One important way to tell the end of a bull market is to monitor price movements and trading volumes. This will give you insight into how to cash out massively during the bull market without getting distracted by the excitement, sentiments, and hype.

In this article, you will learn eight (8) key signs you need to look out for in a bull market. These clear signals will help you recognize when a bull market’s end is approaching. It also explains how long a bull run lasts and what happens thereafter.

This guide is very timely. It is all you need to understand how a bull market works. Now, let us start with a detailed explanation of a bull market.

What is a Bull Market?

In the crypto space, “bull market” is a term used to describe a period where the prices of cryptocurrencies experience continuous and significant increases. The substantial price increase recorded during this period is usually 20% or more.

A bull market is the opposite of a bear market. A bear market occurs when there is a continuous decline in the prices of crypto assets. The price drop may be up to 20% or more. Hence, the difference between the two is this: A bear market records drastic price falls while a bull market sees sustained and significant price increases.

The term, bull market, has increasingly become popular. This is due to the current cryptocurrency trend relating to tremendous price increases in the market. Following Donald Trump’s victory as president at the recently concluded 2024 elections in the U.S., the prices of cryptocurrencies have continued to soar.

A vivid example is bitcoin (BTC), whose price skyrocketed in recent weeks, registering a new all-time high (ATH) of $93k. At the time of writing, though, the asset trades at $87k.

Bull markets are usually accompanied by excitement. This is because informed crypto investors and traders enjoy more trading benefits during this season. They make more profits as they can sell their assets at a higher price. There is more, though.

As with other financial markets, uncertainty stands as an integral part of the crypto market. The crypto space is very volatile, making it difficult to accurately predict price movements. As such, it is normal for the prices of crypto assets to fluctuate from time to time, experiencing lows, highs, and in-betweens. Price changes frequently, even within 24 hours, but this is different from what happens in a bull market. The difference revolves around its duration.

How Long Does a Bull Market Last?

During a bull season, the continuous price increase or upward movement in the crypto market occurs over an extended period. It may last for many months. However, the exact duration of a bull season cannot be accurately determined at the beginning.

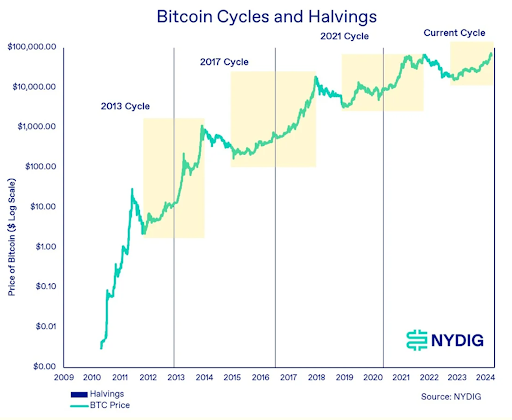

One thing investors must bear in mind, though, is that the cryptocurrency market typically has a four-year cycle, often overlapping with the Bitcoin halving. You can read more about Bitcoin halving in this guide.

Historically, a full-blown crypto bull market typically lasts for 12-18 months and often comes in the period following the halving (e.g. 2012-2013, 2016-2017, 2020-2021). Note that in these three previous cycles, the bull market period followed the Bitcoin halvings. Hence, one may conclude that a full-blown crypto bull market typically lasts for one year or so.

Certain factors, such as market regulations, global events, and others, may also influence the market, making it either last longer or shorter. These factors vary the intensity of the bullish season.

How to Identify a Crypto Bull Market

- Monitor Market Price Movements: Look out for upward market price movements. When the prices of popular cryptocurrencies keep rising for weeks or months, it is an indicator that the bullish phase is on.

- Monitor Trading Volumes: A significant increase in the market trading volume and activity points to a bullish season.

- Keep up with Crypto News and Trends: Follow platforms like cointab.com that publish news on the latest happenings in crypto. Staying up-to-date with the latest developments will help you know when a bull market is approaching or has rolled in.

Why Look for Signs?

It is easy to get carried away with the excitement of a thriving bull market. However, as a crypto investor or trader, it is crucial to identify signals that the season is approaching its end.

Here is a reason: Bull markets cannot last forever. As the saying goes, what goes up must come down. This means that, no matter how long it lasts, the continuous price increase will inevitably end one day. Investor confidence will gradually start to decline after a while.

As a result, the market will see downward price movements, which may even be drastic, as some crypto assets may experience all-time lows (ATLs). Before this happens, you need to prepare well to make informed and profitable investment decisions and not allow emotions to cloud your judgment.

In addition, bull markets are not void of volatility. As such, fluctuations in price and trading activities usually occur. Without the right information, an investor may easily mistake normal market fluctuations as the end of a bullish phase.

Moreover, as much as the bull run has fully started, it is only the beginning of the end. The unpredictable nature of the crypto space may confuse an uninformed investor, getting him caught off guard. Owing to this, it is important to identify the red flags and act accordingly.

Every crypto investor needs to learn how to successfully navigate the bullish phase. One of their foremost goals is to make profits. By recognizing the signs that indicate that a bull market will soon end, an investor will know how to leverage potential opportunities.

Eight (8) Signs That Point to the End of a Bull Market

Now that we know the whys, let’s consider the hows. Explained below are eight (8) important ways to tell that the end of a bull market is near.

High Buying Pressure

High buying pressure often occurs when there is a sharp and rapid price increase in the market. When this happens, the need for price correction may arise, leading to the bull market’s end.

