Ethereum ETFs provide traditional investors with a more convenient way to invest in the crypto market. With ETH ETFs, people can easily access Ether, the second-largest cryptocurrency by market capitalization. How so?

This article covers everything you need to know about Ethereum ETFs, including their advantages and investment risks. You will also learn the differences between ETH ETFs and Bitcoin ETFs and find answers to frequently asked questions (FAQs). At the end of this article, you will be better equipped to decide whether to buy Ether (ETH) directly or invest in Ethereum ETFs.

What are Ethereum ETFs?

Ethereum ETFs (exchange-traded funds) are financial instruments that allow users to invest in Ether (ETH), the native cryptocurrency of the Ethereum blockchain, without directly buying or holding it. They track Ether’s market performance and price movements, making it easier for users to invest in the crypto world without going through the rigor of trading or managing crypto assets by themselves.

The Ethereum network is home to not only Ether but various tokens and decentralized applications (dApps) managed by smart contracts. ETFs are an excellent way to transition to the cryptocurrency space through traditional finance (Tradfi). Users who want to invest in cryptocurrencies using traditional financial markets can buy Ethereum ETF shares on stock exchanges and gain access to the crypto market. It is easy to buy and sell ETH ETFs because they are traded like regular stocks. Investors can also bet on Ether’s price using ETH ETFs.

History of Ethereum ETFs

The history of Ethereum ETFs dates back to many years before its approval. Within 2018 and 2023, the SEC rejected about 20 applications for spot Bitcoin ETFs because they had a negative view of cryptocurrency-based ETFs. This, though, changed in January 2024 when the Commission approved the first 11 spot Bitcoin ETFs for trading. You can read more about spot Bitcoin ETFs in this detailed guide.

The ground-breaking development in the financial market was followed by yet another one shortly thereafter. It was Ethereum’s turn as the SEC approved nine spot Ethereum ETFs for listing and trading on SEC-regulated exchanges. These ETFs began trading in July 2024.

Types of Ethereum ETFs

There are two types of Ethereum ETFs; spot Ethereum ETFs and futures Ethereum ETFs.

Spot Ethereum ETFs

Spot, in this context, refers to real-time or live. Owing to this, spot Ethereum ETFs invest in Ether directly, giving investors direct exposure to its real-time or “spot” price movements.

To set up a spot ETH ETF, a financial institution known as an authorized participant (AP) needs to buy and hold a certain amount of Ether. A fund manager will then issue shares in that fund for investors to buy in a stock exchange.

Like Ether, spot Ethereum ETFs experience price fluctuations and predictability. The rise and fall of the underlying asset’s value also determines the value of spot ETFs. As such, when Ether’s price changes, spot Ethereum ETF prices also change.

Futures Ethereum ETFs

Unlike spot Ethereum ETFs, futures Ethereum ETFs do not hold the underlying asset directly. Instead, they track the price of futures contracts and use that to mimic Ether’s price movements.

An Ethereum futures contract is an agreement to buy or sell Ether at a specified price and at a later date. It allows investors to bet on Ether’s future price without trading the asset itself. The price of a futures contract may be higher or lower than Ether’s actual price, depending on whether the traders agree that Ether’s price will rise or fall. If more people expect the price to increase, the contract’s price will be higher than Ether’s spot price and vice versa.

Best ETH ETFs

When deliberating on which Ethereum ETF to invest in, you should consider factors such as their price, assets under management (AUM), management fees, and trading volume. Here is a list of some of the best ETH ETFs, ticker symbols, and AUM:

- Grayscale Ethereum Trust ETF (ETHE): At the time of writing, ETHE has $4.68 billion in assets under management. It tracks Ether’s spot price.

- iShares Ethereum Trust ETF (ETHA): ETHA is a spot ETH ETF that currently has $1.76 billion AUM.

- ProShares Ether ETF (EETH): A futures ETH ETF. Its current AUM is $19.81 million.

- Bitwise Ethereum ETF (ETHW): ETHW is a spot Ethereum ETF with $349.40 million in AUM at the time of this writing.

- Franklin Ethereum Trust (EZET): Currently trading with $38.51 million assets under management. It tracks Ether’s spot price.

- VanEck Ethereum ETF (ETHV): At the time of writing, ETHV is trading with $109.06 million AUM. ETHV is a spot ETH ETF.

