CAKE made the rounds last week with its massive surges. The token gained a whopping 60%, crushing its three-month high.

Pancakeswap received a boost from its latest service expansion to Arbitrum and Base. Both networks now use a feature most DEXs don’t have but is present in the Binance chain ecosystem. The newest expansion saw trading increase in the DEX, resulting in higher revenue and price surges.

The crypto market saw a notable recovery last week as several cryptocurrencies halted their downtrends. Assets like Sonic and LDO led the gains, increasing by 41% and 20%, respectively. OM follows closely behind, with gains exceeding 20%.

However, their price improvement failed to see the global cryptocurrency cap hit $3.30 trillion. Several coins in the top 10 remained stagnant or saw further price declines. Solana grappled with notable selling pressure during this period, losing over 3%.

The general sentiment across the crypto market remains bearish as the fear and greed index remains below 40, showing notable fear. Fundamentals are doing nothing to quell the bearish trend. News of Donald Trump continuing his trade war made the rounds a few days ago, resulting in further declines.

Investors are yet to form an opinion about price actions this week. Let’s see how some assets may perform.

Top Five Cryptocurrencies

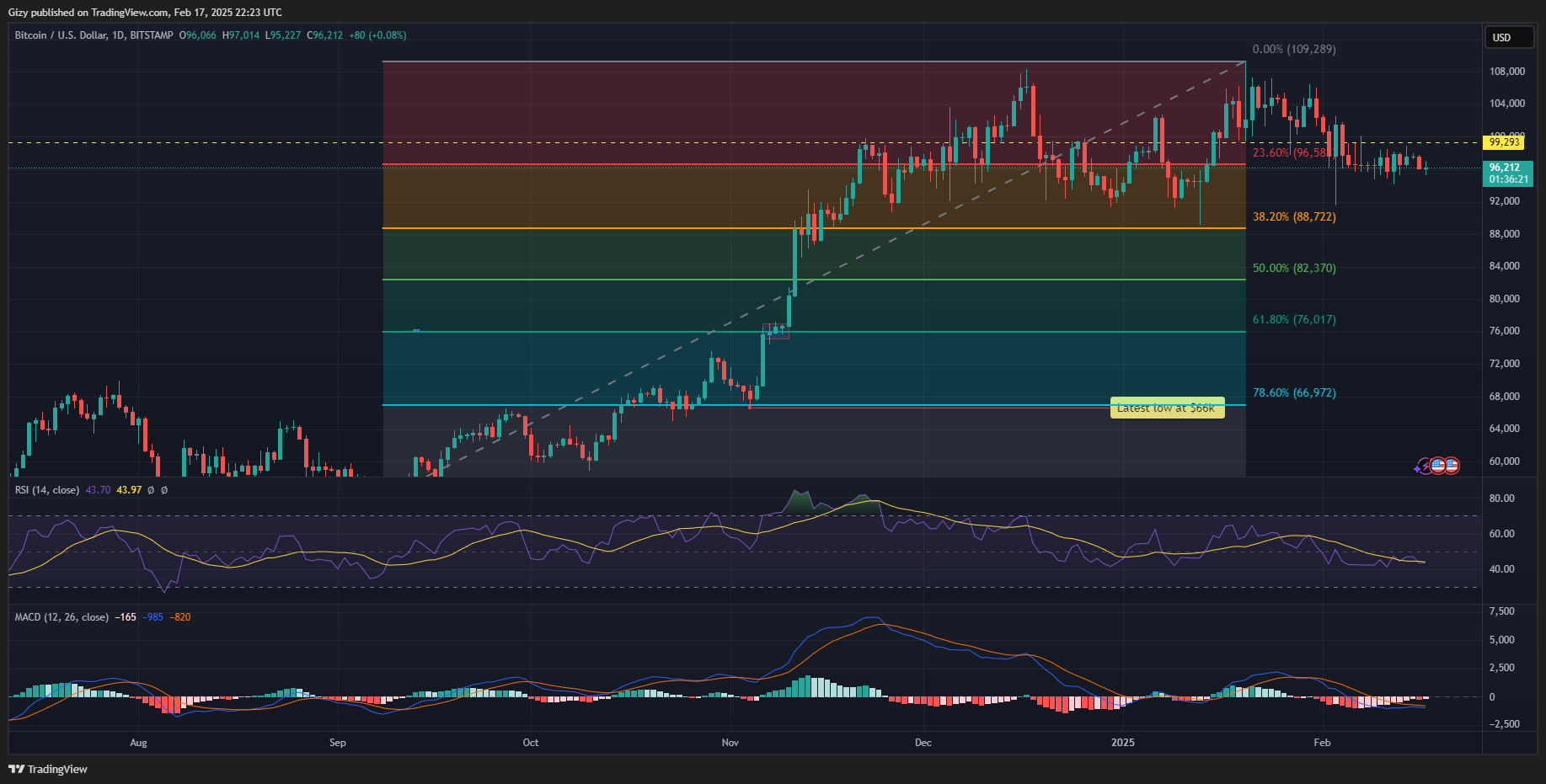

BTC/USD

Bitcoin printed a doji last week. It recorded small volatility but failed to break out of its rangebound movement.

The coin attempted the $99k resistance at the start of the previous week but failed. It slipped lower on Wednesday, hitting a low of $94k due to news of a higher-than-expected CPI, which resulted in notable declines. Nonetheless, it rebounded and attempted the highlighted mark.

BTC continued the back and forth until the week ended. It trades below $99k at the time of writing, indicating that the trend is ongoing. Nonetheless, the apex coin prints a doji as it recovers from a slight correction on Sunday.

Indicators are silent as to the next price actions. The moving average convergence divergence shows the gap between the 12-day EMA and the 26-day EMA remaining the same. RSI sheds no ray of hope as selling pressure remains constant.

Nonetheless, previous price movements suggest that the apex coin may remain within this price trend for an extended period as more investors show weaker buying pressure and the bears are getting exhausted.

