HYPE is currently down by over 2% from its opening price. Although it saw a slight increase earlier, the upward momentum quickly waned.

Nonetheless, the 1-hour chart shows that HYPE traded even lower a few hours ago but rebounded. It has since faced slight selling pressure, slowing its recovery.

The altcoin is edging closer to posting significant losses on Monday. The global cryptocurrency market cap also slipped lower earlier, but may end the day with a doji.

Following four weeks of consistent decline, the crypto market will look to pare back some losses in the coming days. A closer look at the 1-week chart shows selling slowed last week, and the market closed down by almost 2%.

The previous week’s performance suggests the next six days will be more bullish, and the sector may post its first green in more than a month.

However, a closer look at the chart shows that in weeks of significant losses, the market registered notable losses on Monday. With the red candle already in view, it remains to be seen if the trend will repeat.

With the market off to a bad start, several assets have flipped bearish. Let’s see what indicators predict will happen in the coming six days.

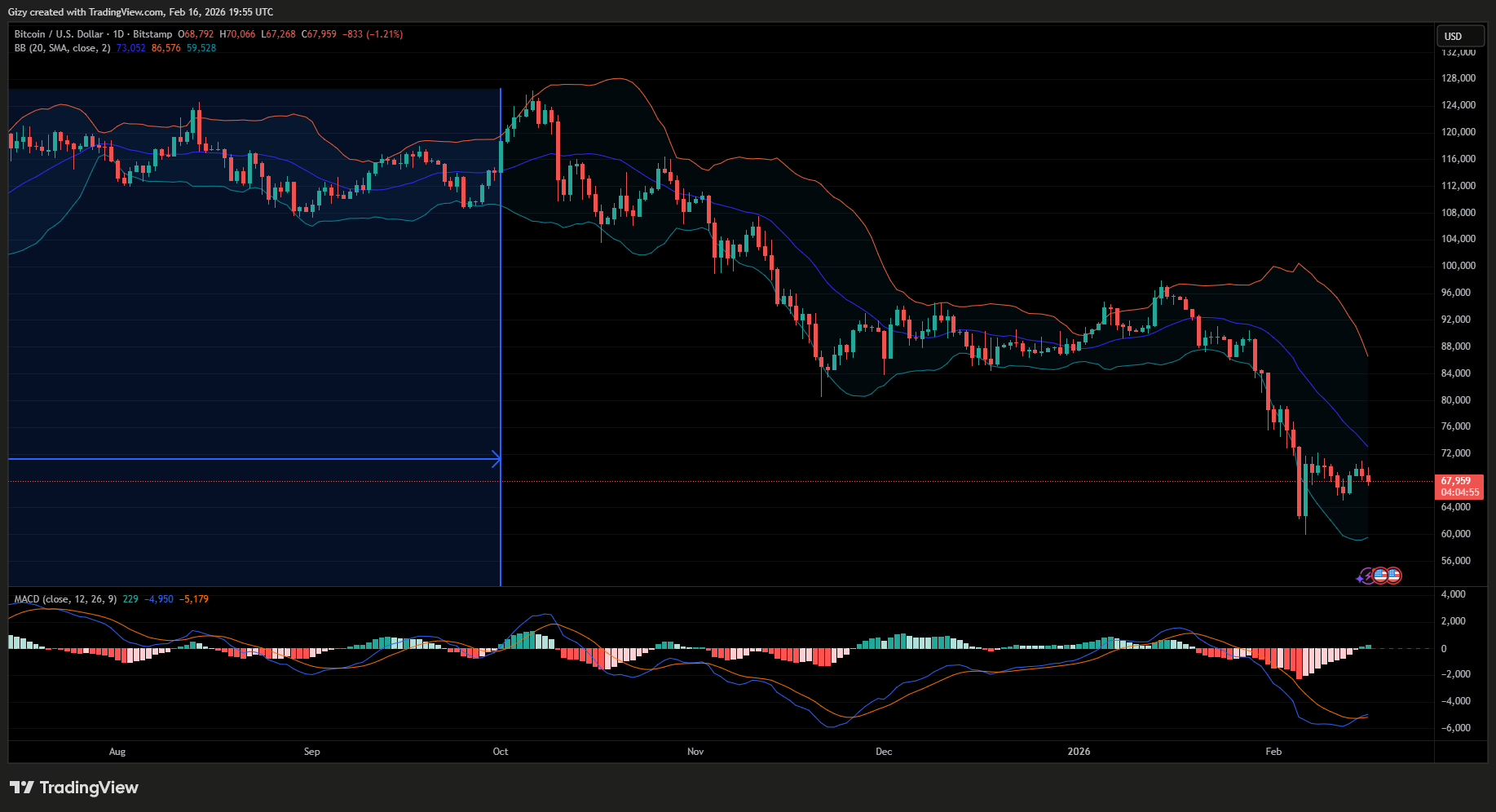

BTC/USD

Bitcoin is trading slightly lower than its opening price. The 1-day chart shows it recently retraced below $68k a few hours ago, but is seeing slight buying pressure.

Nonetheless, a closer look at the chart shows that the coin failed to decisively break above $70k again. The latest attempt will be the third failed attempt at the mark in the last seven days. It’s more concerning considering that the same trend played out last week.

Following the failed attempt at the barrier last Monday, the asset retraced the next day. It printed a doji at the end of the day after rebounding from a prior decline.

Interestingly, the apex coin is edging closer to posting a doji. If it repeats the same movements as the previous week, it will retrace over the next three days, sinking $66k again.

