A whale who is particularly bullish on Ethereum has bounced off a setback and gone in even bigger on the crypto asset. The unidentified trader rebought Ethereum after he was liquidated in a broader market capitulation on August 5.

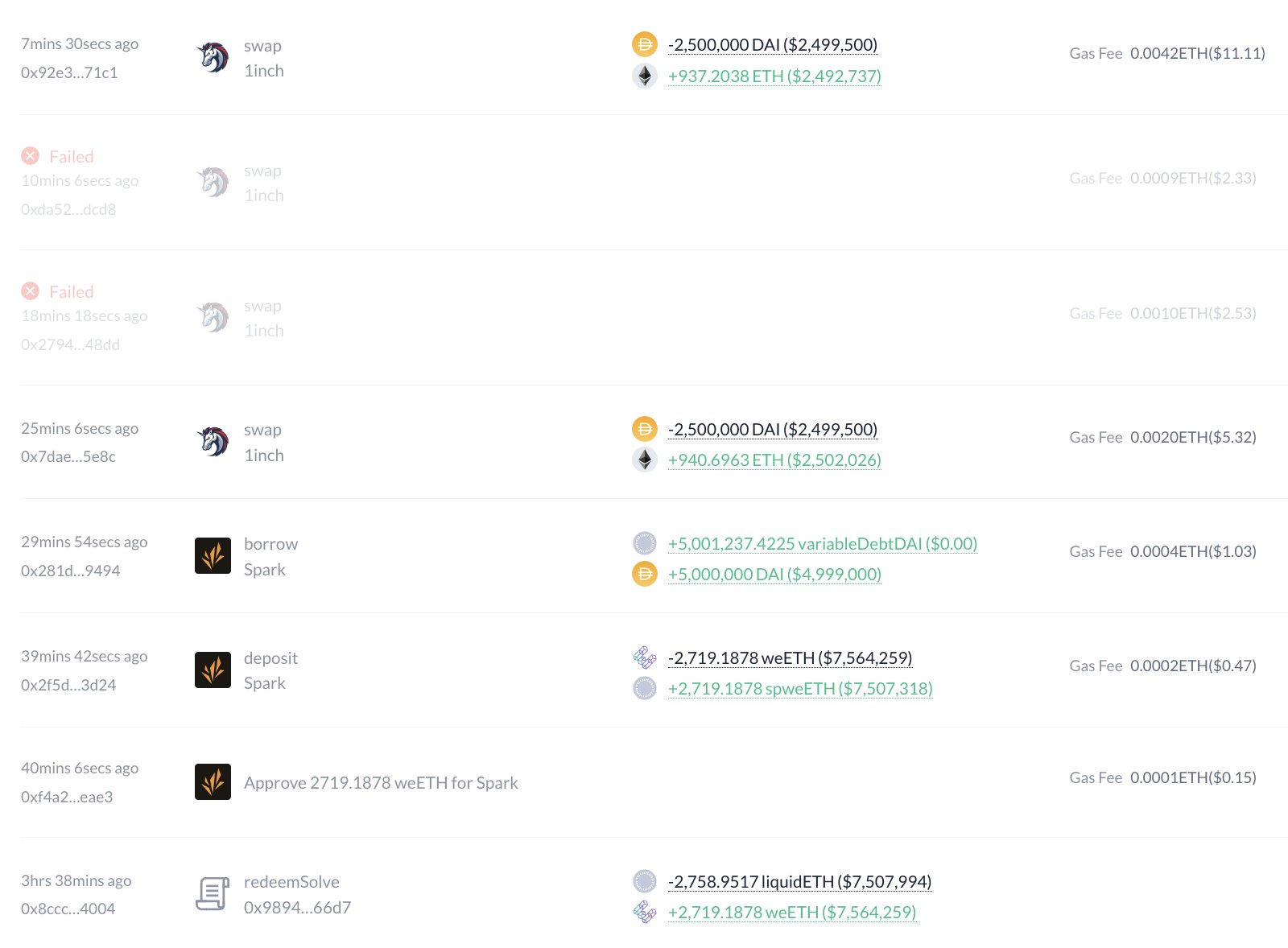

The address, 0x940Df59ba33f3387DEFF3c2400Fecf1286FCCe4c, opened a leveraged position on Ethereum on August 11, seven days after losing 2,890 wstETH ($8 million) when the asset dropped to $2,234. Data from Lookonchain shows that the resilient bull borrowed 6.6 million DAI, 2.7 million USDT, and 2.5 million USDC and bought 4,459 ETH (worth $11.8 million).

Data from Etherscan showed that the whale borrowed the DAI from MakerDAO and the USD stablecoins from Aave Pool.

Hit or Miss?

The whale’s bold move has sparked a lively debate within the crypto Twitter community. While some users have expressed concerns about the trader’s risk appetite, others have shown their support for the wallet owner.

“That’s some high-risk movement,” one user said while another tweeted: “They never learn.”

“If you can’t take risks, you won’t be rich,” a third user said.

However, the whale is already in profit as ETH has moved past his entry. At the time of writing, ether traded at $2,648, down 1.34% in the past 24 hours. The whale’s resilience also showed his strong stance on Ethereum’s bullish potential.

ETH Rebound

Ether pumped from the August 5 lows, surging over 10%. The asset saw a strong Monday, jumping 4% to as high as $2,738.

This bullish disposition of the second-largest crypto asset could be tied to the net inflow of its spot exchange-traded fund (ETF) on Monday. The US Ether spot ETFs recorded $4.9 million in inflows, their first in four trading days.

Data shows that the Ethereum product has a cumulative net outflow of $401 million and a net asset of $7.48 billion.