- Ark 21Shares Active Ethereum Futures Strategy ETF (ARKZ): This is a futures ETH ETF with a current AUM of $6.79 million.

- Invesco Galaxy Ethereum ETF (QETH): QETH is a spot Ethereum ETF that is currently trading with $31.10 million assets under management.

- 21Shares Core Ethereum ETF (CETH): This ETF tracks Ether’s spot price, and its AUM is $26.56 million at the time of writing. The fund’s entire management fee has been waived till January 2025 or until assets reach $500, whichever happens first.

- Bitwise Ethereum Strategy (AETH): AETH is a futures ETH ETF. At the time of writing, its AUM is $4.7 million.

Differences Between Ether and ETH ETFs

- Design: Ether is a cryptocurrency built on a decentralized blockchain, Ethereum. ETH ETFs are exchange-traded funds designed to track Ether’s price movements.

- Underlying Asset: Ether investors hold Ether itself while ETH ETFs investors buy shares of the funds. The funds may either hold Ether or derivatives tied to the asset.

- Trading Venue: Ether is traded on centralized cryptocurrency exchanges (CEXs) and decentralized cryptocurrency exchanges (DEXs), while ETH ETFs are traded on stock exchanges.

- Trading Hours: Ether is traded 24/7, while Ethereum ETFs are traded only during stock exchange hours. The trading hour difference may lead to price gaps between ETH ETFs and Ether during non-market hours.

- Management Fees: Ethereum ETFs incur management fees while Ether incurs none. Instead, ETH investors are required to pay transaction or “gas” fees when performing a transaction on the blockchain.

- Staking Rewards: Ether investors earn rewards when they stake their assets, while ETH ETFs do not.

- Minimum Investment: Investors can buy any fraction of Ether they want or can afford, no matter how little it may seem. However, to invest in Ethereum ETFs, you can only buy a minimum of one share.

Investing in ETH Directly vs. ETH ETFs

Both Ether (ETH) and Ethereum ETFs are investment options that provide access to the Ethereum market. Investing in ETH involves buying some units of the crypto asset using a fiat currency or a stablecoin and storing it in a crypto wallet. You can also decide to trade your assets or hold them for a long time. Ethereum ETFs, on the other hand, allow individuals who cannot, or do not want to, invest in Ether directly to still gain access to the market.

In simpler words, if you want to buy, hold, or trade Ether directly, invest in Ether. If you want to invest in Ether indirectly, buy ETH ETF shares.

Ethereum ETFs Over Ether?

Investing in Ethereum ETFs allows individuals to easily gain exposure to the crypto space without opening a crypto wallet or using a cryptocurrency exchange.

Due to its decentralized nature, the Ethereum network has no governing authority. As such, it is largely unregulated. Investors who want to feel a sense of security may opt for Ethereum ETFs because the stock exchange market is regulated by laws.

Traditional investors may see buying Ether and storing their assets as complex procedures compared to buying ETH ETF shares.

Ether holders are solely responsible for the safety and management of their assets. In contrast, Ethereum ETF issuers take care of these processes on behalf of their investors for a fee called management fee.

These reasons point to why an investor might choose to invest in Ethereum ETFs instead of owning Ether directly. Let us now consider the other way around.

Owning Ether (ETH) Over ETH ETFs?

Although the reasons above are valid, some investors may choose Ether over Ethereum ETFs. Why?

While ETH ETFs are a convenient way of accessing the Ethereum market without necessarily investing in Ether, it is worth noting that ETH ETFs do not provide investors with ownership of the crypto asset. In other words, if you buy a share of a spot Ethereum ETF, you do not own a real unit of Ether. You simply invested in an asset that is backed by Ether. On the other hand, buying ETH on a cryptocurrency exchange offers investors direct ownership of the digital asset.

Secondly, ether can be transferred from one digital wallet to another and traded using centralized or decentralized exchanges. Ethereum ETF investors can sell their shares for fiat currencies but cannot transfer them to crypto wallets.

In addition, individuals who buy and own Ether (ETH) can earn passive income or rewards in the form of extra coins when they stake a certain amount of their assets. On the other hand, Ethereum ETF investors do not earn staking rewards.

Moreover, unlike Ethereum ETFs, which only trade during stock exchange hours, Ether trades 24/7. Hence, ETH investors can trade their coins at any hour of the day.

Investing in Ether directly may be more cost-effective, as ETH ETF issuers charge a management fee between 0.15% and 2.5%.

