Amidst the wider market capitulation in recent weeks, digital asset investment products have continued a three-week succession of outflows. Last week, crypto assets saw a whopping outflow of $435 million.

As always, the two leading cryptocurrency assets, Bitcoin and Ethereum, led the outflow. Data from CoinShares’ Digital Asset Fund Flows report showed that the duo saw $423 million and $38 million withdrawn, respectively. This marks the highest level of outflows since March, suggesting a significant decrease in investor interest or confidence in digital asset investments during this period.

CoinShares’ report also shows that trading volumes for Exchange-Traded Products (ETPs) fell to $11.8 billion last week from $18 billion the week before. This decline occurred alongside a 6% decrease in Bitcoin prices.

Solana Shines, Ethereum’s Outflow Continues

The second-ranked cryptocurrency asset, Ethereum, saw a weekly outflow of almost $39 million last week. CoinShares’ report also showed a month-to-date outflow as high as $123 million and a year-to-date outflow of $50 million.

Meanwhile, a trend switch seems to be observed in the market, with investors allegedly turning their attention towards altcoins like Solana and Litecoin. The flow data showed that Solana saw an inflow of 4.1 million, while $3.1 million flowed into Litecoin last week.

Solana saw an inflow of $2.2 million on a month-to-date basis. The digital asset has also seen a net inflow of $10 million since the start of the year, signaling an investor preference for it compared to Ethereum.

Altcoin Season?

As the flow data suggests, investors have shown increased traction toward altcoins. Altcoin investment products, aside from Ethereum, defied bearish sentiments last week, recording a net inflow of $9.8 million.

XRP, Cardano, and Polkadot saw net inflows of $0.4 million, $0.4 million, and $0.5 million last week. Month-to-date, Litecoin leads in inflow with $12.3 million, while Polkadot follows with $3.5 million.

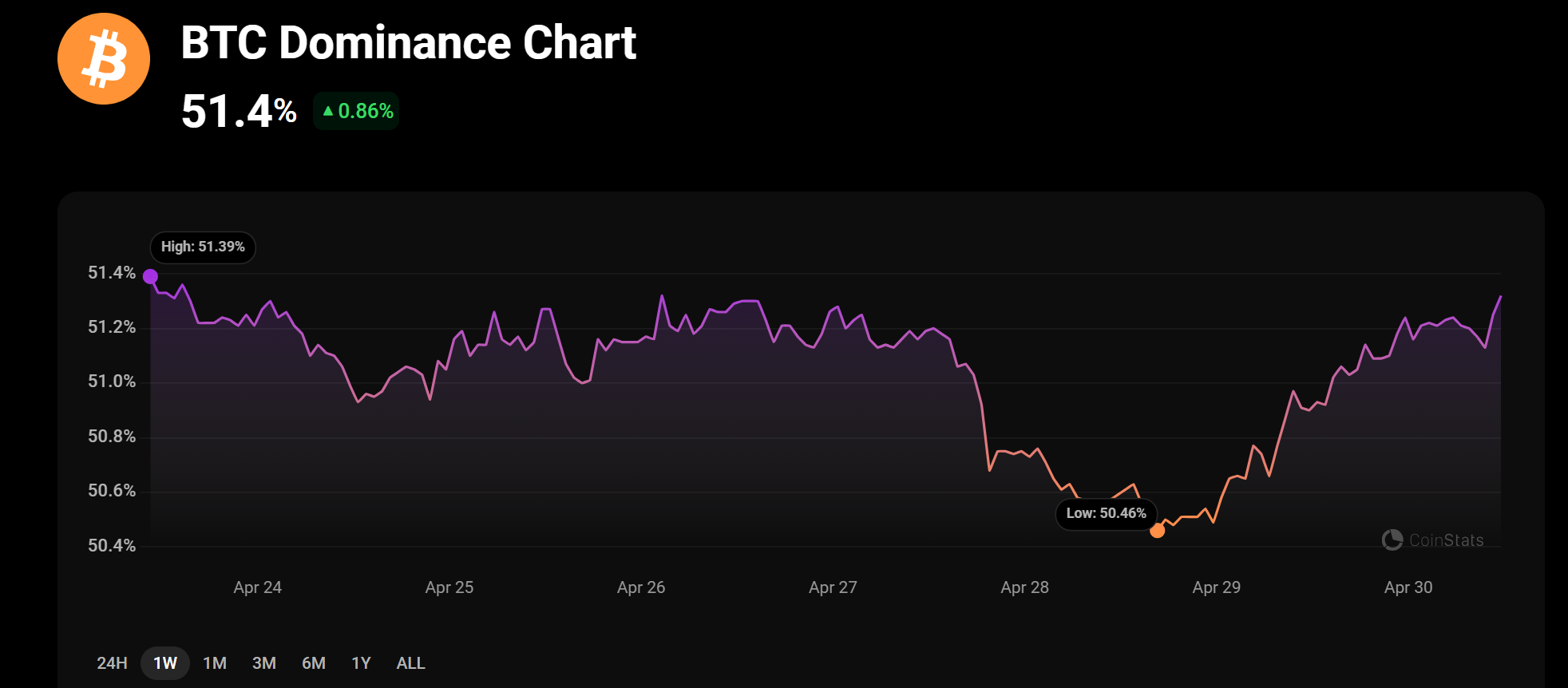

If these trends are to be believed, the popular altcoin season—a term used to describe a period when the prices of most altcoins increase significantly—might be on its way. However, one of the major indicators remains missing as Bitcoin’s dominance continues to show strength.