can pay you in bitcoins in exchange for a product you sold or a service you rendered to them.

Summary

Bitcoin is a popular cryptocurrency because it is the first successful cryptocurrency to be launched. Created in 2008 by a pseudonymous figure, Satoshi Nakamoto, bitcoin has a limited supply of 21,000,000 coins.

The blockchain is a decentralized network. It is not controlled by any individual or organization. It uses the Proof-of-Work (PoW) consensus mechanism to validate transactions.

Bitcoin miners are rewarded for their services in the form of block rewards and transaction fees paid by users. You can invest in Bitcoin by buying some of the cryptocurrency on a cryptocurrency wallet or exchange.

Bitcoin investment is risky due to its highly volatile and unpredictable nature. As a result, potential investors and users need to do proper research regarding when and how much to invest in Bitcoin.