Differences Between Spot ETFs and Futures ETFs

While both spot ETFs and futures ETFs help investors gain exposure to the underlying asset’s price movements, there are some key differences between the two types of crypto ETFs.

- Spot ETFs invest in actual crypto assets, while futures ETFs invest in crypto futures contracts. Spot ETF users own a certain amount of the fund’s cryptocurrency holdings, while futures ETF users do not.

- Spot ETFs track the underlying cryptocurrency’s real-time price as closely as possible, while futures ETFs track the price of the crypto futures contracts.

- Spot ETFs provide more direct access to the crypto’s price than futures ETFs.

- Due to their nature of holding actual crypto assets, spot ETFs are subject to custody risks. For instance, a spot ETF provider can lose their private keys, thereby losing their crypto holdings. Future ETFs, on the other hand, do not face such risks.

- Futures ETFs incur more management fees compared to spot ETFs because futures contracts are traded actively.

- Spot ETFs provide a more straightforward and transparent exposure to the underlying cryptocurrency than futures ETFs.

Ethereum ETFs vs. Bitcoin ETFs

Ethereum ETFs and Bitcoin ETFs work similarly because they both allow investors to gain exposure to the price performance of the underlying assets without investing in them directly. However, they still differ in some ways. As their names imply, Bitcoin ETFs track Bitcoin’s price while Ethereum ETFs focus on Ether. Also, Bitcoin ETFs were launched months before Ethereum ETFs.

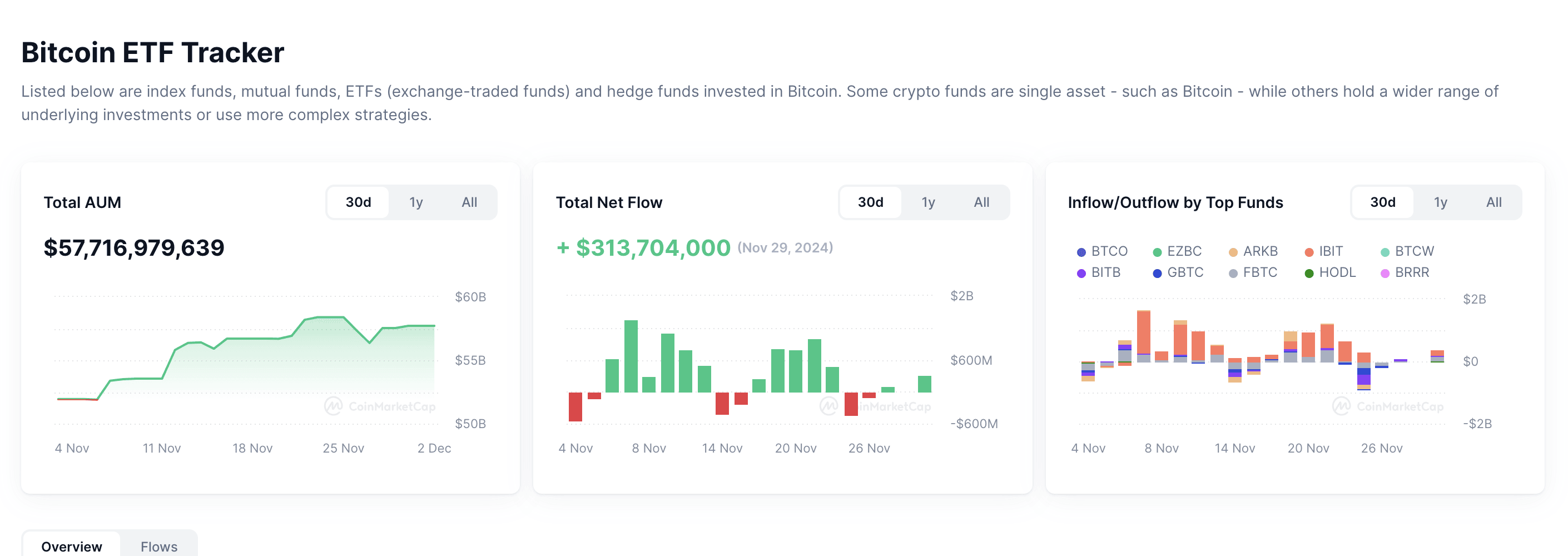

With Bitcoin being the largest cryptocurrency by market capitalization, the introduction of spot Bitcoin ETFs into the traditional financial market scene was a game-changer. The first of its kind, it allowed individuals to invest in bitcoin without worrying about the safety of their coins, digital wallets and private keys. Since the approval, Bitcoin ETFs have been traded in countries with growing markets around the world.

