On Monday, Vetle Lunde, head of research at K33 Research, revealed that institutional investors flocked to Bitcoin ETF products, driving last year’s Q4 ownership surge. Notably, the rise in ownership highlights that institutional investors are increasingly confident in Bitcoin as an asset class.

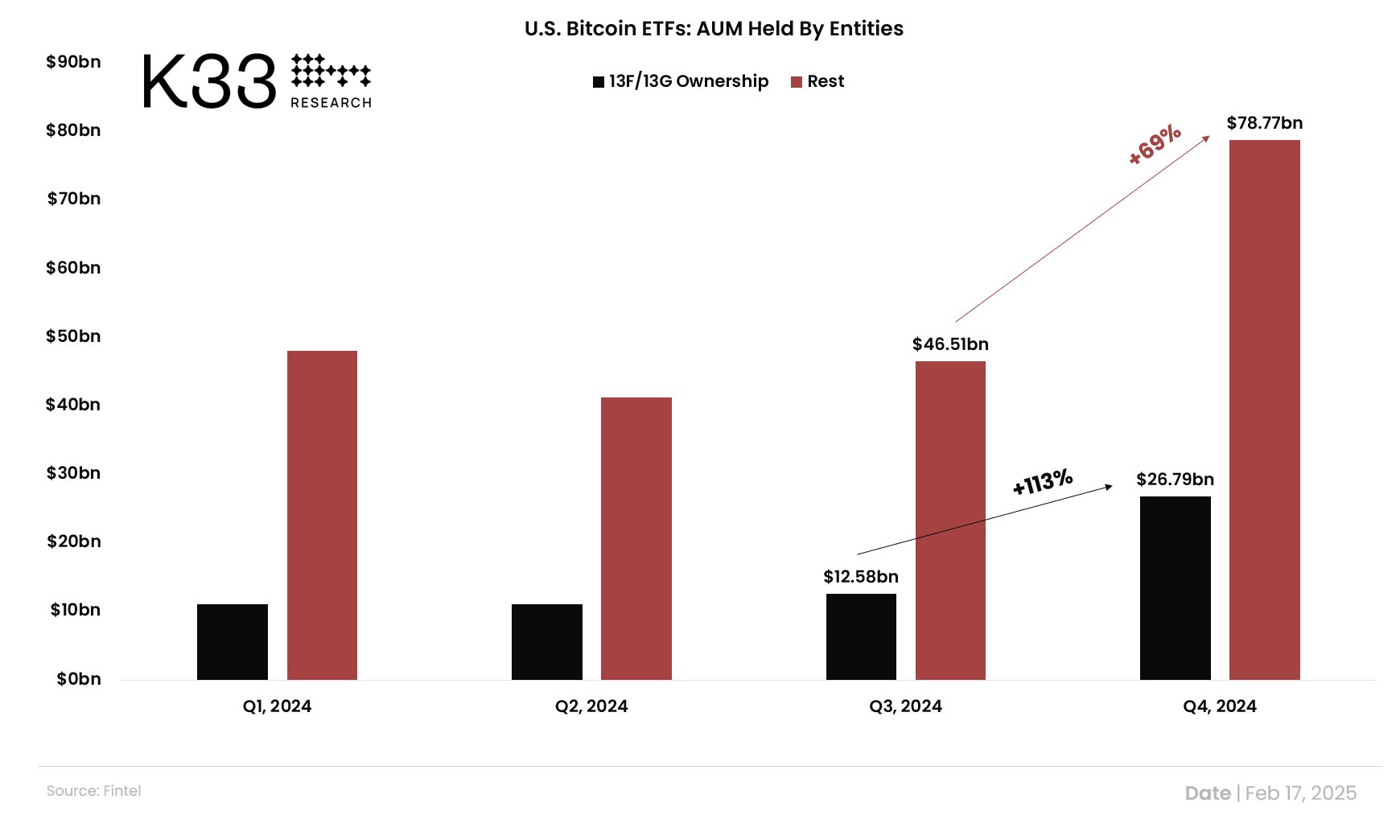

According to Lunde’s tweet, from Q3 to Q4 2024, about 429 professional firms acquired the premier asset through ETFs, amounting to a combined asset under management (AUM) of $26.79 billion. Meanwhile, institutional investors hold 25.38% of the AUM, up from 21.3% in Q3.

Bitcoin ETF Attracts Record Institutional Investment in Q4

For perspective, the first quarter closed with only 937 unique owners acquiring the premier asset through ETFs. However, following its massive adoption, the number of institutional firms holding Bitcoin products has surged rapidly, quarter by quarter.

The second quarter saw 1,136 unique owners, with an additional 199 adopting the premier asset. The uptrend spilled into Q3 and Q4, significantly increasing to 1,147 and 1,576 unique owners, respectively.

Meanwhile, the total AUM among institutional entities also surged along. These entities held $12.58 billion in the total AUM of Bitcoin ETF products by Q3 2024. However, due to institutional investors’ shift towards mainstream adoption of the digital asset, their stash rose 113% to $26.79 billion between Q3 and Q4.

Remarkably, this trend reflects broader acceptance and integration of cryptocurrencies into traditional investment portfolios.

IBIT Leads Mainstream Adoption

The data also shows that the BlackRock iShares Bitcoin Trust (IBIT) led the Q4 adoption charge. The issuer was the second-best ETF below Grayscale Bitcoin Trust (GBTC) by Q1 2024 but garnered investor’s interest as the year progressed, attracting over $16 billion in assets.

Fidelity’s FBTC was the second-best performer for the quarter in review. The issuer recorded around $5 billion in share sales to institutions by Q4, becoming the only asset manager besides BlackRock to reach the mark.

Meanwhile, this trend reflects a broader institutional adoption of Bitcoin ETFs globally. In the meantime, inflows have slowed amid market uncertainties, with the fund recording four consecutive days of outflows before yesterday’s $66 million positive flow.