Rho Markets, the liquidity layer for Ethereum-based Scroll, survived what initially seemed to be an exploit on Friday after the supposed hacker stated he would refund the lost money to the project. Rho Markets was on the verge of losing $7.6 million due to what the hacker termed a “prime oracle misconfiguration.”

The platform announced on X that it noticed an unusual activity on its platform and temporarily halted operations to tackle the issue fully.

We’ve detected unusual activity on our platform and are currently investigating it. During this time, we will be pausing the platform. Most of the pools are safe, so there is no need to worry. We will keep the community updated on the progress of our investigation. The platform…

— Rho Markets📜 | Rho.scroll (@RhoMarketsHQ) July 19, 2024

Rho Markets Survives Exploit

On-chain analyst ZachXBT broke the “good news” in an X post hours after Rho Markets confirmed the attack, where the hacker sent a message to the liquidity provider. The supposed whitehat exploiter stated that the action was not an attack on Rho Markets but a gain from the project’s security compromise.

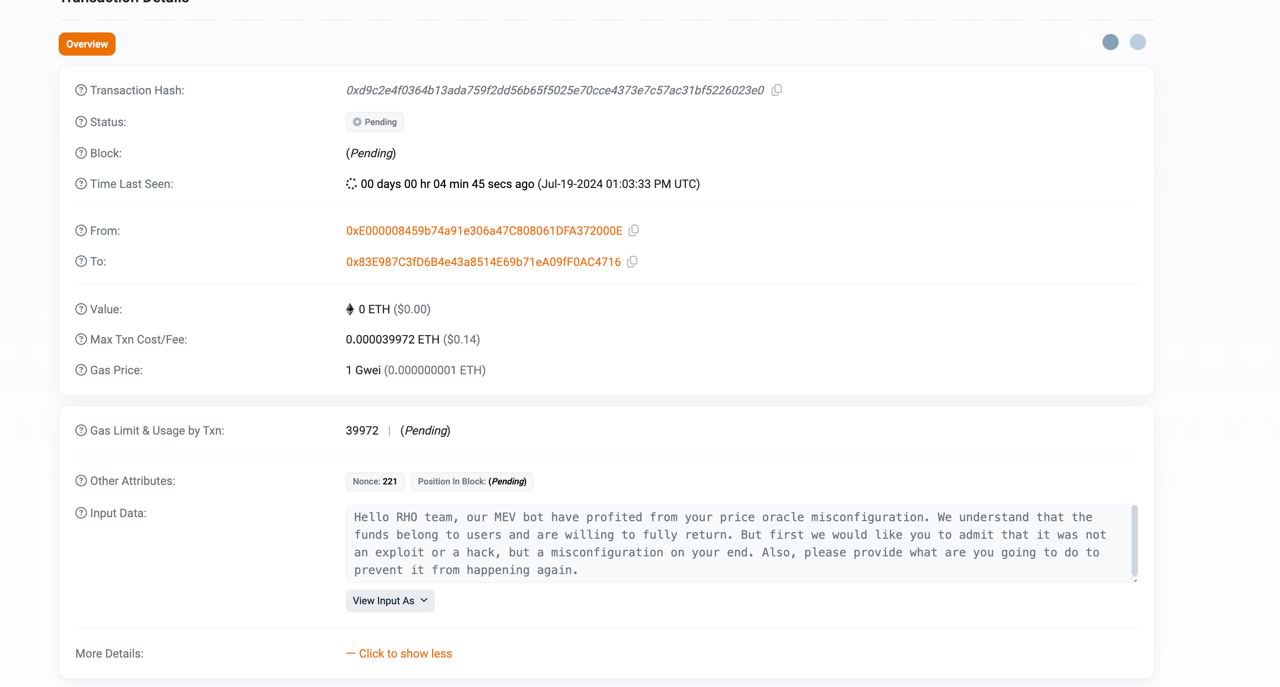

“Hello RHO, our MEV bot has profited from your price oracle misconfiguration. We understand that the funds belong to users and are willing to fully return,” the hacker said in an on-chain message.

The hacker, however, requested that the project term take responsibility for the exploit and announce that it was a misconfiguration from its end rather than an actual hack. The on-chain message also showed that the exploiter asked Rho Markets to provide details of what it would do to prevent future reoccurrences.

At press time, Rho Markets had not responded to the hacker’s message or released an official statement regarding the new development.

Rho Markets’ exploit scare came less than a day after India’s largest crypto exchange, WazirX, lost over $230 million to a hacker who dumped most of its Shina Inu (SHIB) bag.