The incessant Bitcoin sales from the German government will soon be over, as the wallet tied to the country’s Federal Crime Police Office (KBA) is running out of the asset. Data from Arkham Intelligence shows the “German Government” labeled wallet now has 3,846 bitcoins left.

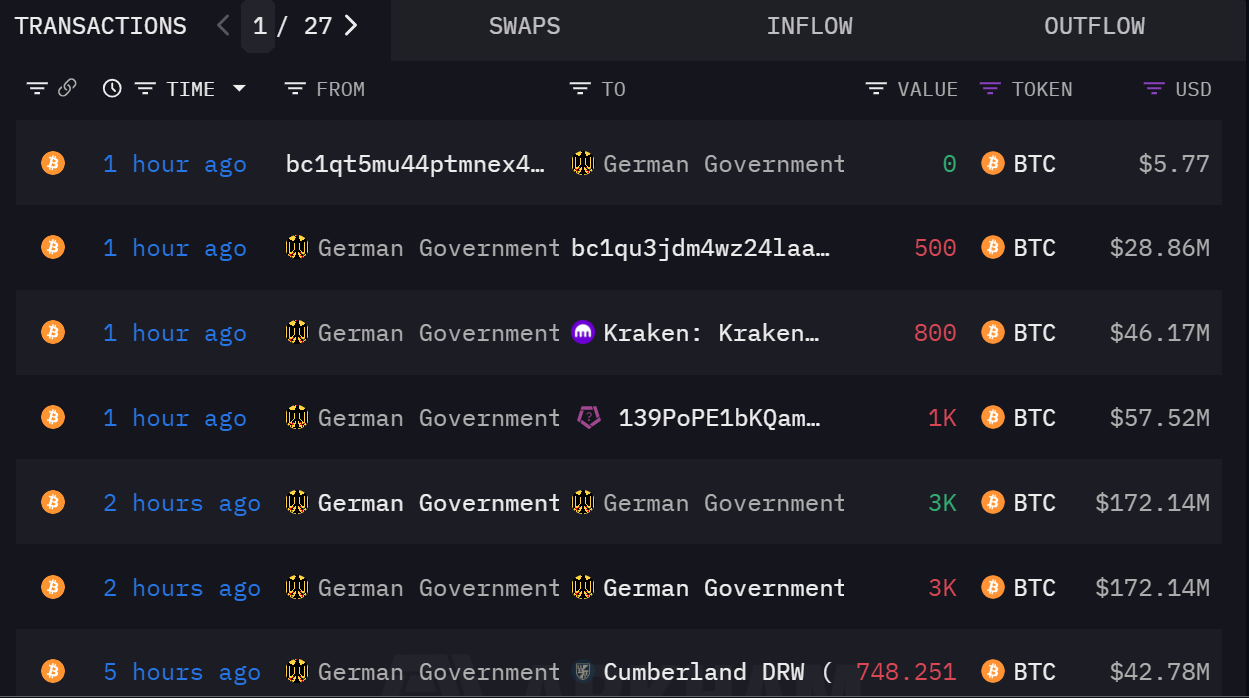

On Friday, the German government sent 4,596 BTC to different platforms, bringing its total sales to 46,154 BTC. An address with the initials 139Po received 2,000 BTC, Cumberland DRW received 748.251 BTC, Bitstamp, Coinbase, and Kraken received 400 BTC, 400 BTC, and 1,200 BTC, respectively, while a wallet starting with bc1qu3 received 1,000 BTC.

German Government’s Portfolio Down 92.3%

KBA started offloading Bitcoin seized from online film piracy platform Movie2K three weeks ago. The German government seized 50,000 BTC from Movie2K in January when the asset was around $40,000.

Germany has now sold 92.3% of its Bitcoin holding, or 46,154 BTC, amounting to $2.67 billion at the current market price. The portfolio started Friday above 8,442 BTC but sent 2,948 BTC early on the day and 2,300 BTC later on.

KBA’s Bitcoin sales have continued despite one of its parliament members, Joana Cotar, ranting on X about the country’s “not sensible and counterproductive” move. Last week, she stated that Germany should have used Bitcoin as a strategic reserve instead of incessantly selling the asset in the open market.

Among other factors, Bitcoin fell heavily with the German government sales last week. The asset reached as low as $53,485 on July 5 before rebounding. Bitcoin is up less than 1% in the past 24 hours and traded at $57,953 at press time.