XTZ is undergoing one of its biggest single-day surges. The massive increase comes amidst growing bearish sentiment across the crypto market.

However, such price hikes are not isolated, as other altcoins are up by a considerable margin. One such is THETA. It started the day at $1.43 and shot up as momentum picked up. It broke its previous seven-day high at $1.65 and peaked at $1.85. Currently exchanging at $1.75, it is up by over 22%.

ALGO had a similar climb. It started at $0.18 and had a short burst as buying volume picked up. It broke its previous six-month high at $0.22 and peaked at $0.23. Currently trading at $0.21, it may close with gains exceeding 17%.

Following the rounds of adoptions from several institutions last week, Bitcoin in on the news as Poland may be another adopter if it elects the crypto-friendly Presidential candidate.

Nonetheless, Microstrategy went shopping again. It added over $4.6 billion worth of the apex coin. The latest purchase came barely a week after it bought 27,200 BTC. Other institutions are also hungry for more Bitcoin. Marathon Digital recently proposed $700 million in convertible notes to acquire more BTC.

The global cryptocurrency market cap has increased by over 2% in the last 24 hours. It is off to a good start, and this is how some assets may perform this week.

Top Four Cryptocurrencies

BTC/USD

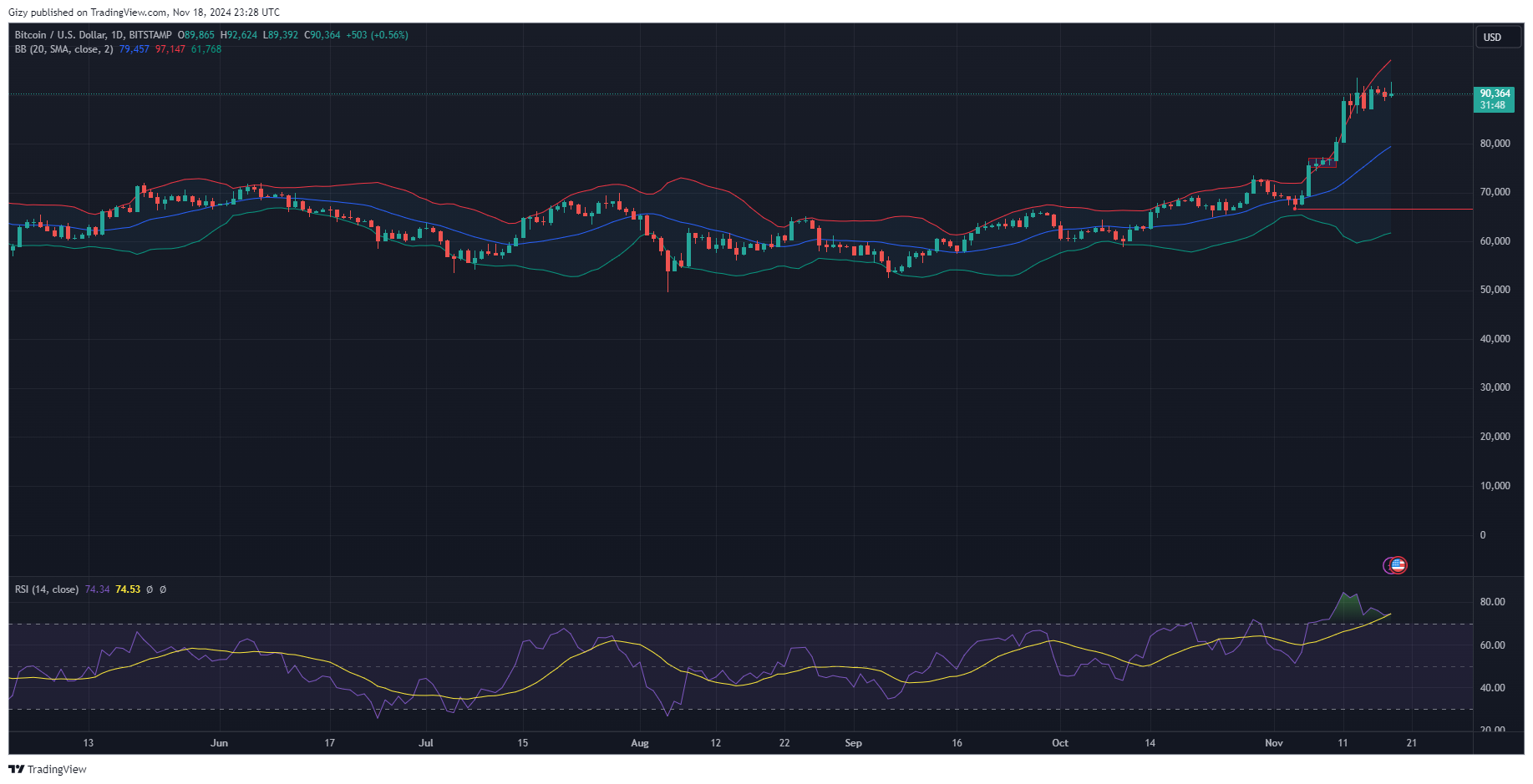

Bitcoin resumed fresh attempts above $90k. Following its peak on Nov. 13, it has struggled to continue its surge. It lost over 3% during the next intraday session but recovered the next day. However, it retraced at $92k, spending Saturday and Sunday below the mark.

BTC recently broke above the highlighted barrier, edging closer to its all-time high. However, it faced massive rejections at $92,600 and exchanges at $91,220 at the time of writing. The apex coin remains locked in the pattern of failing to close above $92k.

The constant failure to decisively flip this critical level may mean that the bulls are accumulating or the bears are gearing up for a massive decline. The apex coin may be experiencing the same trend it had between $75k and $77k. If that is the case, it may shoot up above $95k this week.

However, indicators like the moving average convergence divergence and the relative strength index print negative signals. The 12-day EMA’s uptrend is slowing down and may halt its advances if selling pressure mounts. RSI says the cryptocurrency is currently overbought.

Bitcoin may retest $87k if trading conditions worsen. A flip may send it as low as $84k.

PEPE/USD

PEPE has since grappled with massive price declines following its return to a critical high on Nov. 14. It retested the $0.000026 but faced massive rejections. Another attempt at the barrier the next failed, and the memecoin has not attempted the critical mark since.

A red candle at the end of the current session will mark its third consecutive. The bulls tried resuming the uptrend and were successful at the start of the day, as the asset peaked at $0.000022. However, it retraced as it lost momentum. It is currently exchanging 3% lower than its opening price.

