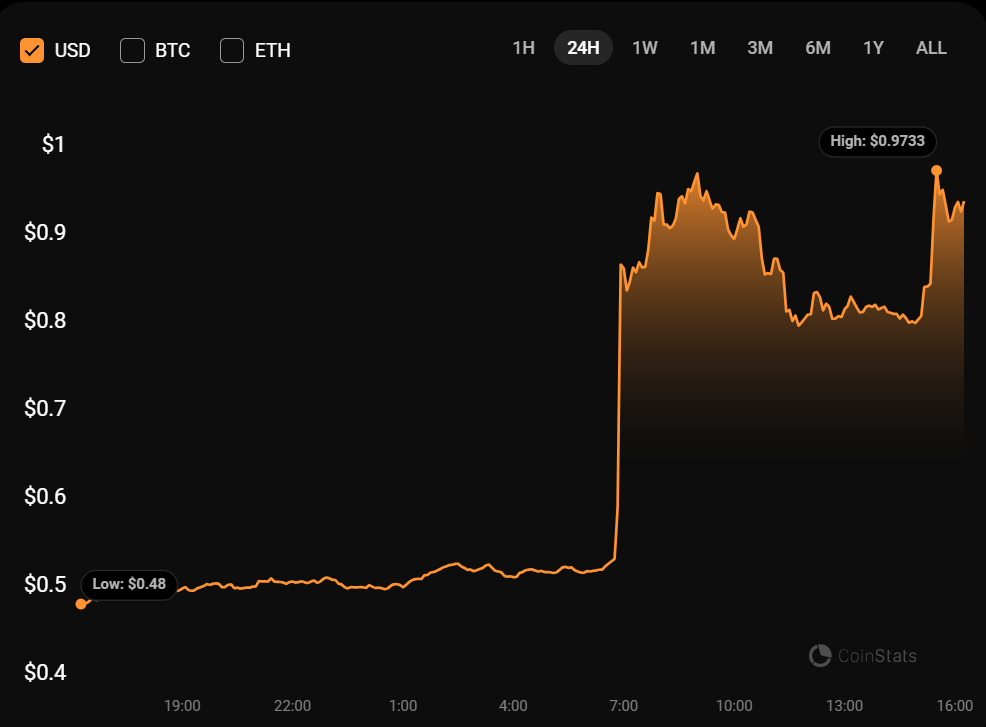

Binance Futures, the futures market for the leading crypto exchange Binance, announced today that it would list DRIFT, the governance token for the Solana-based decentralized platform Drift protocol, alongside two other cryptocurrencies. News of the listing triggered DRIFT’s price surge to as high as $0.9733, representing a 96% price increase within the past 24 hours.

Source: CoinStats

What is DRIFT?

Launched in August 2021, Drift protocol offers a decentralized perpetual market on the Solana blockchain. In April 2024, the DeFi project unveiled its governance token, DRIFT, to give community members governance rights concerning the decentralized exchange. Voting activities occur within the Drift DAO, a decentralized autonomous organization supporting the Drift protocol.

In May, the protocol’s developer team airdropped 12% of DRIFT’s supply to community members. Around that time, Drift joined forces with the Solana-based decentralized exchange Jupiter, contributing to Jupiter’s daily trading volume surge to over $820 million.

According to on-chain data from DeFiLlama, Drift protocol has a total value locked (TVL) of over $596 million.

Binance Futures Launch Three Tokens

Binance Futures’ latest update featured three tokens: Drift protocol’s DRIFT, Grass’ GRASS, and Swell Network’s SWELL. Following the announcement, the latter two tokens soared by over 20% and over 63%, respectively.

#Binance Futures will launch the USDⓈ-Margined $GRASS @getgrass_io$DRIFT @DriftProtocol $SWELL @swellnetworkio

Perpetual Contracts at Nov 8 2024, 15:30 (UTC), 15:45 (UTC), 16:00 (UTC) respectively.

Read more ➡️ https://t.co/f7FEafbPg2 pic.twitter.com/gZiLdEXs1D

— Binance Futures (@BinanceFutures) November 8, 2024

These tokens were launched with 75x leverage, giving traders the opportunity to earn massive profits from trading them.

It is worth noting that the current listing does not imply that Binance’s main platform will add the three tokens. Like most crypto exchanges, they must undergo a vetting process before securing a listing on Binance. Crypto projects that no longer meet the exchange’s listing requirements are delisted, a move that often comes with a price tank for the crypto asset in question.