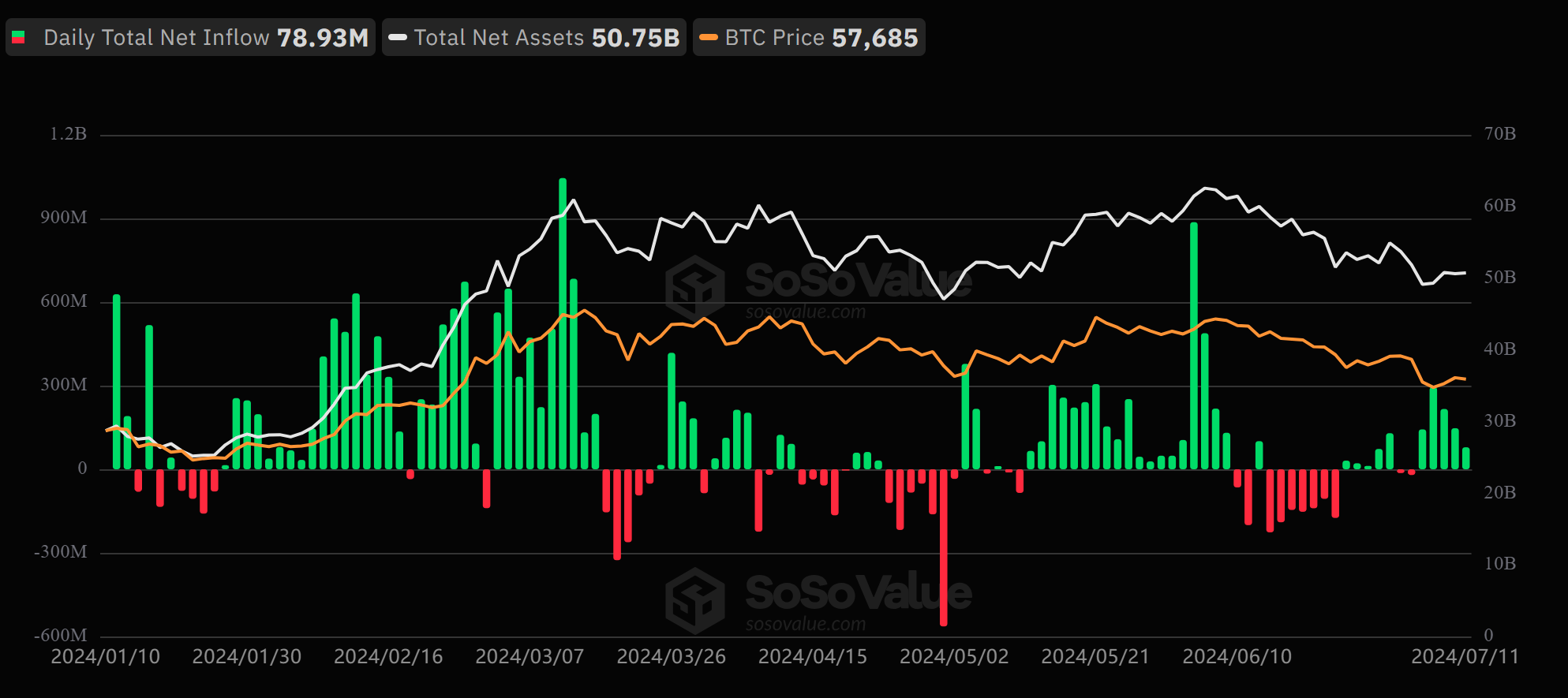

On Thursday, the US spot Bitcoin exchange-traded fund (ETF) saw a single-day net inflow of $78.9 million, extending its inflow streak to five consecutive days. During the streak, the funds have hauled in nearly $900 million as investors seem poised to buy the Bitcoin dip.

Bitcoin capitulated last week on the German government’s incessant sales and exchange Mt. Gox selling FUD. The asset reached a five-month low below $54,000 even as miners intensified their sell-offs.

Amidst the Bitcoin price capitulation, the US ETF issuers experienced a significant cash influx. The 11 issuers recorded net inflows that were last seen between the end of May and the early days of June, indicating positive sentiments in the market.

Resurgent BlackRock Shines

The largest spot Bitcoin ETF issuer by asset under management (AUM), BlackRock, led inflows on Thursday, raking in $72.1 million on the day. After an unimpressive spell in the past few weeks, BlackRock has now led inflows for two of the past three days.

Fidelity’s FBTC had a positive outing again, taking its inflow streak to 12 consecutive days. The asset manager recorded a single-day net inflow of $32.69 million, bringing its AUM to $10.06 billion.

Ark Invest’s ARKB saw inflows of $4.31 million, while Bitwise’s BITB recorded $7.53 million in positive flow. Grayscale’s GBTC extended its outflow streak to three consecutive days and six in the past seven days, with investors pulling $37.67 million from the fund.

Other asset managers recorded zero flows on Thursday, as a total of $1.3 billion worth of value was traded in the US ETF market. The Bitcoin product has had $50.75 billion in total net assets since its launch in January.

Bitcoin Holds Steady Above $57k

The largest crypto asset has not yet responded to the incessant inflows from US ETF issuers, as other asset holders have continued to dump their bags. Bitcoin remained steady above $57,000, trading at $57,268 at press time.

The asset made a scintillating run to near $60,000 on Thursday after the US Consumer Price Index (CPI) came in lower than expected, suggesting a cooling of inflation. However, Bitcoin failed to break the resistance in that region and continued to range.