With the United States’ approval of 11 spot Bitcoin ETFs, traditional investors can now easily invest in Bitcoin without direct exposure to the crypto asset.

What, though, are spot Bitcoin ETFs and how do they work? Read this article carefully as it will guide you to the answers to these questions and many more on this topic.

What are Spot Bitcoin ETFs?

Over the years, the popular Bitcoin has maintained its position as the largest cryptocurrency by market capitalization. As a result, there is a large number of investors holding the asset.

As noted earlier, spot Bitcoin ETFs make it easier for people to invest in the cryptocurrency. But how?

First, what are ETFs? Generally, exchange-traded funds or ETFs are investment funds that monitor or track the price of financial assets such as stocks, bonds, cryptocurrencies, certain commodities (gold or oil), and so on.

Spot Bitcoin ETFs work the same way because bitcoin is a financial asset. They are exchange-traded funds that track the currency’s current price as closely as possible. They invest in Bitcoin. As a result, each share of the ETF corresponds to a specific number of bitcoins held.

How Do Bitcoin ETFs Work?

Every share of spot Bitcoin ETFs is backed by an equivalent amount of bitcoin itself. Due to this, a spot Bitcoin ETF share price is tied to the real-time or current value of bitcoin.

Also, their prices are determined by the rise or fall of bitcoin. In other words, when the value of bitcoin increases, the value of spot Bitcoin ETFs also increases and vice versa.

Bitcoin’s price fluctuates and is highly unpredictable. In this context, spot refers to bitcoin’s immediate price or value of bitcoin. That is why the value of spot Bitcoin ETFs depends on the immediate or current value of bitcoin.

Spot Bitcoin ETFs, however, do more than track bitcoin’s price. They expose investors to bitcoin’s current price without necessarily buying or holding the asset directly.

Notably, spot Bitcoin ETFs are not traded on cryptocurrency exchanges. Instead, they are traded on traditional stock exchanges like the New York Stock Exchange (NYSE). This makes it easy for traditional investors to participate.

To back up their shares with bitcoin, spot Bitcoin ETFs buy a specific amount of bitcoins from other holders or through reliable cryptocurrency exchanges. Due to the level of security needed, a cold or offline digital wallet with several security layers is used to store the coins’ private keys to prevent the risk of hacking. This kind of wallet (cold wallet) is considered the safest option because you cannot access it online.

Next, the exchange-traded funds (ETFs) issue shares equivalent to the amount of bitcoins held in the wallet. The prices of these shares are then based on the current price of the cryptocurrency and traded publicly on traditional stock exchanges.

Spot Bitcoin ETFs allow people to invest in an asset backed by biction and keep track of its real-time value without using a cryptocurrency exchange.

Spot Bitcoin ETFs’ Price Versus Bitcoin’s Price

Being an asset backed by bitcoin itself, the price of a share of a spot Bitcoin ETF is supposed to be the price of the equivalent amount of Bitcoin.

Sometimes, though, tracking errors may occur. As such, the price of a spot Bitcoin ETF may be higher or lower than bitcoin’s price.

Financial institutions known as authorized participants, or APs, work to correct this error. They help to rectify the issue and nudge the ETFs back in line by creating and redeeming large blocks of shares of the funds based on market demands.

This action increases the market’s transparency because it helps to maintain the EFTs’ value as close as possible to the value of bitcoin.

Which Bitcoin ETFs Were Approved?

In January 2024, the United States Securities and Exchange Commission (U.S SEC) approved the first 11 spot Bitcoin exchange-traded funds (ETFs).

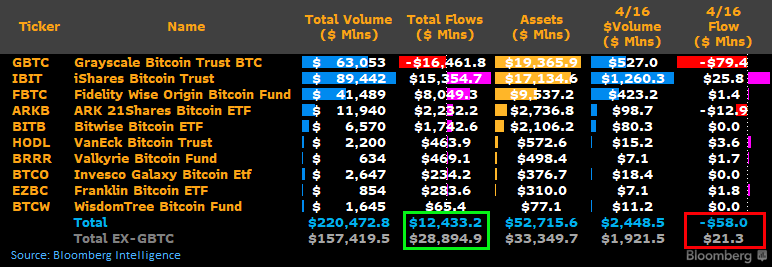

Here is a list of the new spot Bitcoin ETFs, and their fund managers or sponsors, in alphabetical order:

- ARK 21Shares Bitcoin ETF (ARKB): Its fund managers are Ark Invest and 21Shares.