However, the moving average convergence divergence suggests an increased chance of significant upside movement this week. It displayed a positive crossover last week, which may signal further increases. If this plays out, BTC will likely flip $70k.

The bollinger bands move the target higher as the apex coin currently trades closer to the middle band. It will move to flip the SMA, effectively crossing $72k.

HYPE/USD

HYPE recently retraced to a low of $29 a few hours ago, but it has since rebounded and is edging closer to ending the day with notable gains. Since rebounding, the bulls will look to continue the uptick in the coming days.

A closer look at the 1-day chart shows the asset posted notable gains last week. However, it failed to erase the losses it incurred at the start of the session. If the bulls maintain the current momentum, the altcoin will retest $34 in the coming days.

However, indicators suggest that further uptrend is less likely. For example, HYPE is currently trading below bollinger’s middle band. It is worth noting that it broke out of the indicator a few weeks ago and recently fell below the SMA.

It is yet to retest the lower band since it began its decline. The retracement to this level may happen within the next six days. In summary, Hyperliquid may retest $28.5 in the coming days.

ZEC/USD

Zcash ended the previous week with massive gains, surging by over 24%. It registered its first green after six weeks of consistent decline. However, it failed to erase the losses it had two weeks ago.

Nonetheless, it ended the session on a bearish note. Following its 21% surge on Saturday, the asset shed almost 8% the next day. The 1-day chart shows that it has been in decline. Although it saw a notable increase a few hours ago, it lost momentum and retraced.

The bollinger bands suggest that the asset will resume its uptrend in the coming days. It broke above the middle band on Saturday and registered its first candle above it the next day. The last time this happened, the SMA was a support, and the asset surged higher a few days later.

A repeat of this trend will see ZEC drop to $270, then surge to $330 afterward.

