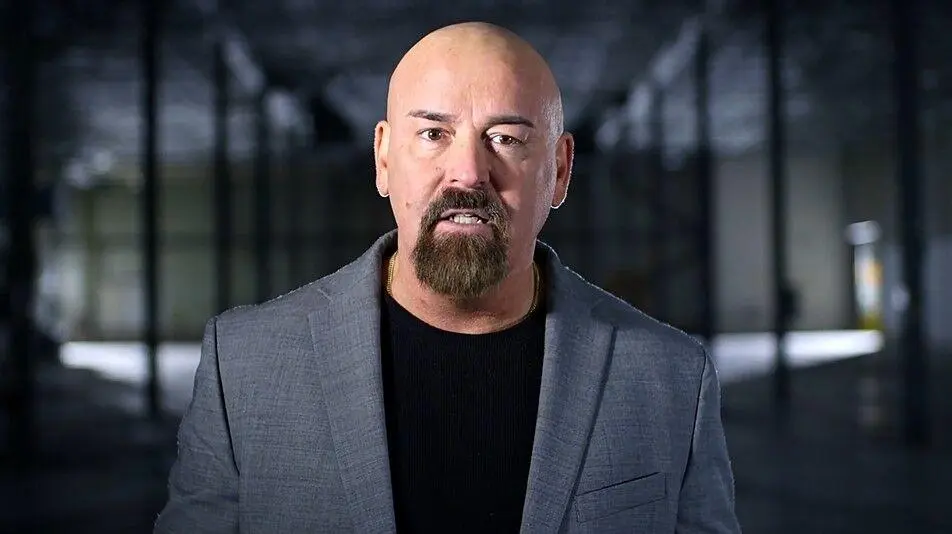

The United States Securities and Exchange Commission (SEC) has faced significant backlash due to its aggressive cryptocurrency market regulation. Pro-XRP attorney John Deaton has publicly stated that the SEC’s approach has cost everyday investors more than $15 billion. Deaton criticized the agency for what he called regulatory ‘overreach’ and pledged to hold the SEC accountable.

JUST IN: 🇺🇸 JOHN DEATON STATES THE @SECGOV’S CRYPTO OVERREACH COST RETAIL INVESTORS $15 BILLION!

“The SEC’s misconduct and gross overreach caused small investors over $15 billion. On behalf of those 75K small investors I represented, we do not accept the SEC’s apology.” —… pic.twitter.com/2VYoiX1nOR

— Good Morning Crypto (@AbsGMCrypto) September 15, 2024

SEC’s Strict Measures Hit Small Investors Hard

The financial regulator’s enforcement-driven approach to crypto has long been controversial. Deaton, known for defending XRP holders, argues that the regulator’s strict measures have hurt smaller investors the most. His statements follow his recent victory in the Massachusetts Republican primary for the U.S. Senate, where he now prepares to challenge Democratic Senator Elizabeth Warren in November. Deaton believes Warren’s failure to challenge the regulator’s crypto stance has prompted him to step into the race.

Although the SEC has recently softened its stance, clarifying that cryptocurrencies are not securities, Deaton remains critical. He sees this shift as too little, too late, given the significant financial losses experienced by individual investors. Deaton asserts that the SEC’s earlier position, which categorized some crypto assets as securities, inflicted major harm on the market.

The SEC’s regulatory tactics continue to draw scrutiny, particularly for their impact on small investors. Deaton stressed that the $15 billion loss was a direct result of the agency’s overreach and mismanagement. He has vowed to bring attention to the issue as he moves forward in his Senate campaign, where cryptocurrency regulation is expected to become a central topic.

SEC Crypto Enforcement Rises 3,000%

On September 12, the SEC settled with eToro, mandating the platform to suspend most crypto trading in its U.S. branch and pay a $1.5 million penalty. The settlement adds to the SEC’s vigorous crypto enforcement efforts in 2024, with the agency having already secured billions in penalties by September. One of its most notable actions was the $4.47 billion settlement in June with Terraform Labs and its former CEO, Do Kwon, marking the SEC’s biggest enforcement win.

In 2024, the agency saw a sharp rise in the total value of fines imposed, amassing $4.7 billion across 11 enforcement actions. This reflects a dramatic 3,018% increase from the $150.3 million collected in 2023, even though the agency pursued 19 fewer cases against crypto companies compared to the previous year.