Reports show that the Bitcoin ETFs’ market performance has been impressive since their launch. For instance, the first day of trading yielded over $4.6 billion in trading volume. Ethereum ETFs, on the other hand, did not see the same immediate demand. On the first day of trading, ETH ETFs recorded a trading volume of about $1 billion, a quarter of what spot BTC ETFs yielded on their first trading day.

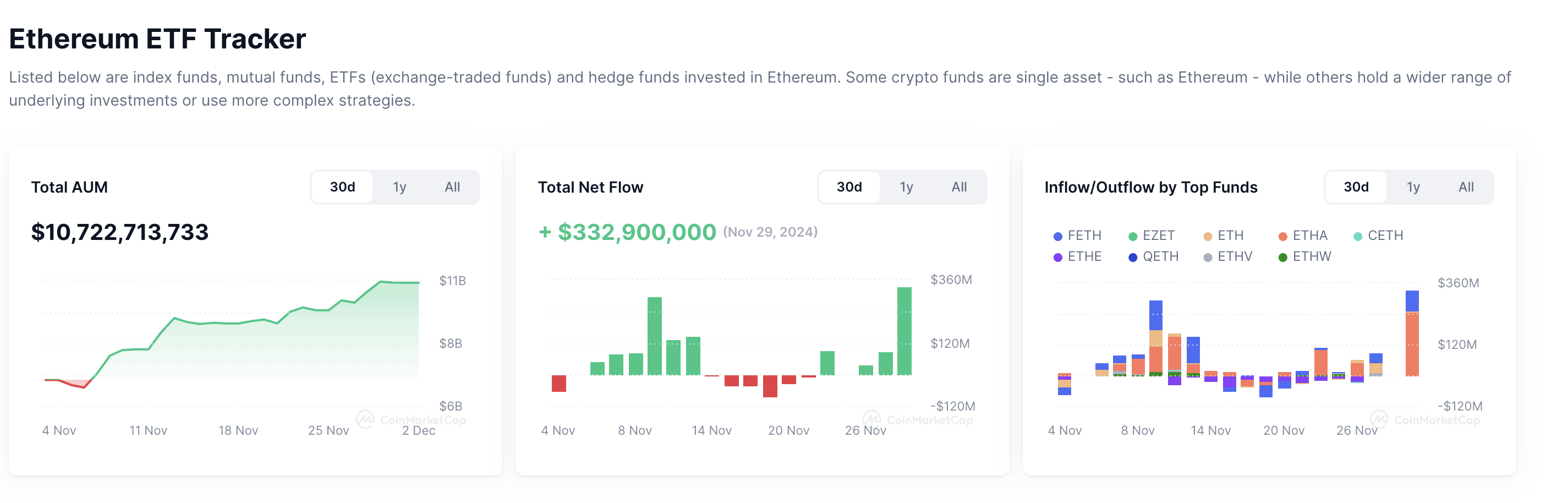

As of November 2024, Bitcoin ETFs hold more than $57 billion in total assets under management (AUM) and a total net flow of over $796 million. Ethereum ETFs’ total AUM is only over $10 billion, and their total net flow is $332 million. This gap is huge.

However, the Ethereum ETF market is growing. Considering that the financial market is generally unpredictable, the fact that ETH trades at a much lower price compared to Bitcoin may signal that more traditional investors may key into Ethereum ETFs in the future. The unpredictable nature of the market may also mean that more cryptocurrencies may get approval for their ETFs in the future.

ETH ETFs’ Potential Impact on Ethereum

- Adoption Rate: The approval of ETH ETFs can signal that cryptocurrencies are becoming more acceptable, making it easier for investors who were earlier scared of entering the emerging industry to get involved. This could make Ether a more attractive investment option and increase its mainstream adoption in the long run.

- Trading Activity: An increased adoption rate can, in turn, lead to a rise in trading activity in the Ethereum market.

- Price: Increased demand for Ethereum ETFs can lead to an increased demand for Ether and, in turn, a rise in its price.

- Liquidity: ETH ETFs could increase the liquidity of the Ether market when its trading volume rises.