- Bitwise Bitcoin ETF (BITB): This ETF is managed by Bitwise Investment Advisers, LLC.

- Fidelity Wise Origin Bitcoin Trust (FBTC): FD Funds Management LLC sponsors this ETF.

- Franklin Bitcoin ETF (EZBC), managed by Franklin Holdings LLC.

- Grayscale Bitcoin Trust (GBTC): Grayscale Investment LLC is Grayscale Bitcoin Trust’s fund manager.

- Hashdex Bitcoin ETF (DEFI), sponsored by Tidal Investment.

- Invesco Galaxy Bitcoin ETF (BTCO): Invesco Capital Management LLC sponsors this ETF.

- iShares Bitcoin Trust (IBIT): iShares Delaware Trust Sponsor LLC is the ETF’s sponsor.

- Valkyrie Bitcoin Fund (BRRR): This ETF’s former sponsor was Valkyrie Digital Assets LLC. The new sponsor is Coinshares Co.

- VanEck Bitcoin Trust (HODL): Its fund manager is VanEck Digital Assets, LLC.

- WisdomTree Bitcoin Fund (BTCW): Foreside Fund Services is its marketing agent.

Along with the approval, the U.S. Security and Exchange Commission’s chairman, Gary Gensler, released a statement.

At the end of the statement, Gensler urged investors to “remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.”

How Can I Buy a Bitcoin ETF?

Bitcoin ETFs can be traded on traditional stock exchanges and are available on several online brokerage platforms.

To buy a bitcoin ETF on any of these platforms, the following six steps apply:

- Research: Carefully evaluate each of the approved spot Bitcoin ETFs and look for factors that will help you decide. These factors may include high trading volumes and many assets under management (AUM). It is also important to check whether the fund managers of these ETFs have good track records or they do not.

- Before deciding which ETF to buy and where to buy them, it is important to carefully analyze your investment goals. Also, consider the platforms’ minimum deposit, the assets available on each of them, their trading fees (if any), management fees, brokerage commission, and so on.

- Make a decision: The next step after careful research on various ETFs is to make an informed decision. An ETF should be selected based on your investment goals and budget.

- Open an online brokerage account: Choose a platform that offers spot Bitcoin exchange-traded funds and open a brokerage account.

- Fund the account: The next step after opening an online brokerage account is to fund the account. You can fund your brokerage account either from another brokerage platform or a bank account. Your account should be funded depending on how much the ETF shares and commissions cost.

- Buy the ETF just as you would buy a stock: Search the ticker symbol of your preferred bitcoin exchange-traded funds on the platform. Next, enter the number of shares you want to buy. Finally, confirm your order.

- Monitor your investment: It is not enough to invest in bitcoin ETFs. It is important to check back regularly. Monitoring your investments will help you to keep track of how the price fluctuations of the underlying asset affects your own investment.

Is it Better to Invest in Bitcoin or Bitcoin ETFs?

Investment in bitcoin versus investment in bitcoin ETFs, which is better?

Here is a simple answer: Your decision to invest in bitcoin or spot Bitcoin ETFs should depend on your investment goals.

If you intend to hold bitcoins directly, you should give investing in bitcoin a shot. It should be done after proper research, of course.

On the other hand, if you only want an asset that exposes you to the immediate price of bitcoin without holding bitcoin directly, you can consider investing in spot Bitcoin ETFs. Again, you should do thorough research before making a decision.

Now let us examine some pros and cons of spot Bitcoin ETFs investment.

Advantages of Investing in Spot Bitcoin Exchange-Traded Funds

- Simplicity: Investing in spot Bitcoin ETFs is a simpler way of gaining exposure to the price of bitcoin without taking risks or going through the complex route of owning the asset directly. Investment is also simple because it is done through familiar brokerage platforms.

