As optimism swelled following asset manager VanEck’s application for a spot Solana exchange-traded fund (ETF), market maker GSR Markets has speculated that approval of the product would substantially increase SOL, the network’s native token.

In a blog post on Thursday, GSR gave different thresholds at which a Solana ETF would impact the SOL price, stating that a very bullish market stance on the product would see the token grow over 8.9x.

VanEck’s Solana ETF application on June 26 raised bullish sentiments around Solana, with the token’s price increasing over 7% on the day. SOL’s price has been one of the fastest-growing in the crypto sector, rising almost 700% year-to-year.

ETF Impact on Solana

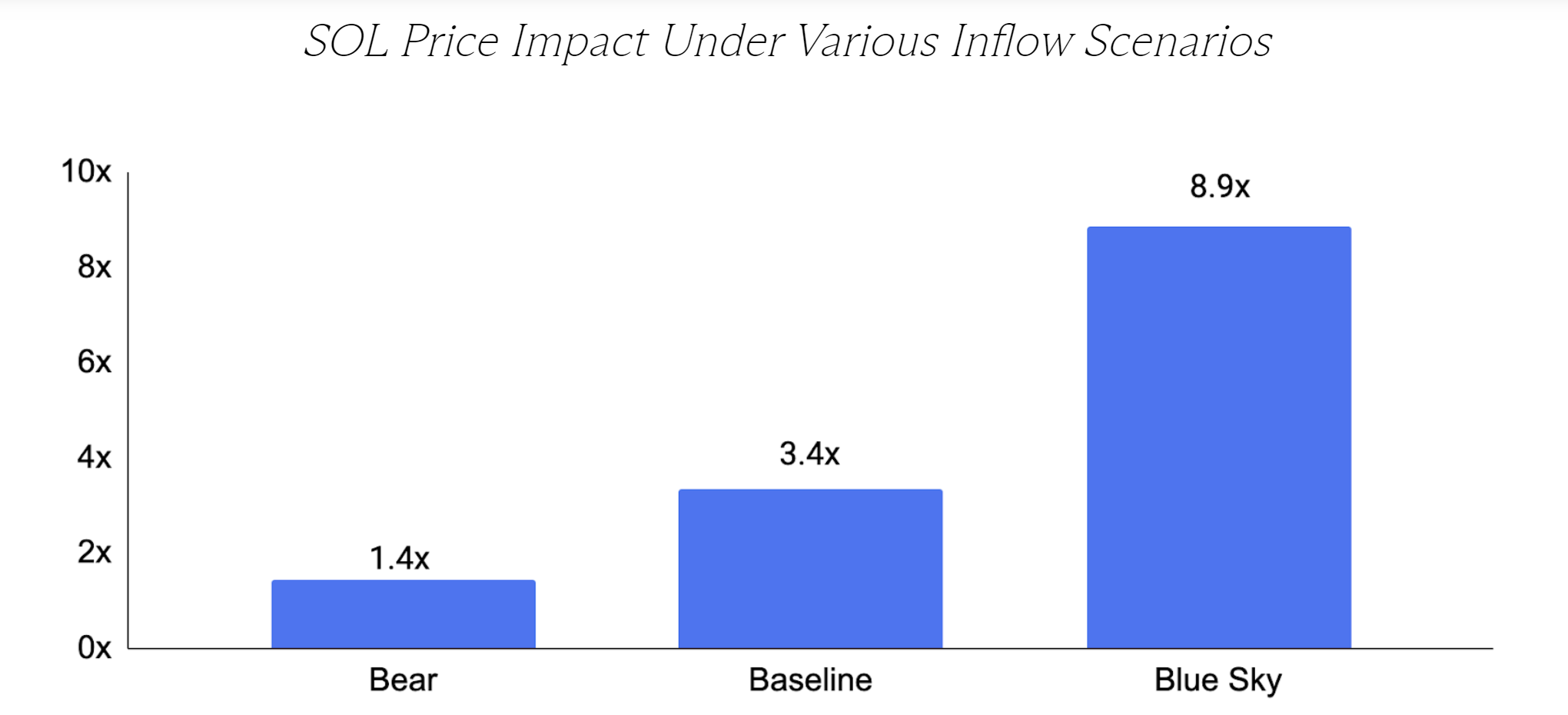

GSR drew up a thesis comparing Bitcoin’s reaction to its spot ETF application and approval and how it would likely work with Solana’s. The market maker created scenarios for Solana’s potential price increment, terming them bear, base, and blue sky scenarios.

According to GSR’s thesis, Solana would increase 1.4x in a bear scenario, 3.4x in a base scenario, and 8.9x or more in a blue sky scenario. At the current price of $145, SOL is expected to trade at $203, $493, and $1,290 or more in any of these scenarios, respectively.

Given the token’s utility, GSR expects Solana to do more than its estimations. It also stated that it sees SOL having the largest price impact when additional spot digital asset ETFs are allowed in the US.

“Moreover, there are reasons to believe the impact could be higher than these estimates since, unlike BTC, SOL is actively used for staking and within decentralized applications, and as the relationship between relative flows and relative size may not be linear,” the market maker noted.

Decider for Next ETF Approval

Notably, GSR based the possibility of the next ETF’s approval on two factors: decentralization and demand. Although Solana performed exceptionally on the two metrics, the possibility that a more friendly crypto regulation would facilitate the product’s approval remains high.

Analysts have speculated that Donald Trump’s victory in the November election and a change in the SEC’s hierarchy would facilitate the approval of the Solana spot ETF. Bloomberg’s James Seyffart also noted that he doesn’t expect a decision on the SOL ETF product until “sometime in 2025.”