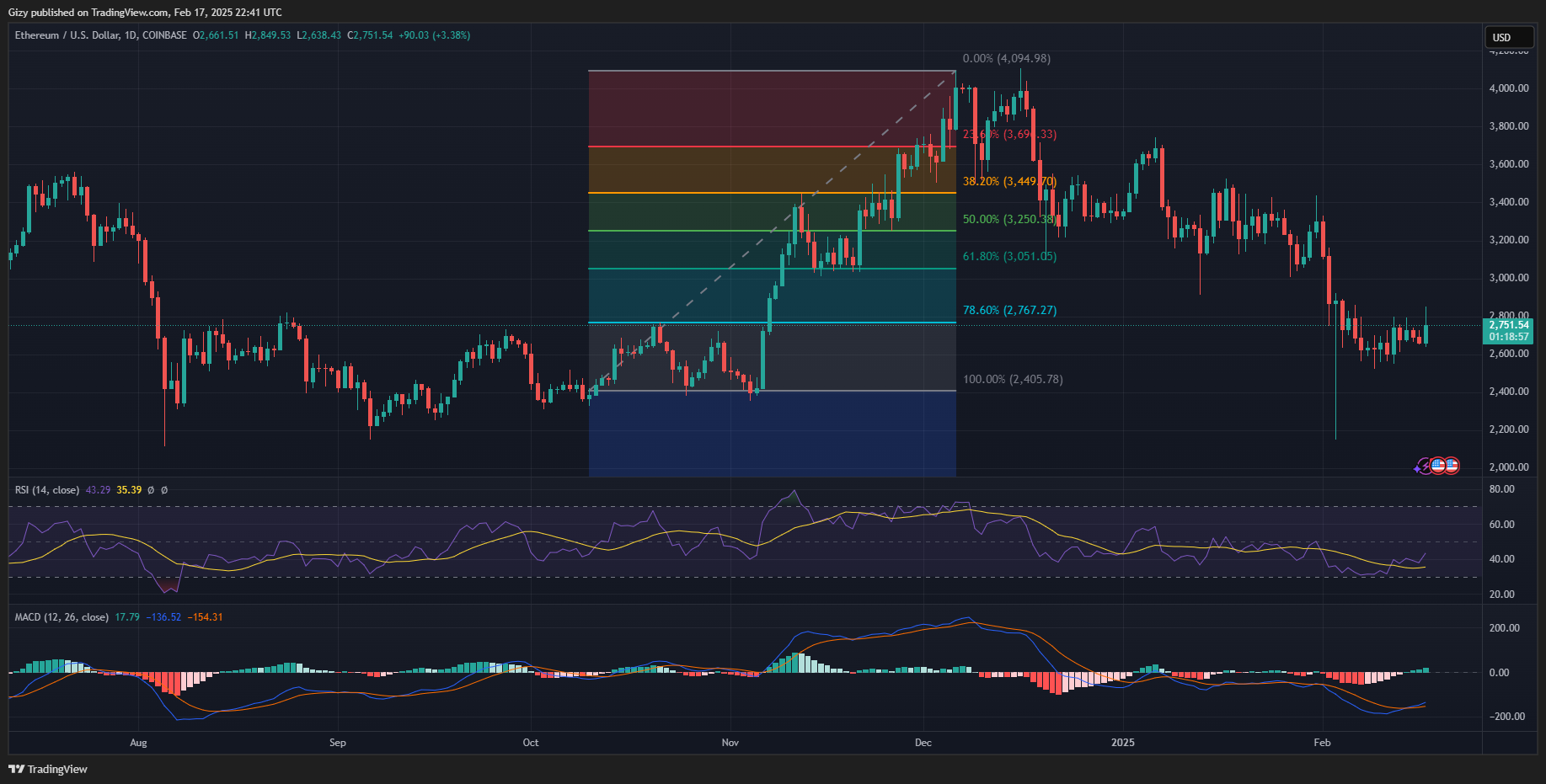

ETH/USD

Ethereum is on the verge of another breakout. Its price action over the last 24 hours suggests massive buying actions.

Data from CryptoQuant shows that exchange reserves are declining. They dropped by 0.15% in the last 24 hours. Reports from the platforms suggest that on-chain activities contributed little to the uptrend as network activity is at its lowest.

Active addresses dipped by over 10%, and transactions within the ecosystem significantly declined. It is worth noting that the coin is seeing an inflow of assets from cold storage as investors send 160% more coins to trading platforms.

While onchain data hints at corrections, MACD suggests further uptrends. The metric displayed a bullish divergence a few days ago. The 12-day EMA and 26-day EMA continue their uptrend, and the bulls sustain it. The relative strength index sees the same trend due to notable buying pressure.

ETH briefly broke above the 78% Fibonacci retracement level, peaking at $2,849. However, it slipped below the mark, trading at $2,750. Previous price movements hint at a decisive flip before the week runs out. The largest altcoin may break above $2,900 but risks a dip to $2,600.

PEPE/USD

Pepe is up by over 5% at the time of writing. It sees received a massive boost from the launch of a similar memecoin on the Ethereum ecosystem. This gave it a trickle of volume, resulting in the ongoing surge.

PEPE peaked at $0.00001056 but retraced after hitting the mark. Nonetheless, it marks its first green after two days of notable declines.

The memecoin continues experiencing notable selling congestion around $0.000010. A similar retracement happened on Friday—nonetheless, indicators like the moving average convergence divergence and bollinger hints at a decisive flip this week.

