Widely dubbed the Asian MicroStrategy, publicly-traded Japanese firm Metaplanet announced it had purchased an additional 20.2 bitcoins with 200 million yen ($1.2 million). It made the disclosure on an X post at the end of the Tokyo Stock Exchange trading session on Monday.

The Monday purchase marked the second consecutive week that Metaplanet had purchased the largest crypto asset. The Japanese investment firm announced on June 24 that it would buy Bitcoin worth 1 billion yen ($7 million) from bond sales proceeds.

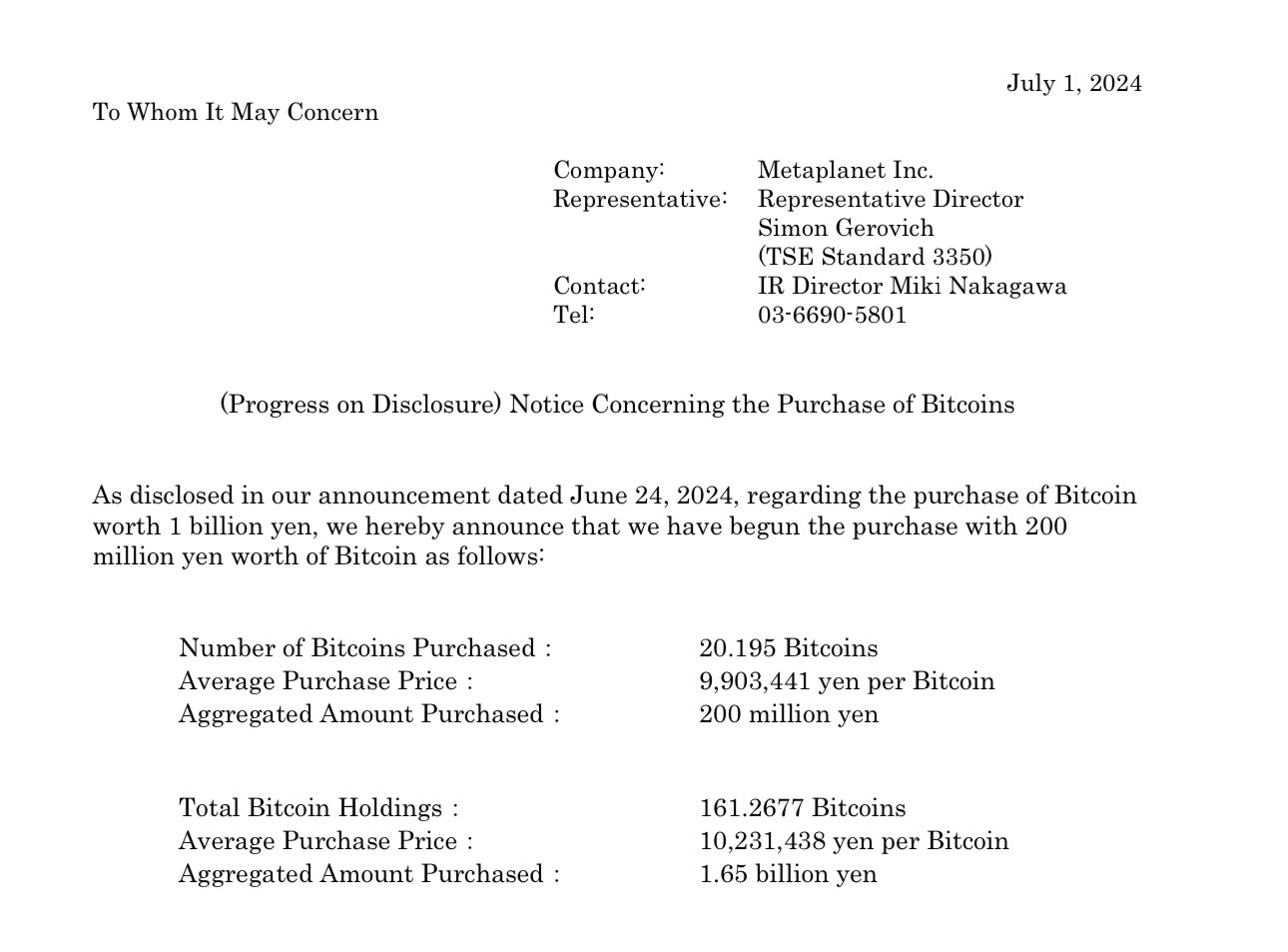

“As disclosed in our announcement dated June 24, 2024, regarding the purchase of Bitcoin worth 1 billion yen, we hereby announce that we have begun the purchase with 200 million yen worth of Bitcoin…,” Metaplanet stated in a publication on Monday.

Metaplanet’s Big on Bitcoin

Since turning to Bitcoin in May to address growing economic pressure in Japan, Metaplanet has acquired 161.27 bitcoins worth 1.65 billion yen ($9 million). Metaplanet acquired the bitcoins in five buys at an average price of $63,435.

Asian McroStrategy’s bet on Bitcoin seems to be paying off as the yen continues to fall against the dollar. Last week, the Japanese yen weakened to a new 38-year low and was trading at 1 yen to $0.006 (161.16) at press time. Although Bitcoin is still below its average price, Metaplanet’s adoption of the asset has hedged it against Japan’s growing inflation and devaluation.

Metaplanet’s stock rose slightly on Monday, trading above 100 JPY. Metaplanet (3350) has increased 61% in the past month and over 300% since announcing Bitcoin as its primary treasury reserve.