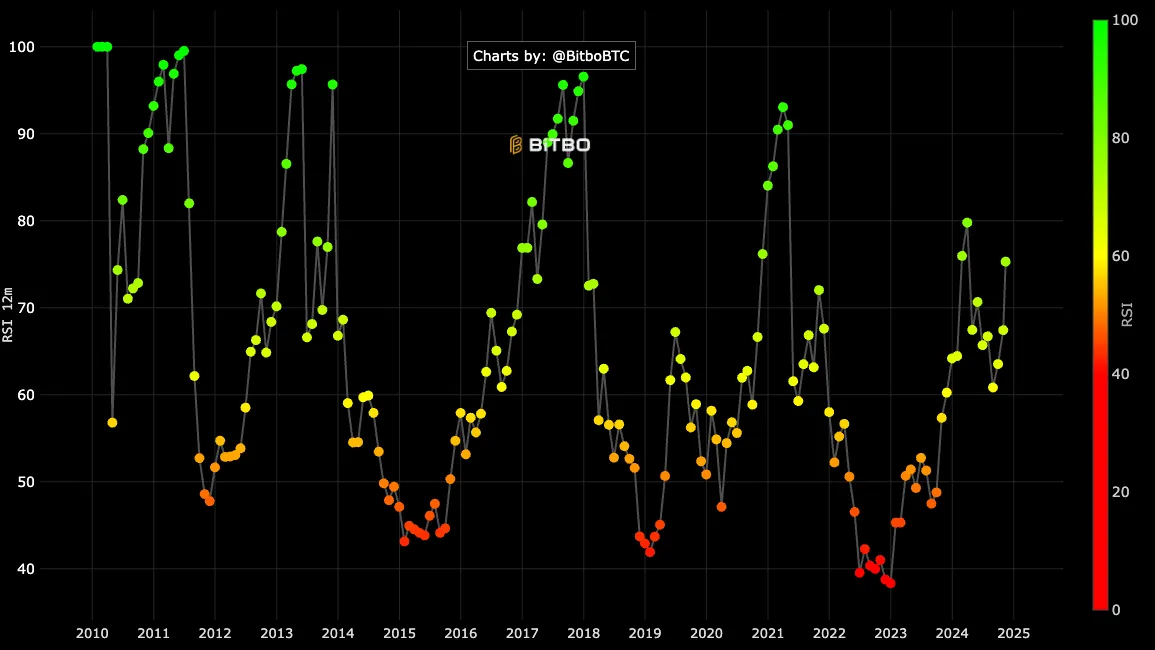

A technical indicator that can be used to monitor this is the Relative Strength Index (RSI). This indicator has a reading of 0 to 100. A reading under 30 indicates an oversold market, while a reading above 70 indicates an overbought market.

Logically, any reading well above 70 indicates high buying pressure and that a potential market top is on the horizon. For example, the earlier-mentioned market peaks in 2013, 2017, and 2021 all saw the RSI on Bitcoin soar well above 70.

Unrealistic Optimism

Unrealistic optimism sets in when market sentiments show that investors are overly confident and believe that the price increase will not end. It is important to note that when almost everyone comes out on social media to show off high trading profits or investment returns, the bull run may be approaching its peak and subsequent end.

At the same time, new ones may also start rushing to join the crypto space, talking about how good it is to invest and whether they are late to the party. Once this trend carries on for a few weeks, it might be an indicator that a market top is around the corner.

Overvalued Crypto Assets

Due to a rise in favorable sentiments, market prices may rise so much that some currencies become overvalued. For instance, during the 2021 bull market, the price of meme-inspired cryptocurrencies such as Dogecoin and Shiba Inu soared to billions of dollars, even overtaking the value of companies with real-world economic activity. To adjust this, a correction period ensued, marking the end of the growing market.

Fear of Missing Out (FOMO)

As a result of the intense market hype prevalent during the bull season, the fear of missing out (FOMO) may cause some investors to make poor investment or trading decisions without carefully thinking them through.

These usually include jumping on buying the peak for fear of missing a lucrative investment opportunity. When prices start reducing gradually, these investors may panic sell and further accelerate the decline rate.

Decrease in Market Trading Activity

A decrease in trading activity occurs when fewer traders participate in the crypto market. A decrease in trading volume combined with a sustained price drop may point to the end of a bull market.

The Rise of Negative Events

News on unfavorable regulatory actions or hacked crypto exchanges or wallets may weaken investor confidence and morale. It may also intensify some already existing market developments, like those listed above, that have the potential to end a bull market.

Sharp Volatility

Although high volatility is normal in the crypto industry, a sharp rise and fall in prices may indicate that the bull market is unstable, leading to panic selling and a potential bearish season.

Increased Adoption

While the increased adoption of assets is usually for a good cause in the crypto space, it may signal the close of a bull run. This is because increased adoption in the bull market often comes with investors being obsessed with the potential of their holdings. It may also trigger FOMO in other investors, high buying pressure, and overvalued crypto assets.

Please note that these signs work better when used together and not independently. Also, it is best to confirm them before making a trading decision to avoid taking premature actions.

What Happens When a Bull Market Ends?

A bull market is often followed by a market correction period, a bear market or both. As the name implies, a market correction period aims to adjust or ‘correct’ the prices in the crypto market. It occurs when the crypto assets experience a price drop of up to 10% or more from the bullish increase.

A bear market usually follows a market correction period. Its start is marked by a continuous decline of 20% or more in market prices, leading to reduced earnings, decreased investor confidence, company staff layoffs, and others. Certain investors and traders, though, make good use of a bear market to buy crypto assets at lower prices with hopes that they will later sell high to earn profits.

Conclusion

Recognizing the signs that tell the end of a bull market is crucial for successful navigation amidst the excitement and hype. Some of them include high buying pressure, reduced trading volume, sharp market volatility, increased adoption, and others.

Bull markets are usually followed by correction periods or bearish conditions. Crypto investors and traders should identify the red flags before the bull market ends to protect their investments and capitalize on potential profit-making opportunities.