The relative strength index peaked at 88 a few days ago due to the massive increase in buying pressure. It showed the asset was overbought at the time and is currently the same at the time of writing. The metric is at 73. The decline may continue until it drops below 70.

Such a decline may cause the memecoin to lose $0.000020 in support and sink as low as $0.000018 before rebounding.

MACD’s 12-day EMA uptrend is slowing down and may halt its advances if selling pressure mounts. A bearish convergence may be underway. Nonetheless, the asset may surge, breaking above $0.000026 based on bullish fundamentals.

HBAR/USD

Hedara is a contender for top gainer over the last 24 hours. It started the day at $0.089 and surged after a brief decline. It revisited a mark it hasn’t since June, continuing until it eliminated a 0 from its price. It broke above $0.10 and peaked at $0.15. It is trading at $0.13 following the massive rejections at the peak.

The latest increase comes after Saturday’s 25% increase. Currently up by over 47%, the bulls grapple with traders taking profit to keep the price above its current mark. The accumulation and distribution chart suggests a chance they may achieve as there is currently more demand than supply. MACD is also on the rise.

However, the relative strength index prints sell signals at the time of writing. It is at 89 at the time of writing, following its breakout above 70 a few days ago. The current readings show that the asset is overbought and due for corrections. It is trading above the upper Bollinger band.

HBAR may experience massive declines in the coming days as profit-taking worsens. Previous price movements show significant demand concentration at $0.10. If the bulls fail to defend the barrier, it risks further decline. Nonetheless, the uptrend may continue, with eyes set on the $0.20 barrier.

XTZ/USD

Tezos may close the current intraday session as the top gainer. It started trading at $0.79 and continued upward after a slight decline. XTZ reclaimed the previous week’s high at $0.90 and reclaimed its $1 status shortly after. It returned to April’s high, breaking $1.20 and peaking at $1.37. Although it is currently seeing massive declines, it maintains trading above $1.20.

Currently up by 57%, it’s closing with one of its best performances in more than a year. However, some indicator prints sell signals at the time of writing. RSI resurfaced above 70 for the second time over the last seven days. The metric is at 80, meaning the asset is overbought and due for a massive correction.

The Bollinger Band supports the previous claim. XTZ broke out of the upper band a few hours ago and may end the day above it. The metric is currently at $0.97, increasing the chances of a possible decline to this crucial level.

XTZ may experience massive declines in the coming days as profit-taking worsens. Previous price movements show significant demand concentration at $1. If the bulls fail to defend the barrier, it risks further decline. Nonetheless, the uptrend may continue, with eyes set on the $1.60 barrier.