- Legitimacy: Buying spot Bitcoin ETFs translates to investing in a legitimate asset since they are now approved by the SEC.

- Increase in bitcoin’s price: Spot Bitcoin ETFs do not affect bitcoin’s price directly. However, when these ETFs increase their demand for bitcoin, it may, over time, lead to an increase in bitcoin’s value.

Disadvantages of Investing in Spot Bitcoin ETFs

- Market volatility: Since spot Bitcoin ETFs are tied to the value of bitcoin, they are as volatile as bitcoin itself with unpredictable price movements. This may prove to be a difficult pill to swallow for uninformed investors.

- Regulations: Regulatory actions taken against bitcoin which may affect its price will also affect spot Bitcoin ETFs’ price. This is because spot Bitcoin ETFs are backed by bitcoin.

- Lack of bitcoin ownership: As an investor in spot Bitcoin ETFs, you cannot take custody of the bitcoins your shares represent. However, they give exposure to the price of bitcoin.

- Limits on trading: Bitcoin can be exchanged with Ethereum and other cryptocurrencies. However, bitcoin ETF is an investment fund that simply tracks the price of bitcoin. It is not a cryptocurrency. So, it cannot be traded for or exchanged with a cryptocurrency.

Frequently Asked Questions About Bitcoin ETFs

Under this heading, we will answer some frequently asked questions about bitcoin exchange-traded funds (ETFs).

Do Bitcoin ETFs have to buy Bitcoin?

Yes, spot Bitcoin ETFs buy bitcoin. After all, the funds are backed by bitcoin itself. Spot Bitcoin ETFs invest directly in bitcoins. They buy and hold bitcoin as the underlying asset.

They are designed to mirror bitcoin’s price in the cryptocurrency market. This exposes investors to the underlying asset’s price movement without holding the coin themselves.

If you invest in a spot Bitcoin ETF, your fund shares represent bitcoins. However, you cannot take custody of the represented coins. Therefore, as an investor, spot Bitcoin ETFs buy and hold bitcoin on your behalf so you don’t have to.

Do Bitcoin ETFs Pay Dividends?

No. Spot Bitcoin ETFs do not pay dividends. The value of spot Bitcoin ETFs is based on the increase or decrease of bitcoin’s price.

Can Spot Bitcoin ETFs Affect Bitcoin’s Price?

Not directly. Spot Bitcoin ETFs cannot directly affect bitcoin’s price. However, they can do so indirectly.

How?

- Increased demand: When more and more investors, who want to track bitcoin’s price, invest in bitcoin ETFs, the funds will experience an increase in demand. This increased demand for ETFs leads to an increased demand for bitcoin, causing its price to appreciate over time.

- Market acceptance: The recent approval of the new spot Bitcoin ETFs could further prove that bitcoin is a legitimate investment. This market validation may spike bitcoin’s demand and increase its price.

What is the Best Spot Bitcoin ETF to Buy?

When researching which spot Bitcoin ETF to buy, look for funds with high trading volumes and many assets under management (AUM). Also, check to see if the issuer behind it is reputable. Any ETF with all these characteristics is the best one to buy.

Summary

In this article, we have learned that spot Bitcoin exchange-traded funds (ETFs) track the price of bitcoin and expose investors to the asset’s price movement by investing in bitcoin on their behalf.

Whenever a tracking error occurs, financial institutions known as Authorized Participants (AP) work to nudge the ETFs back in line and return them to the same price as the underlying asset.

In January 2024, the U.S. SEC approved 11 new spot Bitcoin ETFs that can be traded on stock exchanges and online brokerage platforms. A list containing the names of these ETFs, their ticker symbols, and the fund managers behind them was included in this article.

The steps involved in buying a spot Bitcoin ETF include research, making a decision, opening an online brokerage account, funding the account, purchasing the EFT, and monitoring the investment.

The best spot Bitcoin ETF to buy is one that has a record of high trading volumes, many AUM (assets under management) and is managed by a fund manager with a good track record.

Finally, making an investment decision should, among other important things, be influenced by proper research and evaluation of your investment goals and budget.