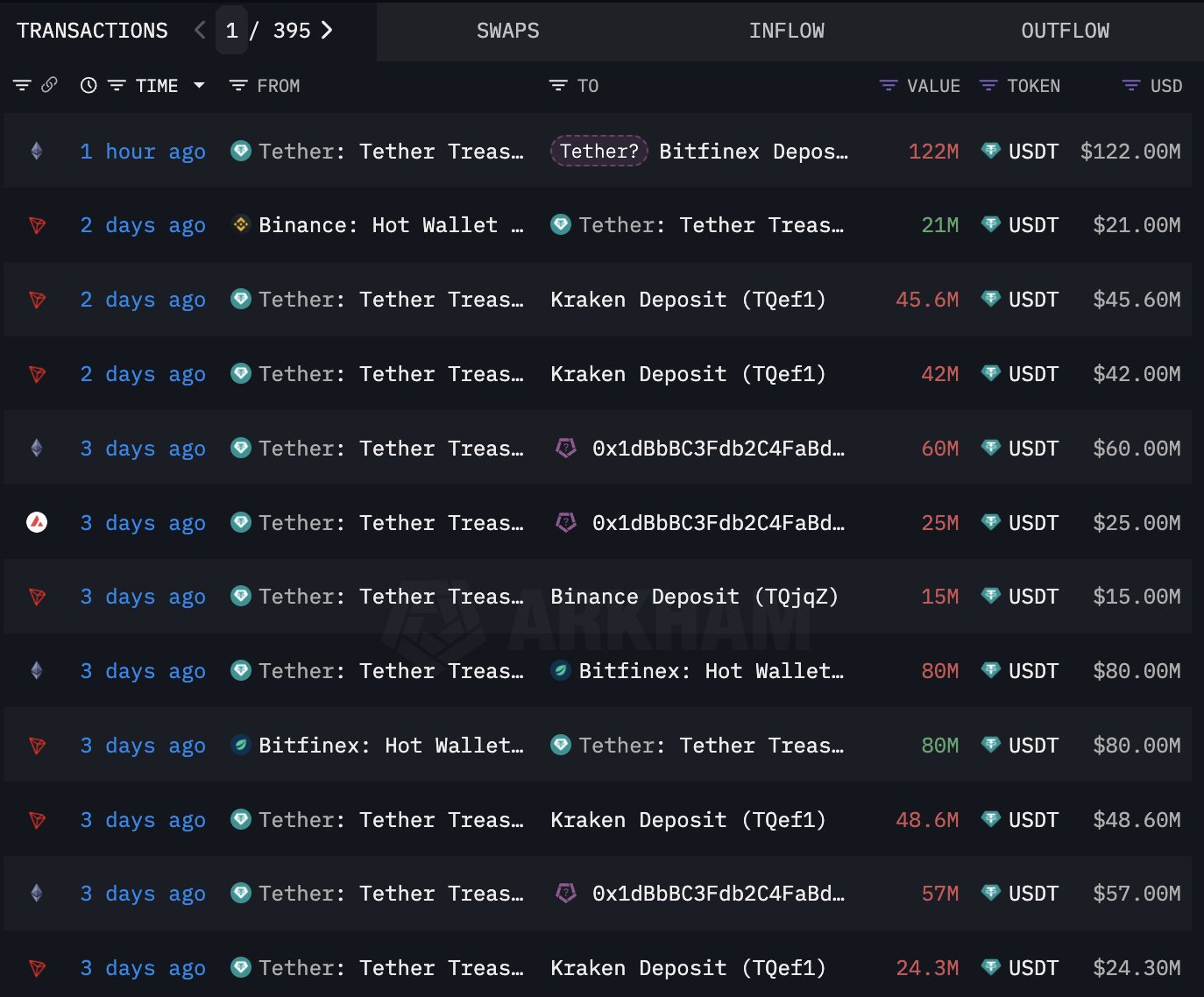

The hype around institutional investors buying the dip seems to be sizzling out after data from Lookonchain showed declining activity. On-chain analysis showed that crypto whales have temporarily stopped minting USDT from Tether and sending it to exchanges in the past two days.

The reduced buying pressure impacted the Bitcoin price, with the token diving 4.5% over the weekend. However, the largest crypto asset rebounded on Monday, nearing $60,000 at press time.

What Went Wrong?

Data showed that institutional investors transferred $1.3 billion from the Tether Treasury to buy cryptocurrencies on exchanges from August 5. This activity showed a “buy-the-dip” disposition for whales as Bitcoin briefly dropped below $50,000.

However, such activity has gone down significantly in the past two days. Lookonchain showed that the only fund moved from Tether to exchanges was $122 million, which was transferred to Bitfinex early Monday.

Speculation indicates that the drop might be due to low liquidity in the crypto market on weekends. A few other sentiments suggest this was due to Celsuis’s lawsuit against Tether on Saturday.

Bankrupt crypto lender Celsius sued Tether over the weekend, claiming that the stablecoin giant mismanaged its Bitcoin worth $2 billion and contributed to the firm’s financial troubles. Tether has issued an official statement stating it will defend itself against the allegations.

The coming days will determine whether the reduced stablecoin influx into exchanges is due to a loss of appetite among whales for Bitcoin or an underlying issue from Tether’s legal battles. However, the Fear and Greed Index steadied at 50, indicating a neutral bias among investors.