Following months of battling a major decline in market cap due to a U.S. banking crisis in early 2023, USD Coin (USDC), the second-largest stablecoin in the crypto industry, has begun to experience massive growth again.

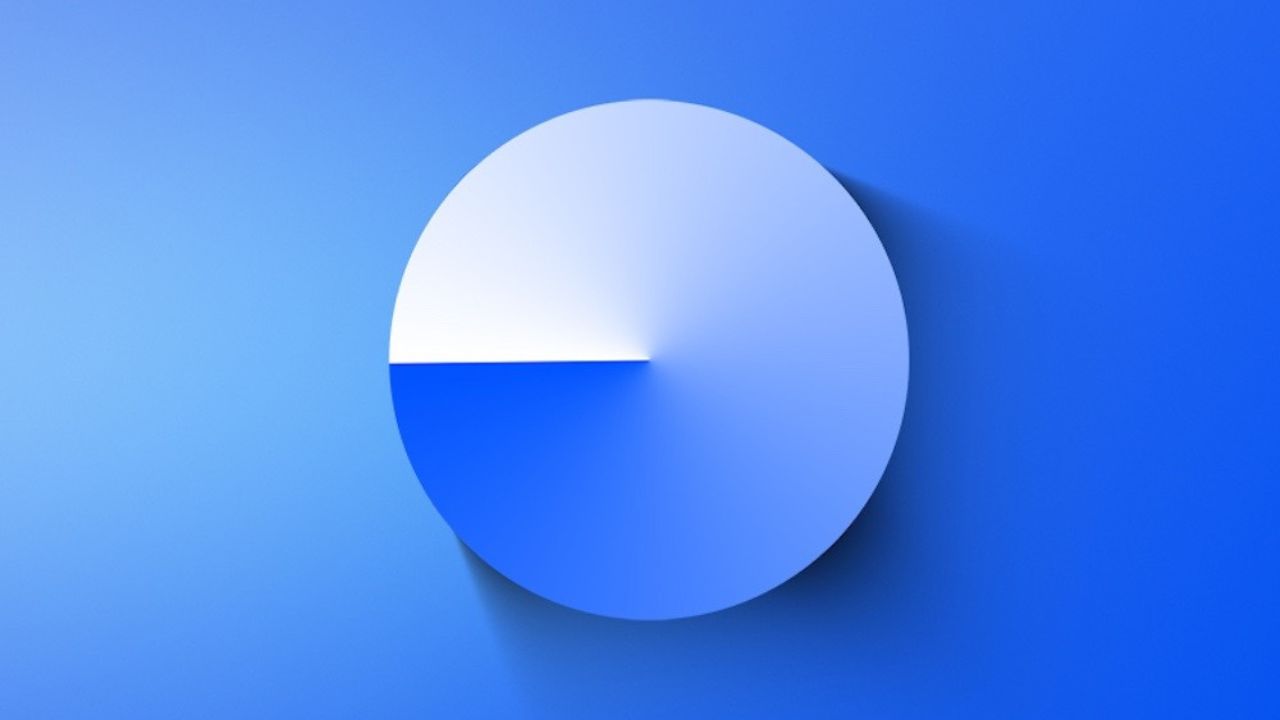

Data shared by the on-chain intelligence platform IntoTheBlock on X revealed that USDC is seeing accelerated growth in market cap compared to its rivals like Tether (USDT), Dai (DAI), and TrueUSD (TUSD).

The MiCA-Compliant Stablecoin

Although January has yet to end, the market cap of USDC has increased by 18%. Data from CoinMarketCap shows the stablecoin’s market cap sitting above $52.8 billion after months of steady growth.

IntoTheBlock said the growth in USDC’s market cap is likely driven by the cryptocurrency being the only stablecoin compliant with Europe’s Markets in Crypto-Assets Regulation (MiCA). On the other hand, other stablecoins, like the leading USDT, have been facing headwinds and challenges.

MiCA came into effect for crypto-asset service providers on December 30, 2024, and since then, related entities have been tailoring their products and services to comply with the new regulations.

Some exchanges have had to delist cryptocurrencies that do not comply with the requirements of the MiCA framework. One such is Coinbase, which announced in late 2024 that it would be delisting USDT and other stablecoins that do not meet MiCA requirements from European platforms. Barely two days ago, another trading firm, Crypto.com, said it would no longer support USDT and nine other assets because they failed to meet MiCA requirements.

These exchanges have asked their European users to convert their assets into MiCA-compliant cryptocurrencies like USDC, and this has resulted in a surge in the asset’s market cap.

Multi-Chain Expansion

In addition to being the only MiCA-compliant stablecoin, USDC has recently expanded to several other networks. In September, Circle, the USDC issuer, launched the stablecoin on the Sui network and, less than a month later, on the decentralized finance lender Suilend. Following the latest integration of USDC on the Aptos network, the stablecoin is now available on over 16 chains, including Algorand, Avalanche, and Base.

Notably, USDC crossed $15 billion in daily traded volume on Base in late 2024, reflecting the digital asset’s accelerating use. USDC has also been recording increased use on Solana, with Circle minting five billion USDC on the network since the start of 2025.

Get Trending Crypto News as It Happens. Follow CoinTab News on X (Twitter) Now