The US spot Bitcoin ETF saw a $192 million net inflow on Thursday, its second positive flow in five days. Data from Sosovalue showed that the single-day inflow was its highest in two weeks after an underperforming period for the Bitcoin product.

The Thursday inflow saw Bitcoin post its highest single-day price increase since February 2022. The asset surged over 12% on June 8, closing above $62,000 on the day. Bitcoin’s impressive gains marked a market rebound and demonstrated its resilience after the asset dropped below $50,000 on August 5.

BlackRock Leads Inflow

Leading US Bitcoin ETF asset issuer by asset under management (AUM), BlackRock led proceedings, bringing in $157.6 million on Thursday. BlackRock last saw a single-day net outflow from its fund on May 1.

WisdomTree’s BTCW saw its largest one-day inflow yesterday, raking in a whopping $118.52 million. The asset manager has set a record inflow in two consecutive days, reporting $10.5 million on Wednesday before setting a new inflow high the day after.

Fidelity and Ark Invest’s 21 Shares saw a net inflow of $65.25 million and $32.79 million, respectively, while $3.38 million flowed into VanEck on Thursday.

Grayscale’s GBTC saw a net outflow of $182.94 million yesterday, its highest negative flow since May 1. Hashdex’s newly launched DEFI saw a net outflow of $2.03 million, while other funds saw zero flows on the day.

Since its launch in January, the US spot Bitcoin ETF has seen a cumulative net inflow of $17.43 billion and a total net asset of $54.31 billion. Thursday’s trading session saw a trading volume of $2.02 billion.

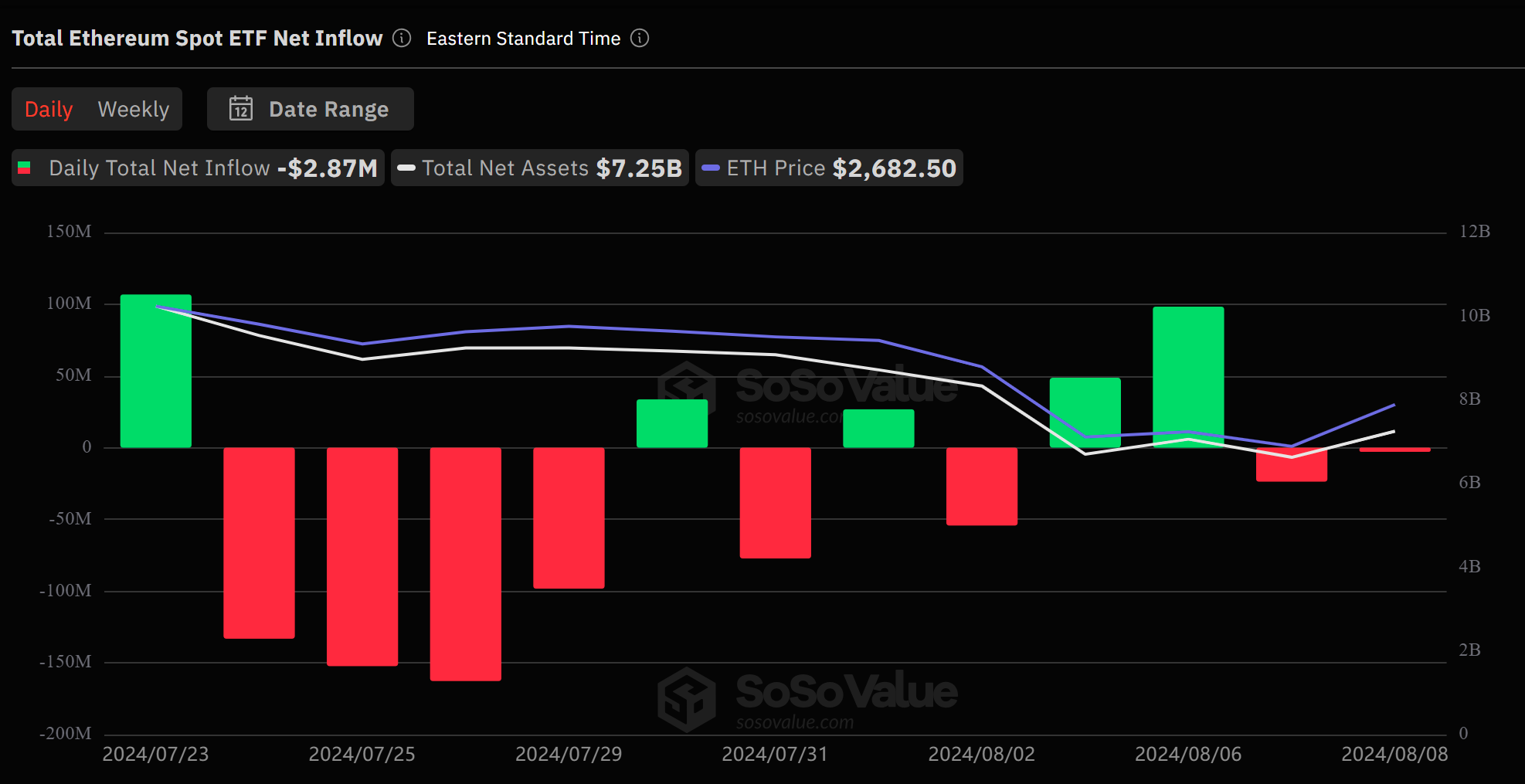

Ethereum ETFs See $2.87M Outflow

Bitcoin’s positive performance did not reflect on the Ethereum spot ETF, which saw a negative outflow of $2.87 million on Thursday.

The Grayscale Ethereum Trust (ETHE) saw its lowest outflow since its launch on Thursday, with a mere $19.83 million negative flow. Fidelity’s FETH also saw $2.58 million flow out of its fund on the day.

According to data from Sosovalue, BlackRock’s $11.74 million inflow, Grayscale Ethereum Mini Trust’s $5.02 million, and Bitwise’s $2.78 million inflow were not enough to keep the total flow positive on Thursday.

The cumulative net outflow of the Ethereum spot ETF stands at $390 million, with a total net asset of $7.35 billion.

Bitcoin traded at $60,707 at press time, while Ethereum exchanged hands for $2,631.