Advantages of Ethereum ETFs

- Ethereum ETFs provide traditional investors with direct exposure to Ethereum.

- Ethereum ETFs allow investors to diversify their traditional investment portfolios.

- Investors can access their ETH ETF shares from their brokerage accounts on stock exchanges.

- Ethereum ETFs save users the stress of complex crypto processes such as storing their digital assets or using a cryptocurrency exchange.

- Users benefit from regulations that guide traditional financial markets when they invest in ETH ETFs.

- Ethereum ETFs offer liquidity and easy access for investors to buy and sell their shares in the stock market.

Risks of Investing in Ether ETFs

As with every investment, it is important to understand the risks associated with Ether ETFs. This will help investors to make well-informed decisions when considering them. Some of the risks include:

- Tracking Error: Although spot Ethereum ETFs are designed to track Ether’s real-time prices as closely as possible, there might be tracking errors, causing a price difference.

- Price Volatility: Ether, like other cryptocurrencies, is a highly volatile asset. It regularly experiences price fluctuations, which can lead to significant losses for spot Ethereum ETF investors as the price movement of their shares is tied to that of the underlying asset.

- Regulatory Changes: Since Ethereum ETFs are regulated by laws, changes in these laws could affect the functionality of the funds.

- Dependency on Stock Exchanges: ETH ETFs can only be traded on stock exchanges. When issues arise within these trading platforms, they may affect the shares.

How to Buy an Ethereum ETF

- Choose a Trading Platform: After thorough research, choose a reputable brokerage that offers Ethereum ETFs. For example, you may choose Robinhood or eToro.

- Open an Account: If you are a new investor, you need to open an account with your selected trading platform and complete all necessary verification processes. If you already have an account, skip this step.

- Fund your Account: Deposit some funds into your account. You can fund your account with any amount of money, depending on how much you intend to invest.

- Look up Ethereum ETFs: Using their ticker symbols, search Ethereum ETFs on the platform.

- Make a Purchase: Place an order indicating how many ETH ETF shares you want to buy. Confirm your order, thereafter.

- Keep an Eye on your Investment: Monitoring your investment is just as important as buying your shares. It will help you stay updated on how well your investment is doing.

Frequently Asked Questions

- How Many Ethereum ETFs Are There?

At the time of writing, there are 25 Ethereum ETFs trading in some countries across the globe, including the United States, Canada, Brazil, Switzerland, and Germany. In the U.S., there are nine spot ETH ETFs currently trading.

- Are Ethereum ETFs legal?

Yes, Ethereum ETFs are legal. The US Securities and Exchange Commission (SEC) has approved Ethereum ETFs for listing and trading on stock exchanges.

- Can I Sell my ETH ETFs?

Yes, you can sell your Ethereum ETFs through your brokerage account. You can also buy and sell your shares as many times as you want in one day within trading hours. Simply log in to your brokerage account and place an order.

- Where Can I Buy ETH ETFs?

You can buy Ethereum ETFs on traditional platforms that sell financial assets like stocks and bonds. They are available on stock exchanges such as the New York Stock Exchanges (NYSE) and the National Association of Security Dealers Automated Quotations (NASDAQ).

- How Much is an Ethereum ETF?

The price of Ethereum ETFs varies because it is set by the market. Before making an investment decision, consider the prices of each of them and pick the one that suits your investment goals.

Summary

This guide contains everything you need to know about Ethereum ETFs and how they work. Here is a summary to aid your memory.

Ethereum ETFs are exchange-traded funds that track Ethereum’s market performance as closely as possible. They are traded on stock exchanges, making it easier for traditional investors to buy and sell the shares. Although BTC ETFs and ETH ETFs work similarly, they differ because of their underlying assets.

There are two types of Ethereum ETFs. Spot ETH ETFs hold Ether directly and track its real-time price while futures ETH ETFs invest in Ethereum futures. The decision to invest in either of these two depends on your investment goals and the results of careful research. Amongst other factors, your research should include the price, assets under management, management fee, and trading volume.

ETH ETFs’ impact on the Ethereum market in the long run may include increased adoption, price increase, improved liquidity, and high trading activity. While Ethereum ETFs allow traditional investors to gain exposure to the crypto market and diversify their portfolio without investing in Ether directly, they are not without risks. Some of these risks include tracking error, price volatility, regulatory changes, and others.