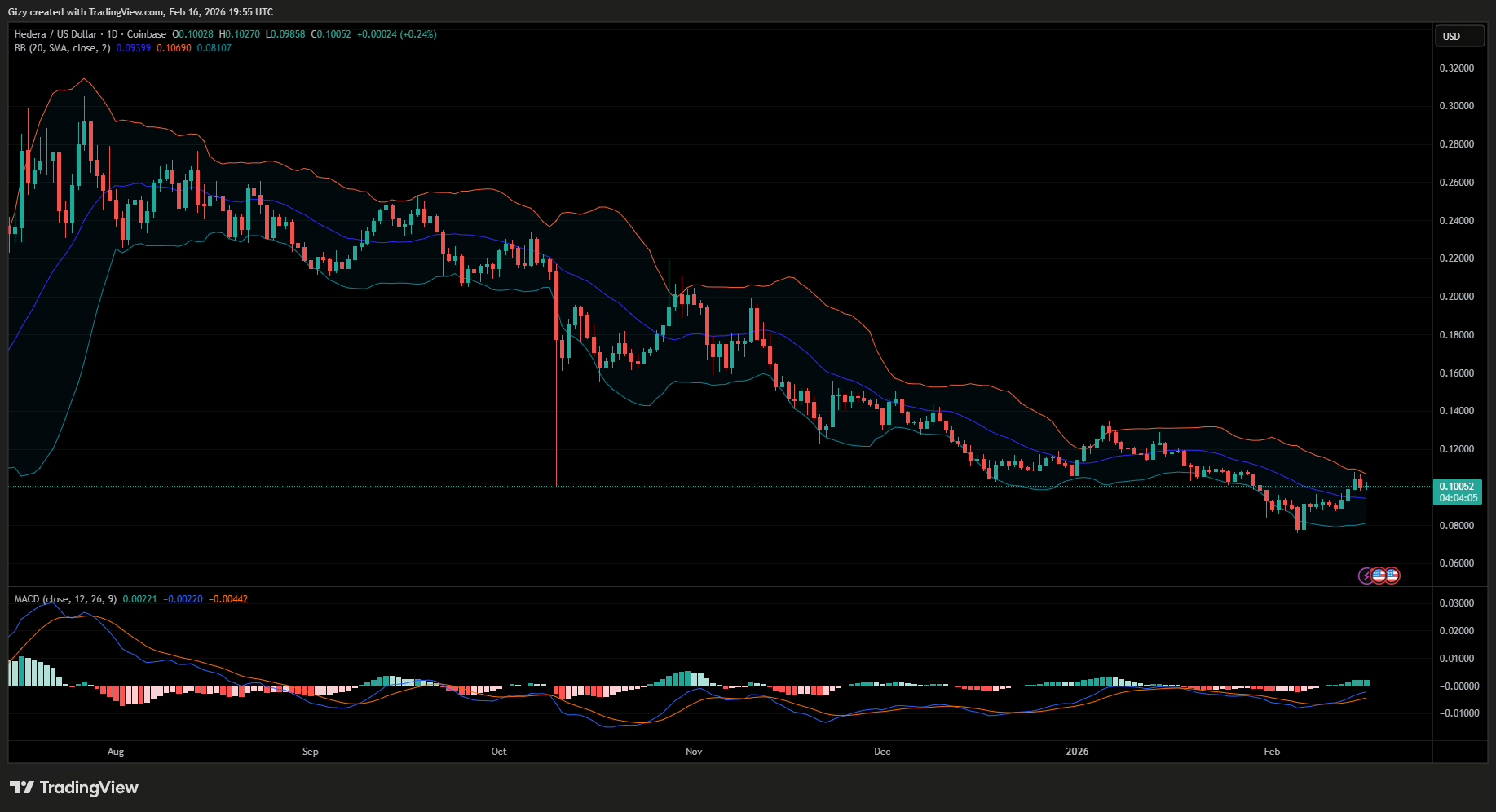

HBAR/USD

Hedera recently rebounded from a slight decline. It has since flipped green on the 1-day chart and may end the day with notable gains.

It may be gearing up for further increases in the coming days following its significant increase last week. It ended the session up by almost 10%, continuing the previous week’s uptrend.

The moving average convergence supports predictions of a further uptrend. For example, the moving average convergence divergence had a positive crossover last week. At the time of writing, the 12- and 26-EMA lines maintain their upward trend.

However, the bollinger bands suggest that the price uptrend may end this week. A closer look at the chart shows that HBAR came close to testing the upper band on Saturday but failed. The retest may happen within the next six days. It would mean the altcoin would edge closer to $0.11 but then retrace afterward.

CAKE/USD

Pancakeswap ended the previous week with slight losses, retracing to a low of $1.23. It saw its biggest decline on Sunday, shedding almost 4%.

Like HYPE, CAKE retraced to a notable low a few hours ago but is currently rising. It’s edging closer to ending the day up by over 2%. It would mark a strong start to the week and may spell further increases for the asset in the coming days.

The MACD showed a bullish divergence last week, further supporting predictions of additional hikes in the next 6 days. Additionally, the bollinger band points to a possible surge to $1.40 if the bulls sustain the current momentum.

Get Trending Crypto News as It Happens. Follow CoinTab News on X (Twitter) Now