PEPE had a positive convergence a few days ago. The bullish divergence is ongoing, and there are no signs of it halting as the 12-day EMA and 26-day EMA continue upwards. It is worth noting that the memecoin rebounded off the lower bollinger band a few days ago.

OP/USD

Optimism made waves over the last 24 hours due to its latest price surges. Many speculate that the fuel behind the hike may be its ecosystem.

Nonetheless, the asset opened the day at $.11 and recovered after a slight decline. It shot up as buying volume increased, breaking its seven-day high of $1.19. The cryptocurrency faced significant selling congestion at $1.22 but maintains trading at its peak.

The latest price increase follows two days of notable declines. OP was oversold a few days ago, and selling pressure peaked. Its latest price surge indicates the return of buyers.

Nonetheless, MACD suggests that the ongoing surge may continue. Optimism had a positive convergence a few days ago. The bullish divergence is ongoing, and there are no signs of it halting as the 12-day EMA and 26-day EMA continue upwards.

Previous price movement suggests sustaining an uptrend above $1.20 may guarantee an attempt at $1.40. Conversely, OP risks slipping below $1.10.

CAKE/USD

Pancakeswap was the top gainer last week. However, it triggered several indicators that blared warnings about an impending correction.

CAKE opened the previous week at $1.73 and surged after a slight decline. The asset broke above $3 but experienced notable selling congestion at $3.41, closing at $2.79.

The altcoin attempted to continue its uptrend Monday but failed as it retraced and trades almost 5% lower than it opened the day. It is worth noting that Pancakeswap was briefly overbought on Thursday. An overbought asset is due for corrections. The unfolding downhill movement may result from the massive buying volume it had.

MACD’s 12-day EMA uptrend is slowing as selling pressure mounts. The Fibonacci retracement level points to a possible decline to the 50% fib mark.