Solana was among the worst-hit by the crypto market’s declines in March. The asset started the month with significant dips, leaving prices low.

One of the biggest hits came on the second day, when the asset opened trading at $178 but dipped, hitting a low of $139. Following a slight recovery, the altcoin lost over 20%, following a massive surge the previous day.

Solana had another significant decline on Mar. 9, slipping from $136 to $124. Due to the consistent declines, the asset trades at $126 at the time of writing.

Nonetheless, investors are delighted that there are no significant bearish fundamentals. February closed with traders on edge over the news of the FTX unlock. The unlock occurred as planned, and the market has moved past it.

However, the global cryptocurrency market continues trading flat with no real direction. Although the selling pressure has significantly reduced, investors are yet to muster the needed pressure to break the trend.

SOL is not exempt from this trend as it failed to break out. Following its previous breakout, it remained rangebound over the last three days. The $130 resistance remains tough as the altcoin slipped below it again.

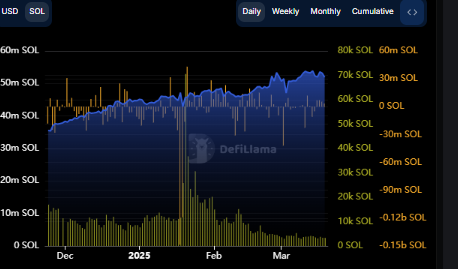

A Shift in TVL

The market trend before saw investors react to selling pressure by pulling staked assets, reducing the total value locked. The selling pressure has since decreased, and the TVL is back on the rise.

The current trend points to a shift in investors’ sentiment that may result in further buying pressure or a shift toward long-term storage.

The coming days may determine traders’s sentiment and resolve. SOL may continue its rangebound movement for long-term storage with minimal price breakouts. However, further increases in TVL may result in growing buying pressure, pushing prices higher. Nonetheless, the influx into the Solana ecosystem remains minimal, with revenues plummeting.

Solana Hints at No Massive Leap.

The one-day chart shows less bullish action at the time of writing. Although prices are slightly up, the stochastic oscillator shows significant selling action. Onchain metrics indicate that the sellers exceed the buyer twofold.

Nonetheless, the moving average convergence divergence remains positive following its bullish divergence a few days ago. It prints buy signals as both the 12-day EMA and 26-day EMA show no hint of a bearish convergence.

However, the coin had a death cross a few days ago. The 50-day moving average intercepted the 200-day MA a few days ago and shows no signs of reverting. Its previous surge came to an abrupt end despite some positive fundamentals.

The much-anticipated PumpSwap started operating on Mar. 20. A few hours ago, the launchpad announced on X that its native DEX will enable instant migration for assets created on the platform, zero migration fees, more liquidity, and creator revenue sharing.

Pump.fun latest launch resulted in a further decline for its previous DEX Raydium. Since the initial announcement, the exchange’s native token has plummeted. It had the same reaction following the launch, dipping by over 10%.

Nonetheless, the relative strength index shows a slight upward trend, pointing to a gradual increase in buying volume.