The opportunity to provide a global infrastructure for everyday investors to trade real-world assets (RWA) around the clock has often been lauded as one of blockchain’s biggest potentials. Citigroup estimates a total addressable market numbering trillions of dollars, and many investors are also keen on the best way to position themselves for such potential growth.

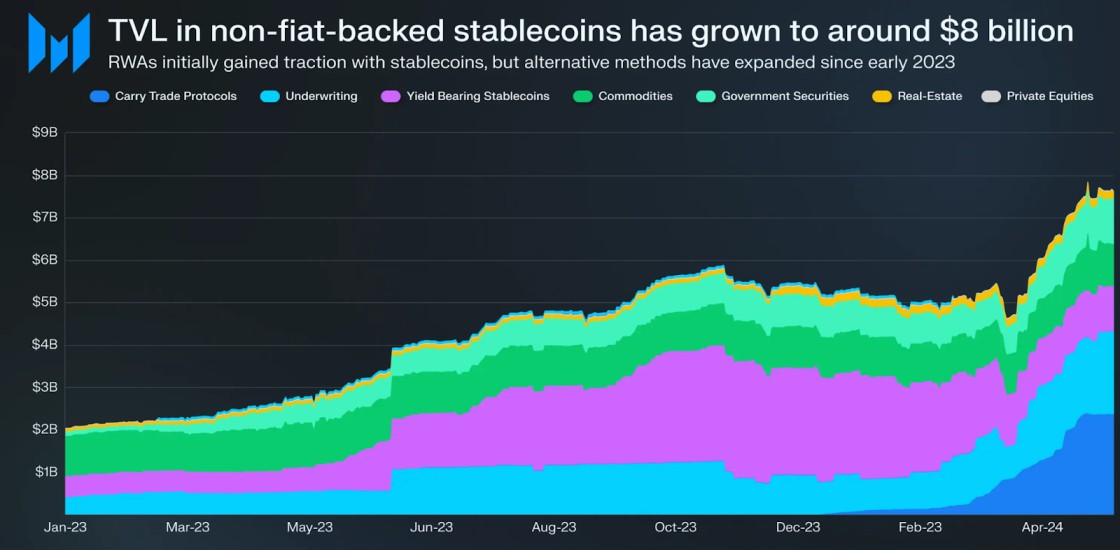

A recent report by Reflexivity Research examined the market for RWAs, highlighting Solana’s potential to become a dominant force in the space. The report notes, among other things, that the current market for blockchain-based RWAs stands at $8 billion, a 400% increase from its 2023 value of $2 billion.

The growing demand for RWA assets on-chain creates a need for a high-performing blockchain that can deliver a seamless experience. The research outlined six core features that a blockchain must have to fulfill such a demand, namely security, scalability, regulatory compliance, transparency and auditability, optimal user experience, and interoperability.

Solana’s widely adopted blockchain reportedly delivers on the core components, with recent innovations on the network making it even more ideal for RWA issuance. For instance, Solana recently ushered in Token extensions, a new token standard that allows tokens to accumulate interest natively and offer greater privacy and other programmable features.

Another highlighted area is Solana’s scalability and focus on layer-1 optimization, as opposed to other mainstream blockchains like Ethereum, which scales primarily through layer-2 solutions. By consolidating liquidity for most dApps on its primary layer, Solana can offer a more efficient technical infrastructure for RWA issuances and allow investors to tap into more liquidity.

Solana Has Room for Growth on the RWA Front

While Solana, in its current state, has a lot of potential for RWAs, the report acknowledges that there is significant room for growth. For instance, the report urges the Solana ecosystem to leverage existing Ethereum token stands like ERC-3643 and ERC-1400 and incorporate the best practices for token management.

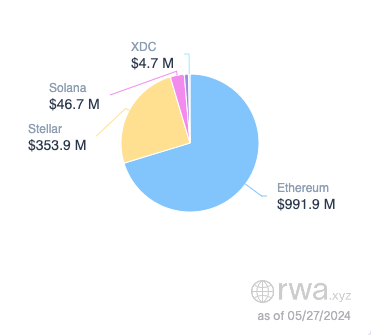

Additionally, the blockchain still has room for growth, especially in terms of attracting capital into on-chain treasury products on Solana. As of late May 2024, the network had roughly $46.7 million worth of assets locked on such platforms, a significantly lower figure than Ethereum’s nearly $1 billion.

As with most fields of human endeavor, it remains to be seen whether Solana’s potential will see it hit the critical mass required to eventually dominate the market for RWAs. However, the blockchain’s developer community has made significant strides, positioning the network to garner the needed interest as the industry matures.

Nick Ducoff, Head of Institutional Growth, Solana Foundation, also believes that Solana is well positioned to capture the growth. He says, “With $2.4 trillion in stablecoin volume on Solana in May, representing two-thirds of the total on-chain stablecoin volume (source), it is increasingly clear that Solana is the ultimate chain of choice for investors and traders alike. As more RWA issuers leverage the power of token extensions to distribute permissioned tokens on the permissionless Solana network, I think we’ll see those numbers continue to grow.”