Solana is seeing significant buyback following two days of consecutive selloffs. It is up by over 5% in the last 24 hours.

The latest increase comes after the asset retraced but rebounded. SOL was not exempt from the significant decline in the crypto market. It dropped to a low of $121 a few hours ago but recovered as the bulls rallied the market.

The global cryptocurrency market cap dropped below $2 trillion for the first time in more than three months. However, it is also recovering and is back above the mark.

Nonetheless, SOL is looking to erase all of its previous losses. For example, it retraced from a high of $153 to $138 on Wednesday. The day ended with the coin losing over 8%. The decline continued the next day, with a low of $127 following a failed recovery attempt. It also closed with losses exceeding 9%.

After its rebound, the bulls are looking to return prices above $150. However, fundamentals point to an impending massive decline.

FTX Repayment Plan

The most recent decline was due to panic that Mt.Gox was about to dump over $2 billion in BTC. However, there are no indications that the exchange plans to sell the asset. Nonetheless, anytime the firm moves this cryptocurrency, the market reacts negatively, with many traders panic selling.

A worse version of this situation may happen to Solana. FTX said in a court filing that almost all of its customers will be able to receive total repayments within sixty days of the bankruptcy court approval.

The exchange also offered creditors a faster process of paying only those owed up to $50,000. It stated that they have until August 16 to cast their vote. Nonetheless, the final approval will happen on October 7.

Unlike the uncertainty surrounding Mt.gox about whether they’ll sell, it is almost certain that FTX will sell its Solana bag. The exchange recently sold some of its holdings in May for a discounted price. The firm also indicated it would pay its creditors cash.

It is crucial for the bulls to cause a notable uptrend in anticipation of the upcoming selloffs. Failure of the coin surge will result in further lows.

Solana at Risk of Dropping Below $100

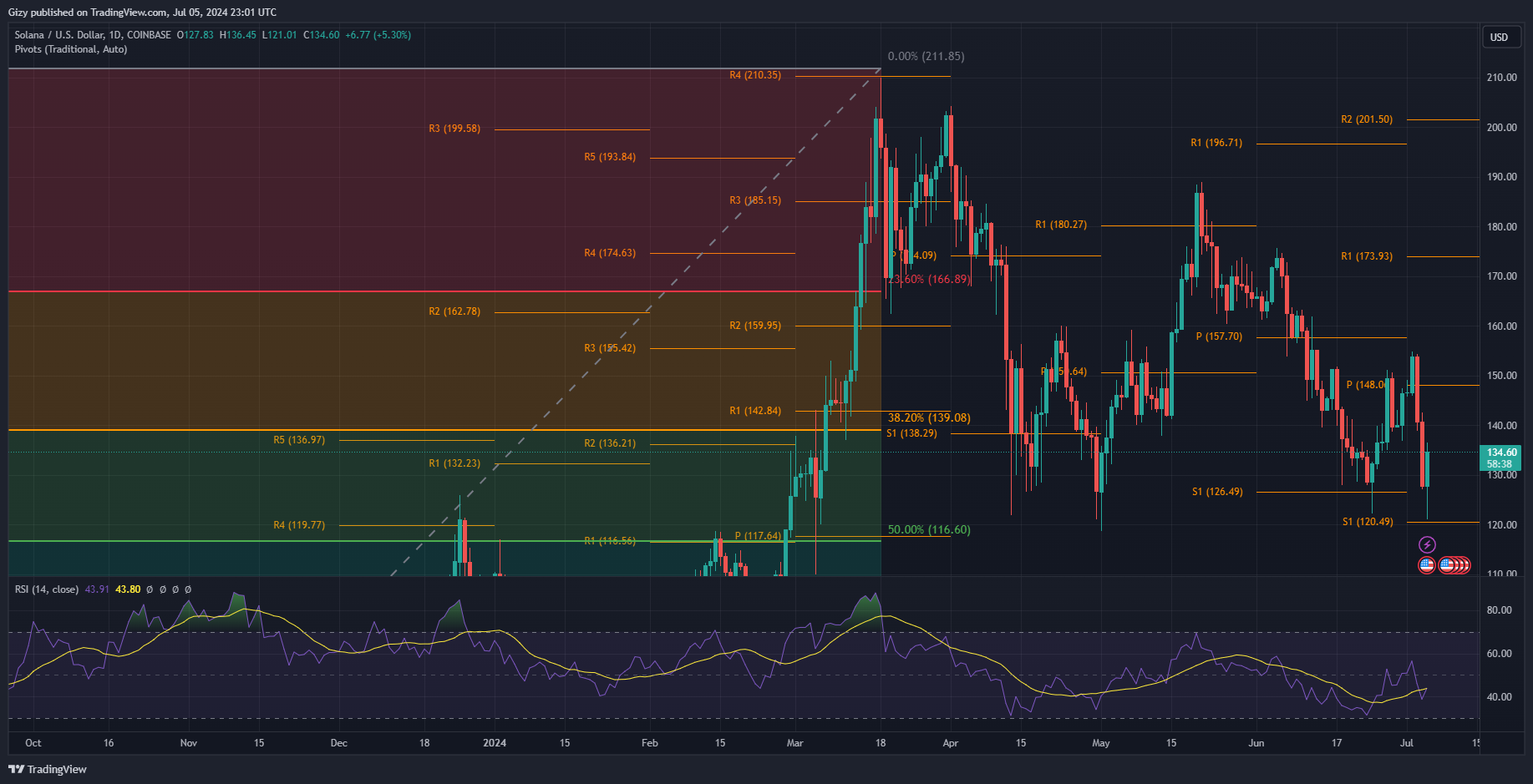

Following its recovery from $120 on June 5, the coin is billed to continue the uptrend. The rebound shows the massive demand concentration at $120. This is also the asset’s first pivot support, which points to a continual attempt at the mark if the uptrend fails.

Nonetheless, trading at $134, SOL may be en route to its pivot point at $148. It is worth noting that a new short-term resistance at $144. It tested the mark with brief success over the last fourteen days. It remains to be seen if the ongoing uptrend will cause any significant change in this trend.

The impending selloff is set to take place in the fourth quarter. Before they hit, the coin may reclaim $150 and continue upwards. After regaining PP, the bulls will look to reclaim the first pivot resistance at $173. It remains to be seen if it’ll break $200 before the anticipated event.

The moving average convergence divergence supports this claim. It is still printing buy signals amidst the current decline. The 12-day EMA is on the uptrend, indicative of a further price climb, and the 26-day EMA is also on the same trend. The bulls will continue the uptrend and possibly flip the 50-day EMA.

If Solana fails to climb as high as $200, the first pivot support may come under intense pressure. It may break as the impending selloff will affect the coin directly. It will also experience more selling pressure compared to what it sees at the time of writing.