Norway’s Sovereign Wealth Fund increased its BTC stash by 938 BTC (worth over $57.3 million) within the first half of this year, bringing its total portfolio to 2,446 BTC (valued at over $149.4 million).

It is worth noting that the Fund does not directly own these bitcoins. Rather, it indirectly owns them through its investment in Bitcoin-affiliated companies like MicroStrategy, Marathon Digital, Coinbase, and Block Inc.

Vetle Lunde, the senior analyst at K33 Research, shared details about the Fund’s indirect BTC exposure via an X tweet. Highlighting that it is unlikely that the BTC stash was “an intentional choice,” he stated that if the Fund was intentional about its BTC exposure, its portfolio would have significantly increased.

Norway’s Wealth Fund Indirectly Owns 2,446 BTC

The Wealth Fund is the world’s largest sovereign wealth fund, with assets under management (AUM) worth approximately $1.7 trillion. The Fund was established to ensure the sustained use of revenue from the country’s oil and gas sector. These funds are invested in real estate, equities, and other investment products.

For years, the Norwegian Wealth Fund has staked portions of its revenue in the business intelligence company MicroStrategy. As of December 31st, 2023, the Fund had a 0.67% exposure to MicroStrategy. However, at the end of the first half (H1) of this year, the Fund increased its stake to 0.89%. Recall that MicroStrategy has grown its BTC stash to 226,500 BTC worth over $13.8 billion, benefitting all entities that have staked in the firm.

Lunde also reported that Norway’s Wealth Fund has invested 0.82% of its funds in Marathon Digital, the leading U.S.-based Bitcoin mining firm. Earlier this week, the mining company revealed its plan to raise $250 million to accumulate more BTC, an act that would profit its investors.

The Fund upscaled its exposure to Coinbase, the leading American crypto exchange, from 0.49% to 0.83%. It also increased its investment in financial payment company Block Inc. from 1.09% to 1.28%.

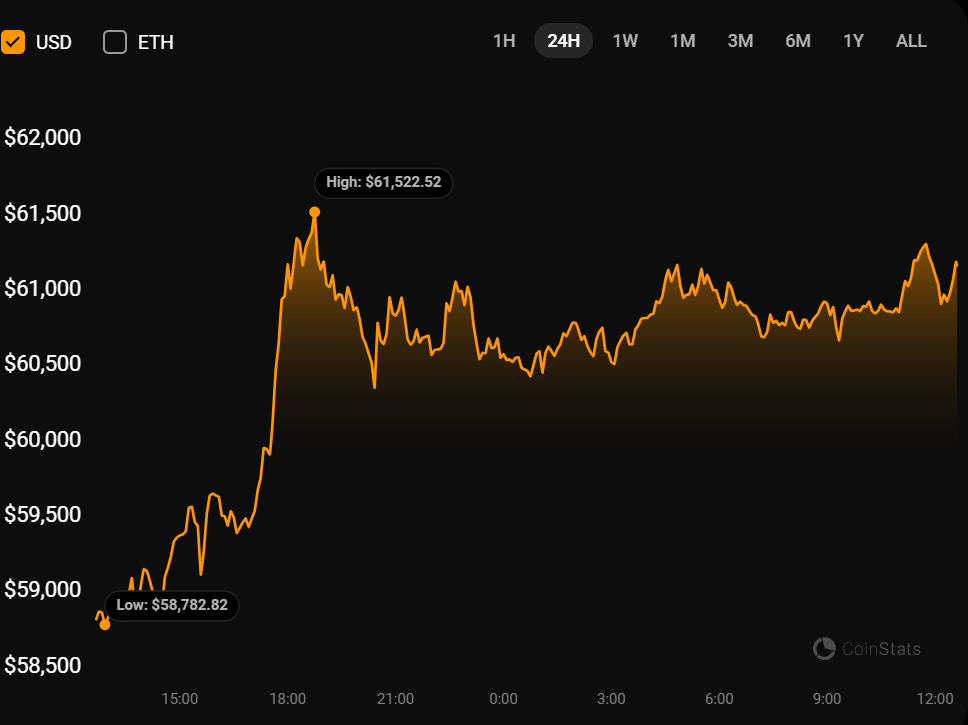

BTC Above $61K

Despite the bear market saturating the crypto market, the leading crypto, BTC, has increased over 4% in the past 24 hours to $61,100 at the time of writing.